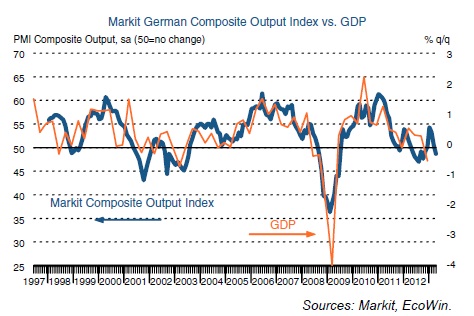

The bounce for Germany seems to be over, and, much like US manufacturing, there appears the mini cycle.

Markit PMI for Germany:

Both the ZEW Indicator of Economic Sentiment and IFO Business Climate Surveys disappointed expectations, as sentiment in Germany looks to have passed an inflection and rolled over again in sympathy with manufacturing. For an economy coming off a 0.6% decline in GDP in Q4, these results tend away from expected recovery (then again, economists are usually the last to see these trends).

Both the ZEW Indicator of Economic Sentiment and IFO Business Climate Surveys disappointed expectations, as sentiment in Germany looks to have passed an inflection and rolled over again in sympathy with manufacturing. For an economy coming off a 0.6% decline in GDP in Q4, these results tend away from expected recovery (then again, economists are usually the last to see these trends).

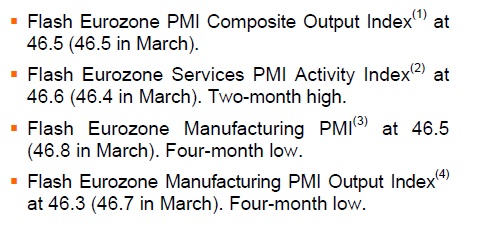

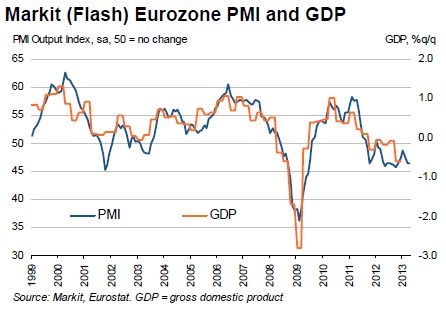

Without the expected German rebound, results for the Eurozone as a whole softened even further. Both manufacturing and services appear entrenched in contraction, as manufacturing fell to a 4-month low on that “unexpected” modulation in Germany.

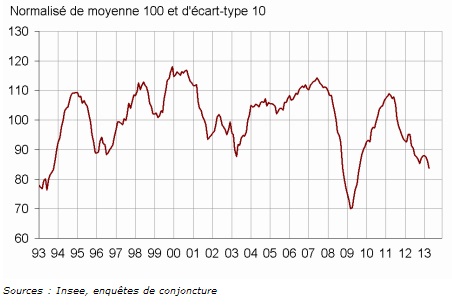

At the bottom end of the European economic dysfunction exists the French economy. Showing up more as a PIIGS or “peripheral” economy, a survey of French CEO’s fell further toward Great Recession depths.

The latest data on consumer spending and durable goods was disappointing, falling 0.2% in February after a collapse in January. For example, car purchases rebounded 2.4% in February, but declined an astounding 11.5% in January. Total durable goods spending by French households dropped 0.9% in February, following the much larger 3.0% decline in January.

Weakness in French consumption is largely related to, as in the US, contraction in real disposable income (-0.5% in Q4 ’12). Disposable income problems in France are not solely due to jobs and employment, another factor in common with American households. Wages were positive in the final quarter of 2012 (+0.3%) and social benefits, ie, transfers, were also higher (+0.9%). Taxes on wealth and income, however, more than offset these gains (+7.0% on income, +2.0% social security contributions by employees).

These results are common throughout the “developed” economies. Jobs and wage growth are not sufficient in any country to bring about a robust enough period of organic economic growth to support the continued burdens of over-financialization. Austerity has gained the most attention recently as an easy explanation for this “unexpected” fifteen-month re-recession in Europe, but the real culprit lies in the heavy emphasis on maintaining banking and forestalling financial loss/capital adjustments.

The trend in taxation is simply the belated recognition of the cost of absorbing bank debt through nationalization; true as much in France as in Spain or Portugal. Exports fell 0.6% in France in Q4, but imports into France fell further, 1.2%. Traditional or mainstream economists expected a wage/labor adjustment between the high cost/low productivity countries (PIIGS) and low cost/high productivity countries (Germany, France, Netherlands). They did not anticipate the economic adjustment would be nearly universal, a development that was sealed in the interconnectivity of European (and global) banking.

It’s not austerity, it is financial gravity at work. Central bank and national austerity measures are nothing more than Sisyphean gestures.

Stay In Touch