Thinking Things Over April 29, 2012

Volume II, Number 17: Hubbard Versus Summers, and Goolsbee, and ….. Geithner?

By John L. Chapman, Ph.D. Canton, Ohio.

The economic news was mixed at best this past week, and in contrast to the majority in the economics prognosticators’ profession, we fear a near-term pullback — we do not mind having raised cash now. At the same time, we remain confident in better times ahead thanks to better policies in the offing. We explain our cognitive dissonance below.

Precisely a year ago during a visit to New York, this writer had the pleasure to speak personally with Columbia University economist and 1999 Nobel Laureate Robert Mundell. Mr. Mundell is a still spry-octogenarian who splits his time between Manhattan’s Upper East Side thanks to teaching responsibilities at Columbia, and his Tuscan villa near Sienna, Italy. Known as the c0-father of supply-side economics along with Arthur Laffer, as well as being the “father of the Euro” thanks to his path-breaking work on optimum currency areas, Professor Mundell was resigned to a long, slow decline in the U.S. economy:

But you see, the path America is now on follows what has happened in Europe. A very large statist apparatus runs a comprehensive welfare state. The size of the state creates burdens on business that mean rising costs and higher taxes, and this is harmful to job creation and income growth…..The people? But you see, they get used to it. They get used to 8%, 10% unemployment as the norm. Life goes on. Higher inflation? It can become the norm too. Life goes on.

It was a very depressing commentary coming from one of the world’s foremost economists over the last half-century, and from one who had personally fought so hard for the cornerstone policies of sustainable growth and global prosperity: open trading arrangements, sound money and fixed exchange rates to promote peaceful trade and specialization, low marginal tax rates to encourage investment and production, and other elements of harmonious cooperative policies based on an international division of labor. But now, it seemed, the United States had crossed the Rubicon to become the largest European-style welfare state of all, with its universal benefits and the price exacted to pay for them: a permanently sclerotic economy of slow GDP growth, stagnant incomes, elevated unemployment, and a lowered standard of living for “most” in order to support comprehensive benefits for “all” (and, of course, any waste of scarce resources or fraud leading to same that comes along with a more expansive government).

Professor Mundell’s comments were recalled to us this week in the wake of mixed economic news of late, coupled with the dust-up between Governor Romney’s main economic advisor, Glenn Hubbard, and former Treasury Secretary Lawrence Summers, former Obama Council of Economic Advisors head Austan Goolsbee, and current Treasury Secretary Timothy Geithner. We could not avoid wondering if the pessimism as evinced above might not in fact prove to be warranted over the long run, in the wake of the Commerce Department’s announcement of 1st Quarter GDP growth coming in at 2.2%, below consensus estimates (2.5%), thanks to estimated declines in investment (both of the fixed and inventory-build variety), lower exports than anticipated, and (per the national income accounting identity) a decline in government spending. Consumer spending was the strongest in six quarters, led especially by activity in the automotive sector, yet per capita disposable incomes declined, hardly comforting those seeking a rationale for sustainability in this level of commercial activity.

(As an aside, we have come to doubt government reporting of economic growth statistics as much as we do employment data — for example, Commerce Department researchers can come close to approximating the nominal changes in magnitudes, based on a roll-up of, in this case, final sales or reported expenditures. Nominal GDP growth of 3.8% in the first quarter, therefore, is a number we would not dispute. But subtracting a general price level increase of 1.54% to arrive at 2.2% real GDP growth is another matter: casual empiricism, the reports of anecdotal evidence by colleagues around the country, and credible third party researchers all give lie to the government’s inflation data in the last several quarters. Even if, for example, we accept the CPI-U for the last 12 months [2.7%, with core inflation, which excludes volatile food and fuel prices, listed as 2.3%] as correct, if it were reasonably smooth, real growth may well be much lower than the 2.2% estimate implies. Ultimately, this may be in the vicinity of the reality of it all based on sharp increases in the non-core inflation data since 2010, and if our fears are proven correct, the end result will be a pull-back in equity prices.).

Meanwhile, orders for durable goods fell in March (-4.2%), at a rate far worse than consensus expected declines (-1.7%). The volatility of orders in this category mitigates month-to-month concern, however, as overall new orders are up 2.7% from a year ago, while orders excluding transportation are up 5.0%. But what the data point to is that 2012’s growth may not be as robust as had been forecast, or deeply consistent with equity market and profit gains announced so far this year. This news, coming from construction-related sectors, combined with the Federal Reserve’s re-affirmation of a somber assessment of the global economy, is likely to affect U.S. equity markets in the near term (and long term Fed projections continue to point to a 2.4% growth economy, well below the long term average for the U.S. since 1900), and cause some consternation among global investors.

The news out of Europe of late has been even more sobering. Spanish unemployment has passed 24%, and its equity market breached 2008-09 lows. Meanwhile Portugal teeters toward default, Greek austerity and outlines for government funding growth seem wildly optimistic, and the French look set to elect a socialist firebrand in early May (Francois Hollande) who insists that wealth confiscation is an option to solve Paris’ fiscal problems. A deeper recession in Europe than had been forecast is now a real possibility, and this cannot be helpful to U.S. markets — or global growth in general.

With all this as backdrop, then, it was of interest to see Romney advisor and Columbia Business School Dean Glenn Hubbard raise very legitimate questions in an op-ed in the April 25 Wall Street Journal, about the viability of the Obama fiscal strategy to re-ignite growth in the years ahead. In short, having done the pro forma math, Mr. Hubbard calculates that additional taxes on upper income earners and corporate entities will raise $148 billion per year in the years ahead. But this will hardly close the gap with an average growth in spending of $500 billion annually over the next decade, and thus, concludes Mr. Hubbard, average income taxes must increase by at least 11% on the “other 98%” of us, to cover President Obama’s spending desiderata. Former Treasury Secretary Summers then responded to this, saying the Hubbard math was wildly inaccurate, and Mr. Goolsbee piled on in agreement, accusing Mr. Hubbard’s boss, Governor Romney, of being a sycophantic bag-carrier for the rich.

But the richest response of all came from current Treasury Secretary Timothy Geithner, who insisted Mr. Hubbard’s thoughts were akin to those of a “political hack.” Mr. Hubbard responded to all of them in the Financial Times on April 27, standing by his concerns about the anti-growth nature of the Obama budget scheme, when contrasted with the Romney plan to lower marginal rates across the board, flatten the rate structure, and eliminate tax expenditure loop-holes to lessen prior policy distortions.

We were both amused and encouraged by the interchange, in the context of the mixed news of late, in the U.S. and around the world. For one thing, Glenn Hubbard is one of the very smartest economists on the planet, and likely the world’s leading expert when it comes to public finance and how to engender economic growth in the face of fiscal challenges. So in any fight between Hubbard on one hand, and Summers, Goolsbee, and Geithner on the other, we feel sorry for those who bet on the inferior collective intellectual candlepower of the latter three. Mr. Hubbard’s analyses are thorough and quite correct in this case, as is his critique of the retrograde, capital-decumulating growth policies put forth by the current Administration. As the likely Treasury Secretary under a President Romney, we can expect vastly improved fiscal policy — and a concomitantly greater appreciation for a stronger dollar from him, too, than has been seen in a decade in Washington, and certainly from the current Bernanke/Geithner axis.

And in our view it is encouraging that the lines of distinction in the coming election are already being sharpened. When the economists are jousting with each other this early, and the sitting Treasury Secretary is so un-nerved as to lose his professional cool via an ad hominem attack on one of the world’s great economists, one can be certain that the intellectual combat this fall will be intense. This is all to the good, because as both Professors Summers and Hubbard agree, 2012 is a hugely consequential election for our future. And this in turn is the source of our relatively upbeat thinking, even in the face of so many challenges in Europe and the U.S., China and Japan, and elsewhere at the moment: we are unaware of any election in U.S. Presidential history where the candidate with the inferior economic growth plan — as discerned by the voters through the filter of the media — won. Now, to be sure, the mainstream media heavily favor Mr. Obama, and will be expected to make the case on his behalf as summarized by Messrs. Summers, Geithner, and Goolsbee per the above.

But this is not 1936, nor is the United States akin to France (at least not yet). There are now alternative media where the arguments and analyses developed by Mr. Hubbard will get their fair hearing, fortunately for all of us. The world economy, meanwhile, urgently needs a return to robust growth on the part of the United States, and its voters, if given the chance to deliver this in November, are not likely, in our view, to disappoint.

Epilogue

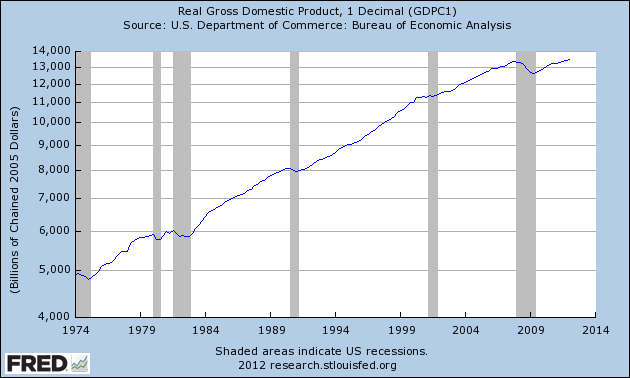

The magnitude of the growth challenge facing the United States can be seen in the following two graphs, and it is important for our readers to study these. The first chart shows GDP growth in the U.S. from January 1, 1974 to the present, while the second is essentially a repeat of the first, enlarged however to begin on January 1, 1997. This is done to show more clearly to the eye the changing inflections in recent years in the growth trajectory of the U.S. economy.

Note the first chart and its 2% real growth between 1974-82, through the end of the double-dip recession. Strong GDP growth beginning with a new pro-investment policy mix effective on January 1, 1983 (highlighted by deep cuts in marginal tax rates over three yars), inflects the growth curve back up to trend by the end of the decade, which also happened after the mild recession of 1990-91. After the 2001-02 recession the curve does not inflect quite back to its prior trajectory due to lowered growth after 2002 and before 2008, but the expansion is still close.

Then, look at the curve over the last 4 1/2 years, up to the present:

Chart I. U.S. Real Gross Domestic Product, 1974-Present (Log Scale, in 2005 Dollars)

What is shown is the deep drop in output in the 2007-09 recession, a slow recovery up to the output level of four years ago, but now a trend line at least 12% (about $1.7 trillion in output!) below the prior trend. If not ameliorated, this will imply a permanent loss in incomes and standard of living, via a forever-lowered trajectory for growth in the U.S.

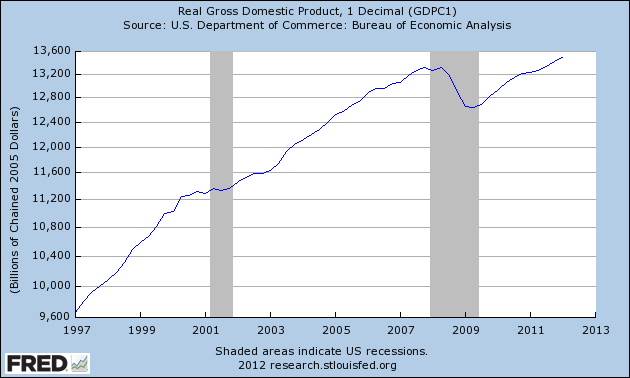

The graph below highlights the years after 1997, including 1997-2000 and its near 4% average real growth, on up to the present, to again show the devastating losses inflicted on the U.S. economy in the last four years:

Chart II. U.S. Real Gross Domestic Product, 1997-Present (Log Scale, in 2005 Dollars)

As Lawrence Summers says, this is a “consequential election.” In graphic terms, what is to be debated this coming fall is, why has that graph not yet returned (or, at this point, when will it, if it will return) to its pre-recession long term trend, as it always has before, even after the Great Depression? While the economic news around the globe has been challenging lately, our firm belief is that a Treasury Secretary Hubbard would understand the policy drivers that shape the slopes of the graphs above better than most, and we could expect improvements in the U.S. economy and public fisc under his leadership in the years ahead. To be sure, we have slight quibbles with Mr. Hubbard, in that he has more evident faith than we do in the viability of a fiat currency managed by a central bank, and he seems more willing than would be preferred to compromise with the political Left in this country on the question of progressive taxation; both its efficiency and its morality are in question — and doubt — for us.

But that does not detract from the objective reality of Mr. Hubbard’s native brilliance, integrity, or suitability for the job of Treasury Secretary beginning next year — an outcome global equity markets would come to ratify.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, John Chapman can be reached at john.chapman@4kb.d43.myftpupload.com. The views expressed here are solely those of the author, and do not necessarily reflect that of colleagues at Alhambra Partners or any of its affiliates.

Click here to sign up for our free weekly e-newsletter.

Stay In Touch