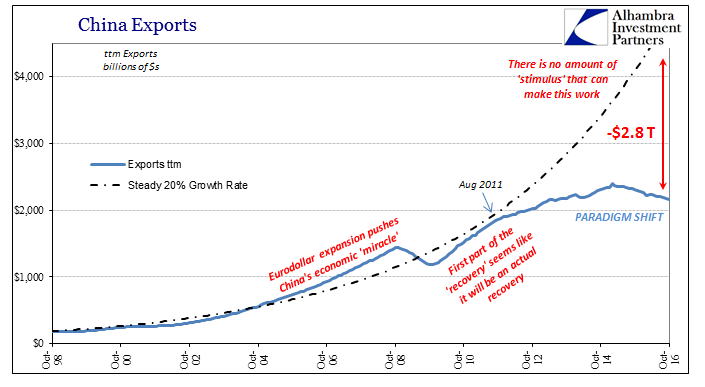

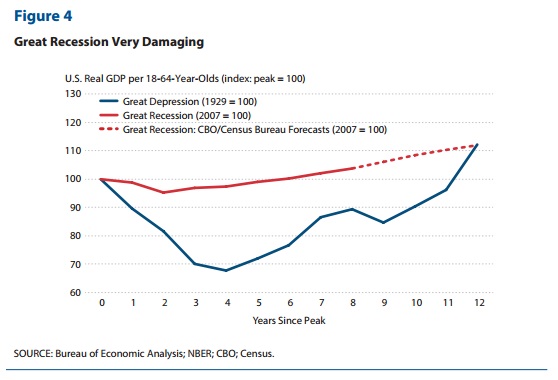

The cost of this economy cannot be strictly measured by statistics or even the massive deviations of those statistics. As noted earlier today, China’s exports in the twelve months ending October 2016 were figured to be just $2.2 trillion. Had the Great “Recession” actually been a recession, where the world resumed growth even modestly like that from the pre-crisis period, China’s exports would have been more than $4.9 trillion. That difference is truly unfathomable, yet it is very real even though it isn’t itself a direct observation (it is a counterfactual that more aptly defines this economy than the mainstream deference to the drumbeat of small, positive changes that signify nothing meaningful).

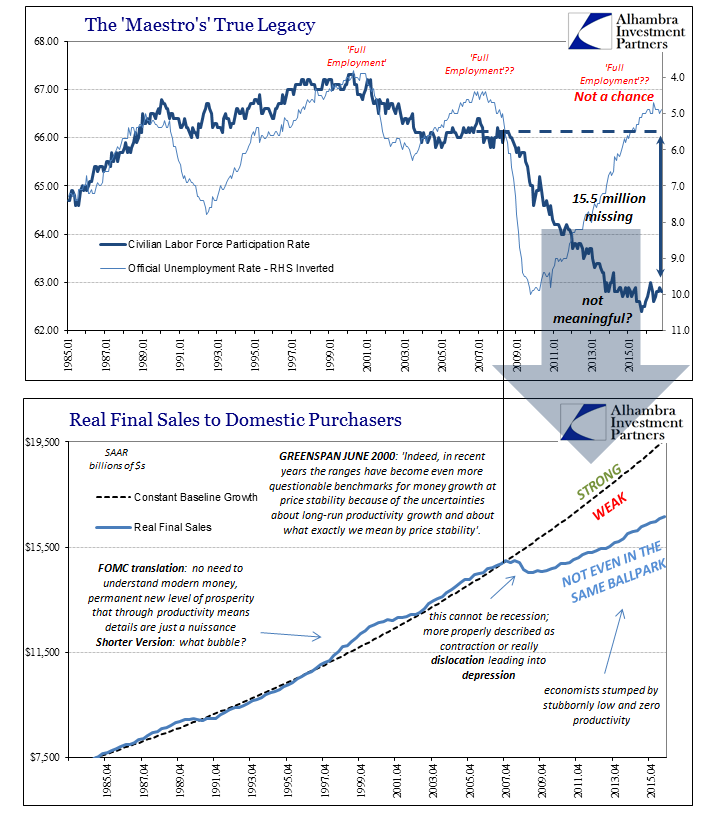

It isn’t, of course, strictly a Chinese problem; it is globally endemic, from across Asia to Europe and even these United States. In this part of the global “dollar” economy, the inconceivable deficit is of the labor market, where the unemployment rate in one sense is actually accurate. In other words, it suggests “full employment” but only of a shrunken official labor pool. That leaves the unemployment rate to describe quite well the current situation where the economy is but some fraction of its prior condition. Economists pay no mind to that minimization, but the real economy cannot escape it; thus economists are constantly confused as to why nothing ever improves and nothing they do or figure changes that.

But the full cost in economic potential isn’t even those 15.5 million “missing” potential workers, massive enough as that shortfall might be. This unthinkable tragedy extends quite far into even the shrunken piece that has been left after 2008 for which has been called the “recovery.” Those that have been fortunate enough to continue employment throughout and the fewer still who have obtained what little additional jobs have been added are still affected and afflicted by this depression (meaning more-than-temporary deviation from trend; a recession doesn’t leave in its wake a smaller, slower economic existence and all the consequences that go with it).

A perhaps perfect summation of these doubly hidden costs was provided last November; full marks if you can guess who said this:

I was appalled that no one asked and no reporter wrote about the fact that a week before that debate a national report was published which said that the life expectancy of working-class, non-college- educated, white Americans, men and women, was dropping and was now less than Hispanics…Because this country’s still coming apart at the seams for millions and millions of people. We have to figure out a way to restore broad-based growth, to have more jobs, more business formation, rising wages.

It wasn’t Donald Trump, or any of his Republican competitors. It wasn’t Bernie Sanders, either, who at least during his turn in campaigning wasn’t shy about describing more completely the plight of those who economists have written out of their regressions. These remarks were made in private (of course) by Bill Clinton at a fundraiser in Canton, OH. His words echo an ominous truth; there is more to Japanification than perpetually zero interest rates and an inability of authorities to dislodge some mysterious “deflationary mindset.” The true costs of Japanification aren’t measured in such ways, more akin to social suicide than strictly economic numbers.

Why? Because they don’t have anything to look forward to when they get up in the morning. Because their lives are sort of stuck in neutral.

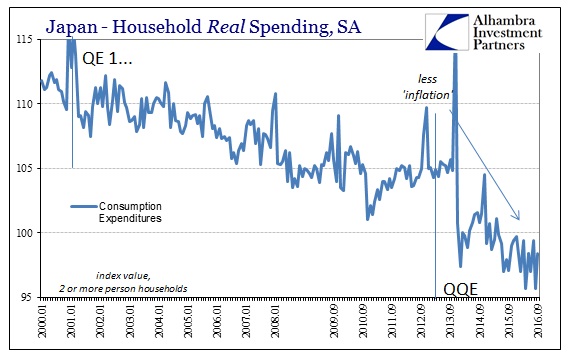

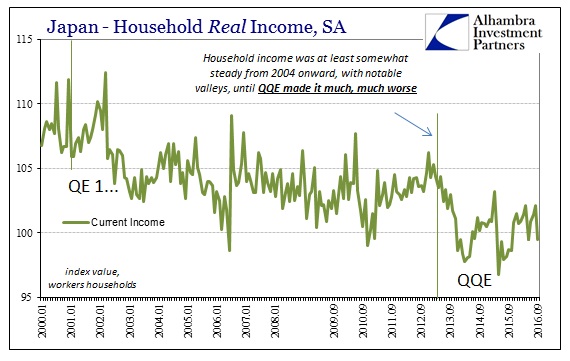

It wasn’t in Japan the “deflationary mindset” that caused their economic afflictions, rather it was unrelenting failure and the political rigidity that led the Japanese to reject almost completely the lives of their parents and grandparents; to expect so little. QQE in Japan didn’t overcome it because the Japanese knew very well it was just another poorly conceived scheme that in the end would make their lives that much worse and harder – as it did.

In other words, the Japanese people know all-too-well that economists are, quite frankly, full of sh- -. So long as economists remain on their political pedestal, however, nothing will change, hopelessness and despair will gain, and Japanification will become our best case. In reality, in a nation such as ours, not to mention less stable situations around the world experiencing variable degrees of the same exact condition, despair won’t likely last all the way to our own “deflationary mindset.”

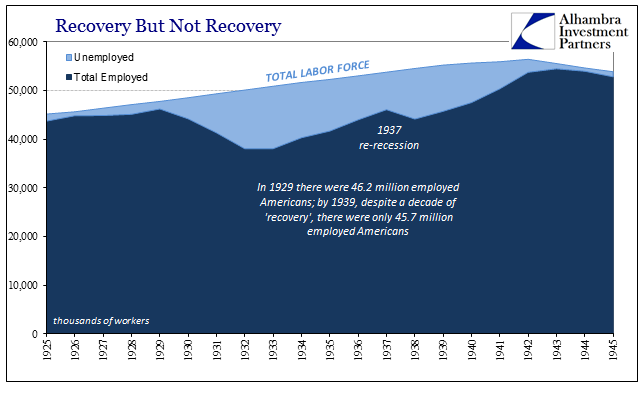

We have been down this road before. Our national character was similarly fractured during the Great Inflation, the last time economists were driven from the political scene (only to have replaced Keynesians with monetarists who became neo-Keynesians). As it was in the 1930’s leading up to WWII.

I can’t help but recall Thanksgiving 1939, though, quite obviously, I wasn’t actually around for it. Because of the lingering Great Depression that just wouldn’t go away no matter what economists of that era schemed and devised, President Roosevelt took the quirk of that November calendar as an opportunity to try a little “stimulus.” With five Thursdays rather than four, FDR broke precedence that dated back to Abraham Lincoln by moving Thanksgiving up a week to the second-last one.

Republican Alf Landon, who had been FDR’s opponent in the 1936 election, suffering massive defeat that might have turned out differently had it occurred in the autumn of 1937 instead, was not amused, using rhetoric at ease with our 21st century ears:

Another illustration of the confusion which his impulsiveness has caused so frequently during his administration. If the change has any merit at all, more time should have been taken in working it out . . . instead of springing it upon an unprepared country with the omnipotence of a Hitler.

Roosevelt was convinced enough to act by economists who surmised that the extra week between Thanksgiving and Christmas would aid retailers, and thus perk up the economy that despite ten years distance from the Great Crash still “somehow” needed it. Instead, the move further divided the nation to where that year there were two holidays in November, though neither was truly official across the whole country (state holidays were declared by state governors who most often simply followed the President on that matter, but in this case many didn’t). There was Democrat Thanksgiving on the fourth Thursday and Republican Thanksgiving the following week in its traditional spot.

One Gallup poll taken at the time showed that the public disapproved of the new arrangement, some 59% were claimed to be against it, leaving 22 states to celebrate the D version, 23 the R, and three managed to “celebrate” both. The split would last a further two years before retail data showed it was just as ineffective an economic idea as it still sounds today. By November 1942, the nation had much worse problems to contend with, those that are equally familiar to continuous economic hardship that when unanswered destabilize in total those nations less able to withstand stagnation and depression. We were lucky for only a short time to squabble about holiday celebrations, no matter how bitter.

As a reminder of just how far this economy is from healthy, and why the characterization of it as a depression is apt and agonizingly appropriate, we heed both Bill Clinton’s private admissions as well as others that have become criminally common:

More people in their 40s and beyond are moving in with their aging parents because of a financial or health setback. “This is kind of a hidden group,” says Steven Wallace, associate director of the Center for Health Policy Research at the University of California, Los Angeles. They expect to be well-established in a career by midlife and thinking ahead toward retirement; then lightning strikes, in the form of a job loss, injury or illness.

Living with Mom and Dad at midlife comes with a heavy stigma and may force painful adjustments in family roles. Deborah Graves moved in with her 87-year-old mother, Jacqueline Graves, in Flossmoor, Ill., last year after a layoff from her 20-year job as a clinical laboratory technician and an unsuccessful job search. Now, she is juggling new demands on her time, including college courses in medical coding, a 20-hour workweek in a department store and driving her mother to medical appointments. She cooks one or two meals a day for her mother—a task “I wish I didn’t have to do,” says Ms. Graves, 58 years old.

Many, many people do not like the use of the “d” word and react emotionally to it, but there is only Janet Yellen (as a figurative representation) to argue against it. Social fragmentation and political dissolution even in softer stages are surefire signs of great unsolved economic deficiency; that the space between recession and depression on charts such as those I have produced above is so very real. It will only get worse so long as they remain unaddressed, and then make it that much harder to overcome should we ever be so fortunate as to be able to do just that – hopefully long before these social ruptures become truly irreparable and the worst of the worst. This is a thoroughly bipartisan disaster, ongoing and global, a poignant reminder for Election Day.

Stay In Touch