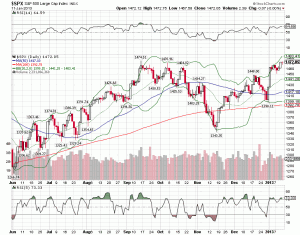

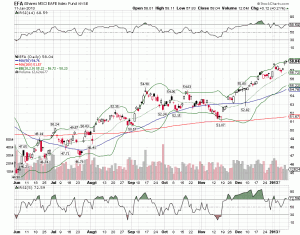

The sentiment regarding US stocks has recently gotten even more bullish and while our longer term outlook is fairly bullish, it is hard to maintain that stance in the short term. The AAII weekly poll now has bulls at 46.5%, bears at 26.9% and fence sitters at 26.6%. While that isn’t enough to send me running to all cash, it is more than enough to keep our cash sitting on the sidelines. Investor’s Intelligence, Consensus and Market Vane all show a majority of their respondents bullish. Being bullish here is not exactly the brave trade. From a technical standpoint the S&P 500 is extended and we’d prefer to assess any pullback before considering further purchases:

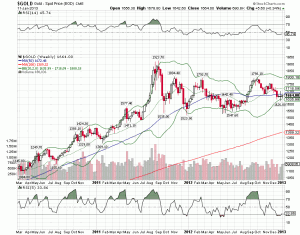

For me the most distressing market movement last week was the US dollar index and to a lesser degree, gold. I have been waiting – for year – for a market with rising stocks, a rising dollar and falling gold. I have been looking for a stronger dollar this year and last week was a set back:

Our investment process is dependent on identifying the expected economic regime and investing in asset classes that benefit from the regime. We really only look at two factors: economic growth and the currency. Our most favorable environment is a rising currency and rising economic growth which is where I continue to believe the US will eventually get to this year. But for now, while growth continues to look okay, the dollar is not cooperating. We don’t have enough evidence – either fundamental or technical – to make a call yet but if it is going to fall, we’ll be looking more closely at gold and other commodities, emerging markets and foreign developed stocks.

Gold has been moving in a sideways pattern for almost 18 months now and gives us no clue as to which way it will go from here. Considering that there still seems to be a plethora of bulls in the space my instinct is expect a move to the downside but I’ll reserve judgment.

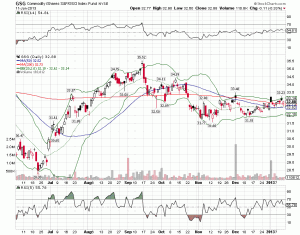

Like gold the general commodity ETF, GSG gives us no good technical information. A move above 34-35 resistance would obviously be bullish and move below 31.5 bearish but for now its wait and see.

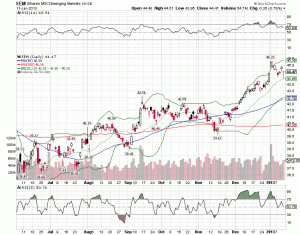

Emerging markets look bullish on a short term chart but are actually sitting at pretty big resistance on longer term charts. We will assess this on any pullback. If a correction is accompanied by a falling dollar, we are more likely to add to EEM and shun SPY.

Like EEM, the short term EFA chart looks attractive but is also at major long term resistance. As Bespoke put it recently, the whole world is overbought. Also like EEM we will evaluate our positions during the correction. If it looks as if the dollar will be in a declining trend, we’ll stress hard assets and foreign stocks. If the dollar is able to sustain a rally, we’ll minimize hard assets and stress US stocks, particularly small caps.

The economic data last week was light but fairly bullish in tone. Having said that, there were also some reports that we found troubling.

The small business optimism report was up a half a point to 88 but remains in recessionary territory. Taxes and regulations – not surprisingly to us – are the two biggest worries. Also worrying was the consumer credit report which showed and expansion of $16 billion. What worries us about this report is the continued abuse of student loans or more accurately, the abuse of students. I expect a lot of these loans to just be written off in coming years and a cynic might think that was exactly what the Obama administration had in mind when the took over the market in his first term.

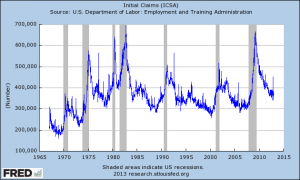

Jobless claims came in at 371k continuing the sideways trend. I can’t help but think the longer this series goes sideways the less likely it is to start falling again.

One unequivocally positive report was the wholesale sales and inventory report. Sales were up 2.3% which swamped the rise in inventories of just 0.6%. The inventory to sales ratio fell to 1.19.

The trade deficit widened in November but both imports and exports were higher so it doesn’t seem to worrying.

Overall the economy appears to have weathered the slowdown in China and Europe along with the political drama in the US in pretty good shape. Of course, the economic data is backward looking and I am more concerned about the coming data for the first quarter. The tax hike, especially the payroll tax, will make a difference to income and therefore consumption. How much is anyone’s guess at this point but further political bickering over the debt ceiling surely won’t help either.

For now, we do not have enough confidence to make a call about US economic growth or the course of the dollar. Until we gain some insight on those items we will remain conservatively invested with a large cash reserve.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or  786-249-3773.

786-249-3773.

Click here to sign up for our free weekly e-newsletter.

Stay In Touch