There were a great many ridiculous things we witnessed last year, but among them was the unshakable desire for the media and economists to label consumers and consumer spending as “strong” regardless of any other considerations. In most cases, whatever month-over-month change would seem positive, but it was so only in that very narrow view. Misunderstanding natural variation, they all would have done better by not seeing only what they wanted time and again.

Retail sales for May 2015, for example:

The American consumer, missing in action for much of 2015, showed up in May…

“The consumer took a month off and came back and spent in style,” said Ward McCarthy, chief financial economist at Jefferies LLC in New York, who correctly forecast the May increase. “Consumers’ behavior has been inconsistent, but the trend has been for gradual acceleration of spending.”

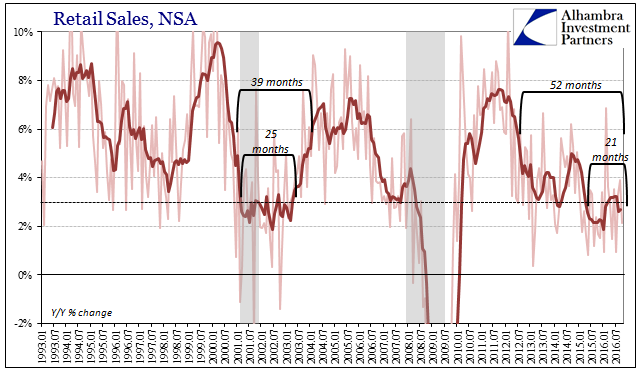

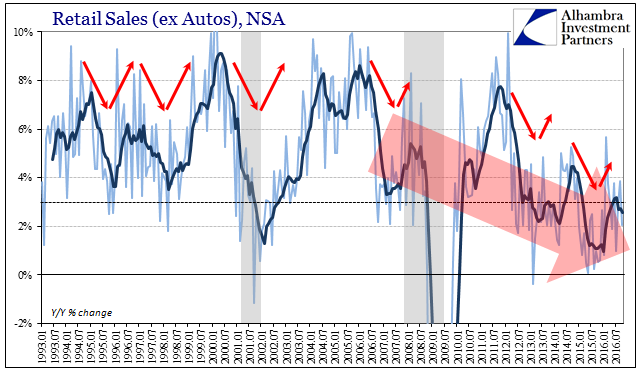

Again, the monthly, seasonally-adjusted change was then figured to be +1.2%, a number that to Bloomberg “reflecting broad-based gains from car dealers to clothing outlets to department stores.” It would only have taken a few seconds work, however, to easily determine that just wasn’t so. Year-over-year, unadjusted, retail sales in total grew by less than +0.75%, one of the worst growth rates in the entire modern retail sales series (it has since been revised upward to all of +0.83%). The last almost two years, including this year’s “rebound”, have been for retail sales just as bad as in the whole of the dot-com recession and its “jobless recovery” aftermath.

So it went for much of the rest of last year, where occasionally the media would get all excited about a monthly variation while wistfully ignoring how in the annual comparisons each of those months were actually near the bottom, “beaten” only by those months clustered into and around the Great “Recession.” There was no acceleration in 2015, just a blanket dose of atrocious.

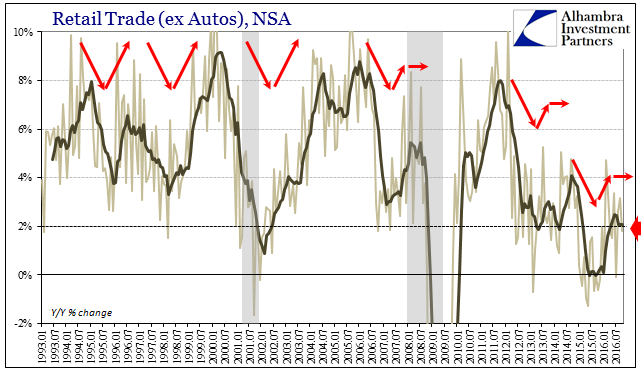

That, however, didn’t lead to recession (though in retail sales it equaled past ones), which meant because of it 2016 was going to be the year of recovery and acceleration. Obviously, it hasn’t been. The best that can be described of this year is the same “weak but not getting weaker” that applies to almost everywhere else. The greater the distance from the “dollar’s” more open financial consequences, the better the relative comparison for economic accounts.

Retail sales have been no different, where last year they were openly atrocious this year has been just bad. In the prior month, September 2016, total retail sales grew nearly 4%, but that was, as usual, the exception to the high side. The just-released figures for October 2016 show that once again retail sales are incredibly weak; year-over-year up just 2.15%.

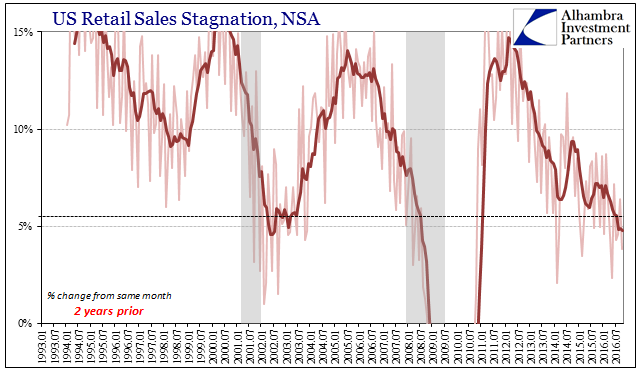

In a truly healthy economy, retail sales would be concerning where the growth rate fell below 6%, now it is unusual to find them above 3% even in a year following one in which retail sales barely registered any growth at all.

That is the big, unappreciated problem that goes way beyond recessions and the business cycle. Retail sales in October 2016 were only 3.8% more than those of October 2014! Again, less than 6% for a single yearly change were once considered a sign of weakness, now retail sales don’t break 4% for a full two-year period? That’s the real problem of “weak but not getting weaker”, where the (global) economy gets knocked down by a monetary (“dollar”) event, but does not get back up from it. In China, as noted this morning, that means what looks like stability or stasis; in the US, in retail sales and other accounts, it has meant slightly higher positive numbers, but none that add up to a meaningful difference.

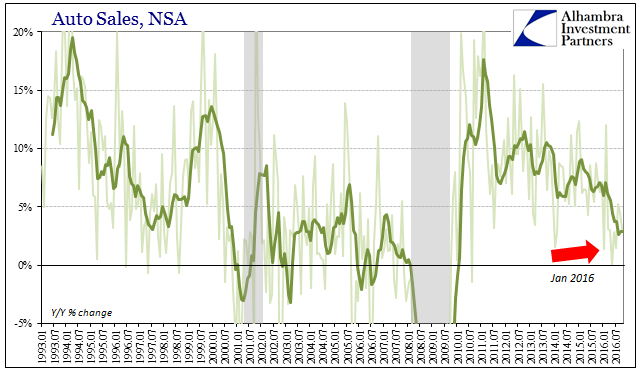

The same trends for the subsectors of retail sales continued in October, starting with autos. Auto sales were up just 3.1% Y/Y, the seventh month out of the ten so far that were 3.1% or less. The 6-month average is just +2.8%, continuing to be more and more like the claim of Ford Motor’s CEO for an automobile “plateau.”

The only real winner in this economy has been online outlets, but at the expense of bricks and mortar stores. Department store sales actually peaked before the dot-com recession in January 2001, but despite that structural change sales registered by these stores have been especially nasty of late. In October 2016, department store sales were down more than 8%, following a decline of 5.7% in September. Overall general merchandise sales fell another 3.2% in the latest month, the fourth consecutive decline, and for the fifth time over the past six months.

During those same six months, sales to nonstore retailers have exploded. Year-over-year, nonstore revenue grew by 10% in October, the fifth double-digit gain of the past half-year where the lowest growth was 8% in July. This has been a trend that building since the “near recession” to start the year, as sales in the category have been above 9.3%, with the exception of July, since January. It suggests, as elsewhere, very real damage to consumers from the last “rising dollar” breakout.

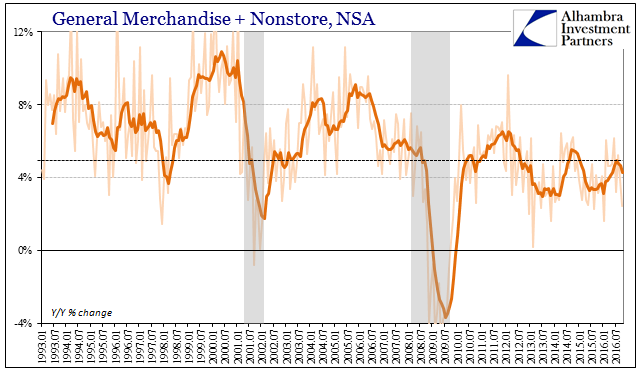

I don’t believe demographics and consumer behavior explains these results, especially considering the timing of them. Combined, nonstore plus general merchandise, retail sales were up just 2.4% in October, the worst since January and still far below what could be characterized as just plain normal.

The direction for consumers is always down, it’s just that it doesn’t happen in a straight line. And because it takes years, in this case five and counting, nobody knows what to make of all this. It isn’t a business cycle, rather it is just an economy stuck between one “dollar” disruption and the next.

Stay In Touch