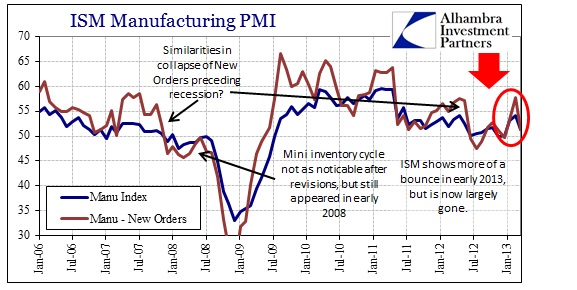

The ISM Manufacturing reports for January and February 2013 looked to be showing a noticeable rebound in manufacturing activity after some rather dicey months in the second half of 2012. I posited that this rebound was largely inconsistent with broader data (notably durable goods and factory orders) and explained them in the context of a potential inventory cycle heading into a potential contraction in overall economic activity.

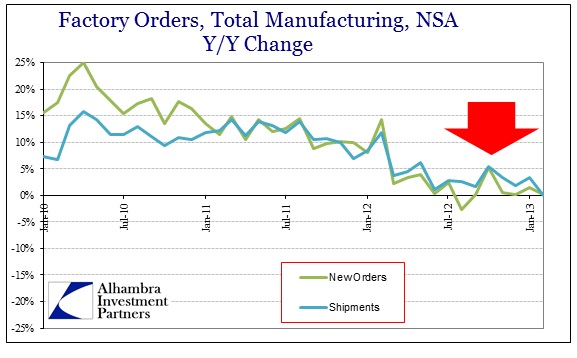

The Factory Orders data from February confirmed the divergence with the ISM, as factory orders and shipments continued at an atypically depressed level.

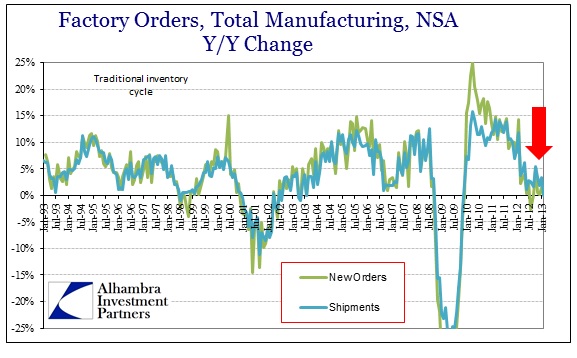

On a year/year basis, total shipments in February contracted (-0.04%) for the first time since November 2009. New orders have contracted in six of the last nine months, including February 2013 (-1.25%). This extended period of weakness is far below what we saw in either 2007 or early 2008 just before the collapse in October 2008; for comparison purposes, the Y/Y growth in shipments and new orders in September 2008 were 3.2% and 4.3%, respectively.

Since the Factory Orders series encompasses non-durable goods industries as well as durables, it gives as a broader indication of goods purchasing in the domestic economy (everything from motor vehicles to capital goods to textiles to food). From this we can reasonably conclude that, at best, there is no forward momentum in the goods economy right now running through the supply chain’s beginning stages.

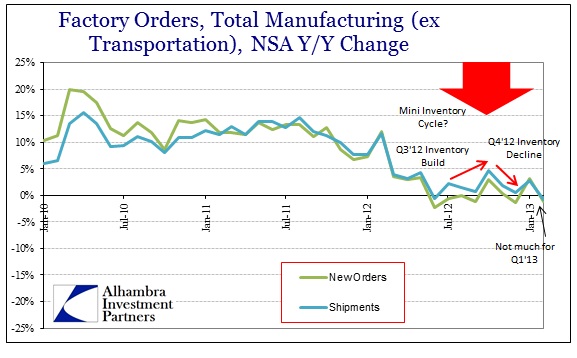

What we may have seen, and what conforms to the revised GDP figures, is a mini-inventory cycle running through the entire supply chain from production to wholesale. We know that at the wholesale level inventories have been building to relatively worrisome levels due to a dramatic decline in retail and wholesale sales in the middle of 2012. From there we have seen rather stark volatility in inventory levels – a build in Q3 ’12 and then a dramatic reversal in Q4 ’12.

I found it somewhat likely and even logical that there would be another rebound in inventories going through Q1 ’13, but both the Durable Goods and Factory Orders data series show, again at best, a relatively minor increase. Even if there was a January rebound, in both these reports they reversed very quickly to contraction in February.

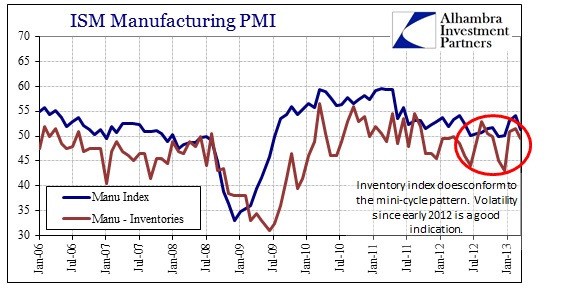

This mini-cycle was far more apparent in the ISM Manufacturing Survey, which showed a far more dramatic rebound into the beginning of 2013.

The inventory component of the ISM index does indeed show exactly the kind of inventory cycle we have expected. Further, the rebound in January & February 2013 has either arrested or has been fully exhausted (depending on which subindex you use for interpretation).

If I am correct about this context, then perhaps the inventory cycle has been further compressed than even I have anticipated. Going by Durable Goods or Factory Orders, there was barely any bounce. Using the ISM or even the Chicago PMI (which collapsed in March from 56.8 to 52.4; New Orders there tumbling from 60.2 to 53.0; overall production from 60.2 to 51.8) perhaps indicates a better bounce in the production end of the supply chain, but also one that appears to be reversing in March. So the timing and the pacing of the mini-cycle may not agree across these data figures, but the overall pattern is relatively uniform.

No matter which series we look at, the inventory mini-cycle seems to be holding, but compressing. Though it is hard to anticipate the pace of compression, businesses respond to challenges downstream into wholesale and retail levels. Into any recession we would expect to see this type of re-evaluation at every step of the process, as inventory builds at first, then is sold off, only to be rebuilt far more cautiously in the next step. If that inventory rebuild finds further difficulty moving up the supply chain and getting disposed into wholesale and retail channels, the cutback in production is progressively tighter and steeper.

I think it is a good bet that the first inventory shock in the middle of 2012 kicked off this traditional inventory ratcheting process. What we don’t really know yet is how far down that road the early stages of production have traveled. Again, the optimism in 2013 driven by the ISM and Chicago PMI vs. the Durable or Factor Goods or even the regional Fed surveys seems to have waned considerably by March.

If that is the correct interpretation, then the next step will be informative as to just how far the potential contraction in activity will go. In responding to a second inventory mini-cycle, we should get a clearer, more quantitative picture of how much businesses will constrain activity the second time and can then get perhaps a better estimation of potentially how deep any contraction might progress. It bears repeating that most of this manufacturing and goods-level data is already at, or very close to, recessionary levels.

There are variations to keep in mind, however. The 1982 double-dip recession (the back half) proceeded far more slowly, taking its time to fully develop, as opposed to the severe and sharp collapse after September 2008. This is not to say that any potential contraction or general recession in 2013 will be as severe or as sustained, only that there are various patterns that may be followed, each with different challenges for both the economy and markets. It is, however, an extremely safe bet to say that whatever the path, it will be “unexpected”.

Stay In Touch