By John L. Chapman, Ph.D. Canton, OH January 6, 2012

Later this month the Federal Reserve’s Open Market Committee holds the first of eight regularly scheduled meetings to discuss ongoing monetary policy with respect to both short term interest rate and balance sheet targets, as well as how best to support longer term growth. Well into his second four year term, Chairman Ben Bernanke now has solid control of the Board of Governors and Open Market Committee policy direction, and there has been little public dissent of his approach to an expanded balance sheet and continued easing. But there are now at least minor “fissures” inside the Open Market Committee with respect to the future, and for investors it will be important to understand whether any shifts in policy, however subtle, take root in the year ahead. For there is now a strong and well-established short term correlation between both interest rates and economic growth, and monetary aggregates and asset prices (and of course this is well-known on Wall Street, which is why there is a fairly sizable cottage industry of full-time “Fed-watchers” who opine on Fed actions — and Fed opining).

It was therefore of more than passing interest that in the past year, the Presidents of the Dallas, Philadelphia, and Minneapolis Feds (Richard Fisher, Charles Plosser, and Narayana Kocherlakota, respectively) voted against Mr. Bernanke on a few occasions, beginning to fear the rise of inflationary pressures. And hints of argumentation within the Fed’s Boardroom have now surfaced, as Chicago Fed President Charles Evans has openly called for more (massive?) quantitative easing until an express target is achieved for unemployment of, say, below 7.5%. The Dallas Fed’s Mr. Fisher (himself a lifetime Democrat and former U.S. Senate candidate) was sharply critical of that in unusually blunt terms for Fed colleagues, and even Mr. Bernanke, pre-disposed to historic levels of Fed activism, has not yet assented to this, preferring a wait-and-see approach to the new year. So where is policy headed, and can we glean any hints from current trends, for asset prices and GDP growth, as well as investor sentiment?

First, there is no reason not to take Mr. Bernanke at his word: the Fed’s current interest rate posture is more than likely to stay in place until at least the summer of 2013 ( that is, per the Fed’s announced policy, they intend to maintain “exceptionally low levels for the federal funds rate at least through mid-2013”). In the interim, the Fed seeks to keep its balance sheet in roughly stationary position — and that is important because ostensibly there will be no contraction of the monetary base any time soon (the monetary base is of course currency in circulation plus bank reserves held at the Fed, and the base is the one monetary aggregate the Fed can control with unambiguous certainty; broader aggregates include M1, which is currency plus checkable/demand deposits and non-bank-issued traveller’s cheques, and M2, which is M1 plus savings and time deposits < $100,000, as well as all money market deposit accounts). Mr. Bernanke has also taken steps to be more “open” in announcing to the markets and investing public any shifts in Fed policy in an orderly manner; thus, he broke tradition and will now do periodic press conferences in addition to policy speeches, and the Fed will also now issue regular forecasts for interest rates. Hence the ever more pro-active nature of Fed communications leads us to believe with confidence that, to the degree policy was once designed to entail periodic “surprises” so as to influence shifts in real magnitudes (based upon the well-known axiom of modern macro theorizing that rational expectations preclude desired behavioral changes when policy is anticipated), that the Bernanke Fed really IS attempting to be more transparent so as to instill investor confidence.

Current Fed Policy

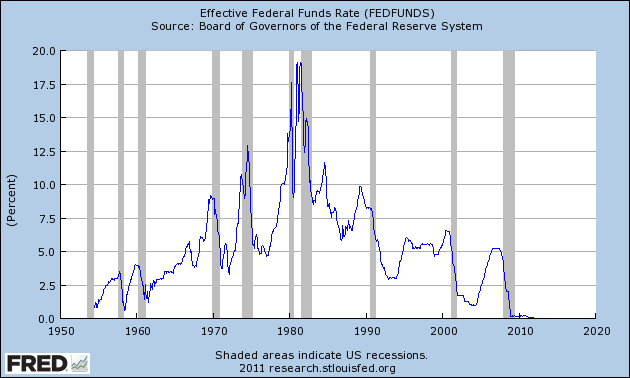

Nonetheless, current policy when assessed against current monetary trends does offer some otherwise unspoken clues for investment strategy in the near term. First, it is appropriate to be reminded of the “big picture” relationship between short rates and economic activity. Here is the historical movement of the fed funds rate since 1954:

Chart I. Federal Funds Rate (Overnight Loans between Federal Reserve System Member Banks), 1954-Present

Note the pattern evinced in this chart, of rate rises preceding recessions. Milton Friedman once pointed out that based on his research the lag for monetary policy was intermittent, ranging from 4 to 29 months. That statement would be even less certain in its time range today, when financial innovation, globalization, international capital flows, and new technologies have all conspired to loosen the links between explicit Fed actions and resultant co-movements of policy variables. But were we to stretch this graph all the way back to the Fed’s first year of operation a century ago, we would see a remarkable fact: 100% of all recessions have been preceded by rises in the fed funds rate. Not all sustained increases in interest rates lead to recession — though most do — but all recessions are preceded by rate increases, that are steady if not sharp.

Note the pattern evinced in this chart, of rate rises preceding recessions. Milton Friedman once pointed out that based on his research the lag for monetary policy was intermittent, ranging from 4 to 29 months. That statement would be even less certain in its time range today, when financial innovation, globalization, international capital flows, and new technologies have all conspired to loosen the links between explicit Fed actions and resultant co-movements of policy variables. But were we to stretch this graph all the way back to the Fed’s first year of operation a century ago, we would see a remarkable fact: 100% of all recessions have been preceded by rises in the fed funds rate. Not all sustained increases in interest rates lead to recession — though most do — but all recessions are preceded by rate increases, that are steady if not sharp.

So this forms the point of first departure in considering investment alternatives around the globe: Mr. Bernanke knows that rising fed funds rates, engineered by the Fed to stabilize the dollar’s value, lead to increases in all other rates, pari passu. And in turn this leads to a slowing of economic activity that then usually tips into recession, and declining financial markets in the U.S. Empirical research confirms that it is the relationship depicted above, with the fed funds rate mapped historically across time, that is most correlative between economic activity and any single market interest rate. Hence, we feel highly confident that there will be no recession in the U.S. this year, absent any panic-induced retrenchment from troubles in Europe or war in the oil-producing regions of the Middle East. Indeed there are reasons to believe the U.S. economy will be solid across 2012 in terms of GDP and jobs growth, and hence rising stock prices seem likely in U.S. markets (tempered of course by countervailing challenges elsewhere around the globe).

We would be less sanguine about this prospect if Mr. Bernanke had not signalled Fed intentions with such precision, and if they had not issued a detailed description of global economic challenges this fall that all but screamed “monetary accommodation” for the foreseeable future. So we believe he can be taken at his word about the next 18 months of stable fed funds rates, and the implications this holds for macroeconomic variables.

Further, Mr. Bernanke is nothing if not supremely confident in himself, and that extends to his prior research as an academic. In this case, specifically, he has examined in detail the relationship between monetary policy — and its transmission — and asset markets, bubbles, and equity prices, over many years. The exact nature of the relationship between Fed actions (that influence interest rates and bond prices) and equity markets is controversial, because, in short, there are two countervailing effects. On the one hand, rising rates makes business and consumer borrowing more difficult, and can act as a drag on growth that lowers the volume of economic activity and hence stock prices.

Keynes, however, argued for the opposite effect. He held that stock prices will not respond to a monetary shock in the short run because of sticky prices that he believed pervaded most markets; this led to adjustment through interest rates. Keynes believed that money supply changes could influence asset prices only if it the Fed policy move altered expectations about future Fed policy and/or caused a change in future interest rates. For example, an announcement of a bigger money supply (and falling interest rates) could lower stock prices because of expectation of higher future interest rates and lower future revenues and profits resulting from lower future economic activity. Keynes therefore expected a positive relationship between changes in the federal funds rate and stock prices, since he posited a negative relationship between money supply and stock prices.

The empirical literature on this topic is as broad as it is deep and longstanding, and it is an unsettled question in modern finance (and beyond our narrow scope here). But for our purposes as investor analysts in the moment here in January 2012, what matters is what Mr. Bernanke thinks. And here we know, especially from his research with Kenneth Kuttner of Williams College, that Chairman Bernanke believes low rates bolster equity markets (see their Journal of Finance article in May 2005 on this topic, where they showed that every unanticipated 25-basis point cut in the fed funds rate induced a broad and enduring market gain of about 1%). And indeed, in graphing the fed funds rate against the Dow Jones Industrial Average, there is a decently reliable inverse correlation after the beginning of the Reagan boom in 1982 (the relationship is less strong during the inflationary period of the ’60s and ’70s).

Further, borrowing from Keynes’ 1936 description of investment analysis as attempting to discern what others are discerning, we think the stock market’s participants believe this relationship to be determinative, too. Hence this reinforces our viewpoint that until rates begin to rise in a sustained way, accommodative monetary policy provides a powerful floor for stock prices — and we think will indeed aid in gains this year.

With the Fed’s intentions clear, what do the data say? Interestingly, the monetary base is declining slightly, in spite of Mr. Bernanke’s canonical commitment to maintain the current size of the Fed’s balance sheet:

Chart II. Non-Seasonal (Blue) and Seasonal (Red) Adjusted Monetary Base (2010-Current)

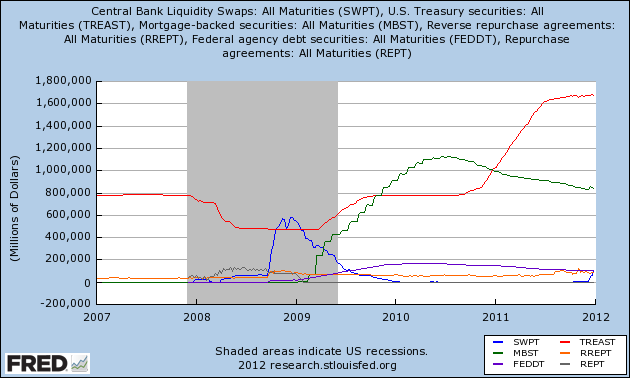

From a high of $2.71 trillion in July, the seasonally-adjusted base was down to $2.56 trillion by year-end, a drop of more than 5%. This is not insignificant per se, so we broke down the Fed’s asset structure to determine the movements of individual asset classes that in turn would cause the base to shrink:

Chart III. Federal Reserve Balance Sheet Assets: Treasuries (Red), MBS (Green), GSE Debt (Purple), Currency Swaps (Blue), Reverse Repos (Orange)

This permits us to understand the recent decline in the base. Since the end of QE2, the Treasury inventory has hovered near its current level of about $1.65 trillion. Across the last several months however the mortgage-backed inventory declined by nearly $200 billion, which is of interest because Mr. Bernanke expressly mentioned his intent to prevent any decline in the level of MBS assets. Other asset classes remained in place although in recent weeks swap lines were again opened with the ECB.

One explanation for this — and it is a guess — is that the Fed has been intensely monitoring developments in Europe for the last two years. In stark language in November, in fact, the Fed expressed serious concern about Eurozone growth and financial system trouble in 2012. It may well be that, anticipating the need to meet dollar demand in the Eurozone, the Fed has decided to create for itself “capacity” for lending and swap operations in Europe in the time ahead. Hence a decision may have been made to offload or not replace maturing MBS assets.

For now we do not see this as problematic for intra-U.S. economy issues. It is, however, yet another warning about the serious trouble Europe may be in. While frustrated by the opacity of ECB and major Eurozone bank balance sheets, and equally so by a concomitant lack of knowledge of the level of exposure of U.S. banks and corporations to Europe, we have wondered for some months now, what does the Fed know, that we do not know? All this is to say, our prediction is we are going to see a rise in swap lines to Europe, and we think the monetary base may well float back to higher levels in the months ahead. It will in any case bear watching. (As an aside, it is at least mildly troubling that the U.S. taxpayer is now being put at risk with these loans and swaps to the ECB, just as is any creditor who is loaned up to a shaky debtor).

Insights from Current Demand for and Supply of Money

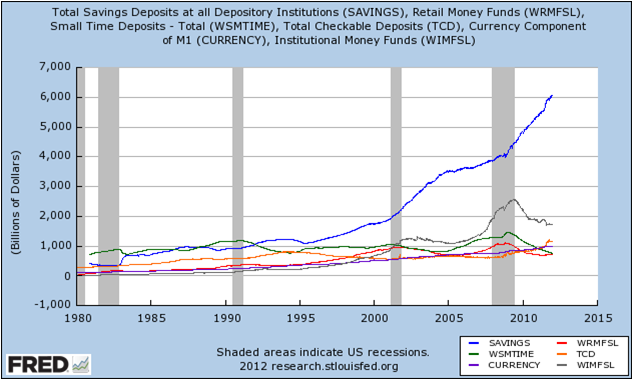

Meanwhile, as the base is shrinking, M2 has been rising, shown here in its constituent parts:

Chart IV. M2 through End of 2011, Shown Broken Down into Savings Deposits (Blue), Institutional Money Market Funds (Gray), Checkable Deposits (Orange), Currency (Purple), Small Time Deposits (Green), and Retail Money Market Funds (Red)

This chart offer insights into current investor psychology: in the last year there has been a sharp rise in savings deposits and in checking account (demand) deposits; other asset classes are either flat or down slightly. This has one unambiguous meaning: the demand for money, while impossible to quantify, has been increasing sharply. Texas State economist David Beckworth puts the matter succinctly:

Something…really caught my attention in the [Fed’s September meeting] minutes. It was this acknowledgement by the Fed staff:

M2 surged in July and August, as investors and asset managers sought the relative safety and liquidity of bank deposits and other assets that make up the M2 aggregate. Notably, institutional investors, concerned about exposures of money funds to European financial institutions, shifted from prime money funds to bank deposits, and money fund managers accumulated sizable bank deposits in anticipation of potentially large redemptions by investors. In addition, retail investors evidently placed redemptions from equity and bond mutual funds into bank deposits and retail money market funds.In other words, we have rapid growth in M2 coming from a surge in money demand. This is a big deal, because money is the one asset on every market and an increased demand for it will thus affect every other market. The more money demand there is, the less nominal spending there will be on goods, services, and other assets. This development means the economic slump is being prolonged.

Mr. Beckworth goes on to point out that the velocity of money, which can be thought of as the near-perfect inverse of its demand-to-hold, has been declining as M2 assets have been rising. He developed this interesting chart to portray this relationship:

Chart V. Liquid Household Assets Mapped Against the Velocity of M2

Professor Beckworth’s graph only goes through the beginning of 2011, but the key point we make here is the unambiguous inverse relationship between velocity and demand for safe and liquid assets to hold. Beckworth goes on to point out that from the peak of household asset values in July 2007 through to mid-year 2011, U.S. households had lost $8.8 trillion in non-liquid asset value. But in spite of these massive losses to net worth and concomitant decline in real personal incomes, households had increased their holdings of money and money-like assets by a staggering $1.6 trillion.

This “fetish for liquidity”, as Keynes called it, matches perfectly the caution we see exhibited in corporate America, with more than $2 trillion in cash and highly-liquid assets on corporate balance sheets and capital investment levels down (to 1975 levels as a percentage of GDP, in fact, according to the Boston Consulting Group). Beckworth goes on to point out that across the mid-2000s, the ratio of total savings deposits to personal income was in the 32-34% range, yet it shot up to the mid-40s post fall 2008 and is still at 44% today. This is, again using Keynes’ term, precautionary demand for money balances that remains highly elevated.

Indeed, in data through Monday December 26, M2 has continued to grow unabated, and grew sharply earlier in 2011 even as the monetary base was shrinking by more than 5%. Conversely the most recent data on M2 velocity, through the 3rd quarter of 2011, showed M2 reached a historically low level (1.6X) not seen since 1964. Obviously, M2 and an elevated demand for money are not all determinative in terms of gauging economic activity: December was the best month for job creation, income growth, and hours worked since the recession ended. And prospects for 2012 in he U.S. economy remain “decent” if Europe does not move into a severe recession this year.

But in our view, the data suggest three things, one “academic” and two highly relevant for investors. First, however well the economy does this year after the 1.7% GDP growth of 2011, the recovery could be much stronger if both businesses and households exhibited a more normal level of “animal spirits”. The level of fear and caution among economic agents is still quite striking.

Secondly, and more importantly for investors, recovery, however modest, once sustained will bring with it inflation. Even a 10% gain in velocity — still well below pre-crisis levels — matched with a decline in excess reserves due to more demand for loanable funds, would continue to elevate M1 and M2, and bring a jump in prices well above the current 3-4% range. We can infer this because this happened in he 1970s: M2 velocity jumped at the conclusion of Nixon’s price control program and inflation rates shot up, dipped through the 1974-75 recession, and then shot up again.

(We should add that gains in velocity are not necessarily harmful if matched with gains in productivity; in Fisherian terms, where MV=PY, V can increase when Y is increasing and not necessarily see P rise as well. If however M and V exhibit increases during a period when investment has been stultified, P may bear the brunt of increasing nominal income levels.)

Thirdly, the dramatically elevated precautionary demand for money among households gives one pause with respect to envisioning a rapid recovery in housing anytime soon. That “household-level fear” is still as high as it is 2 1/2 years into the recovery, December jobs report notwithstanding, gives us concern that the housing sector with its million-more foreclosures in 2012 will remain subdued for a few years yet. Certainly GDP growth itself, and other industrial and consumer goods sectors, can show improvement — however modest — in the time ahead. But housing is the ultimate durable asset and big-ticket capital expense that requires confidence in the future, in terms of income streams to defend the asset and maintain it. Owner-occupied housing cannot recover in any strong way until the precautionary demand for money recedes. To say this differently, when studying the data on monetary aggregates and the demand-for-money-to-hold (through velocity), it is no coincidence that rental housing rates have been rising along with demand for rental homes in recent years. Rental housing seems to us to represent one of the very best investment opportunities available in the years ahead.

Excess Reserves are Falling: Pick-up in Activity?

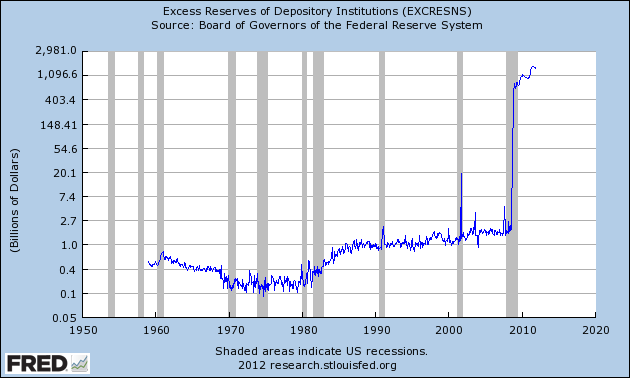

Meanwhile, the other development from the data to consider in terms of current policy is the level of excess reserves, elevated to historic levels since the fall of 2008 (and significantly non-zero for the first time in Fed history). After continuing to rise through the quantitative easing operations earlier in 2011, excess reserves peaked at $1.62 trillion in July, before falling by $120 billion in the ensuing four months — a decline of 7.5%:

Chart VI. Excess Reserves in the U.S. Commercial Banking System, through November 2011 (Shown in Log Scale)

This is an unambiguous signal that economic activity has picked up, however marginally. Banks have been collecting interest on these reserves since the onset of the financial crisis, and hence have been more circumspect about loan quality and risk levels. Given this the peaking of these reserves clearly indicates quality loan demand has picked up, and stands in contrast to a highly elevated precautionary demand for money.

This is an unambiguous signal that economic activity has picked up, however marginally. Banks have been collecting interest on these reserves since the onset of the financial crisis, and hence have been more circumspect about loan quality and risk levels. Given this the peaking of these reserves clearly indicates quality loan demand has picked up, and stands in contrast to a highly elevated precautionary demand for money.

What are the implications for the economy of these developments? The dollar?

In summary, we see no reason to question Mr. Bernanke’s stated intent to maintain an expansive Fed balance sheet and an accommodate monetary policy well into 2013. The behavior of households and businesses in hoarding cash and cash-equivalents tells us there is still an extraordinary level of nervousness about economic prospects in the United States, in spite of pundits such as Paul Krugman decrying confidence as an issue impeding robust recovery. And from a political perspective, this nervousness bodes ill for the re-election prospects of President Obama. That in itself helps investors plan into the future as it is a “non-pollable” data point that is highly revelatory. And on an unfortunate note, it also is singular in importance in thinking through how durable, or intense, this “recovery” will ever be. The fact that so much household and corporate demand is latent and not active is an unambiguous signal to the political class that current policy direction is woefully wrong, or to say it differently, is adding to rather than vitiating the level of economic heartburn. And the Fed itself, with its refusal to end its de facto price controls on credit at such extreme levels, is in this sense only adding to investor and household disquiet.

As to current and near term prospects, of course December’s 200,000 jobs is a welcome sign. But as banks begin to draw down their reserves, and as the Fed continues to support the ECB and other agents involved in the international transactions demand for the U.S. dollar, inflation will rise in the U.S. along with real growth (per the discussion above re: rising velocity, when it happens). At the same time, however, the brewing catastrophe in the Eurozone and unsettled economies in Asia will, in a relative sense, maintain demand for dollars and thus its trade-weighted strength. In this sense Mr. Bernanke is “more lucky than smart,” because if the U.S. dollar were not still the pre-eminent global reserve currency, inflation prospects would be gruesome here now. In the long run the U.S. dollar must per force decline in value because of high U.S. debt levels and poor fiscal policies, and we still fear Mr. Bernanke is playing a dangerous game: there is no easy way to drain these reserves without engendering Catch-22 effects in terms of the bond market, interest rates, or inflation.

But again, in the immediate near term of 2012, as long as the Eurozone stays glued together at least this year (and hence causes no panic in the U.S.), rising stock prices and GDP growth with moderate inflation (higher than 2011’s 3.5%, in our forecast) seem to be the likely trajectory in the U.S.

One last observation: the fact that Mr. Bernanke more than tripled the Fed’s balance sheet in the wake of the 2008 panic, yet found $1.6 trillion, or nearly all of the balance sheet expansion, wind up as excess reserves, is telling with respect to the Fed’s policy instruments and their efficacy. There is an ever more tenuous link between the monetary base and its derivative aggregates, and ultimately now a “Hobson’s Choice” has developed as and when monetary velocity picks up, both due to increased activity here in the U.S. and the eventual retreat from dollar demand abroad. All of this makes us fans of Professor Beckworth and his longtime advocacy of nominal GDP targeting. In a second-best world, that is to say, in a world with fiat currencies where gold is relegated to demand for wedding rings, and where a monopoly note-issuer known as a central bank has to exist, we think a rules-bound monetary regime targeting NGDP is the best answer to investor and household disquiet. Like a broken clock, even Keynes was right twice per day, and his description of elevated liquidity preference in the face of a panic or depression, and how it impedes both investment and consumption demand, is surely correct. But where we assert Keynes and his modern acolytes like Krugman go terribly wrong is in their insistence for monetary ease and government-dominated investment as the antidote to this pervasive nervousness, that leads to slack demand. The way to end the nervousness is to incite the latent energies of the heroic life force that is inherent in entrepreneurs. Production creates and is the source of demand, as J.B. Say taught us 200 years ago. And thus we need more capitalism of the “real”, and not the “crony”, kind, even though the former means fewer jobs for central bankers and government bureaucrats.

The author thanks Professor David Beckworth for helpful and indeed excellent insights on, and discussion of, the foregoing. Mr. Beckworth’s excellent blog on monetary economics is well worth following: http://macromarketmusings.blogspot.com/. For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, John Chapman can be reached at john.chapman@4kb.d43.myftpupload.com.

Click here to sign up for our free weekly e-newsletter.

Stay In Touch