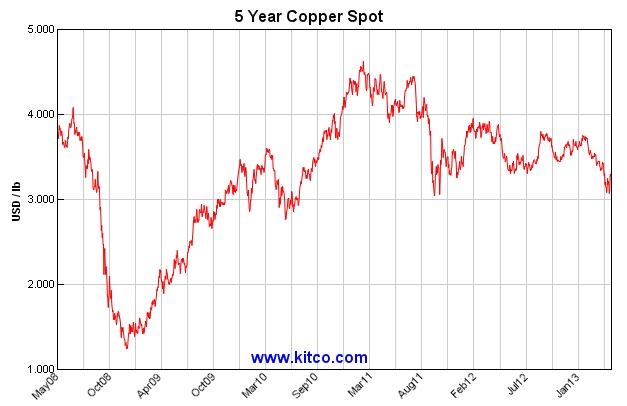

Following up on the global trade warning out of Australia, commodity prices are acting as another corroborating piece of the global slowdown. Typically, copper acts as a decent barometer of global manufacturing activity, earning the nickname Dr. Copper. Copper prices have slumped recently, moving back to the lows of mid-2011 (just before the European re-recession emerged).

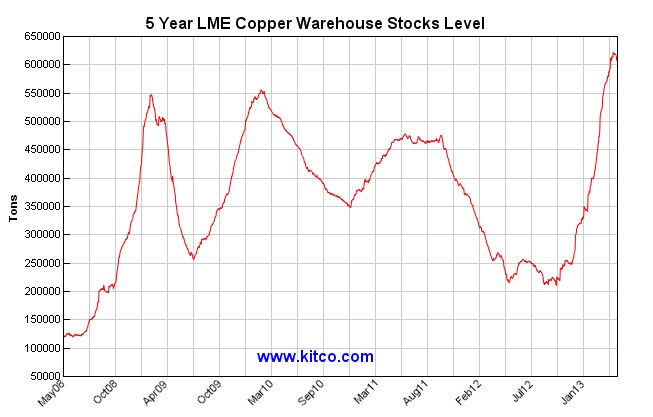

What is more amazing, and potentially more meaningful in terms of estimating future activity, is the massive buildup of copper inventories.

The sheer level of accumulation is not even matched by the demand and activity collapse in 2008. Since copper prices remained relatively depressed after the 2011 slowdown, it does not appear as if prices are driving new supply to market far above typical demand (like the inventory increase in late 2009/early 2010). Rather, given the behavior here, it seems more likely that demand dropped off a cliff toward the end of 2012.

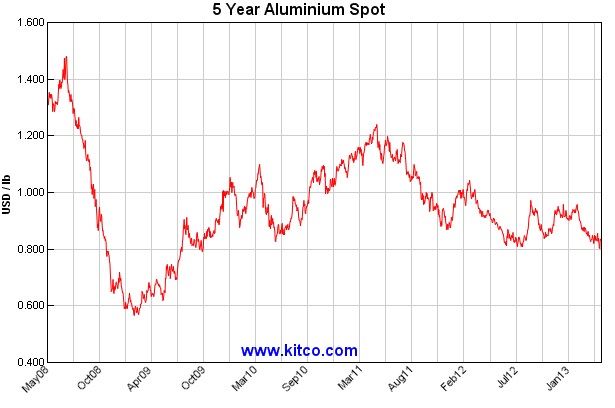

While not as dramatic, we see similarity and sympathy from metals like aluminum.

We can tie all this movement to the depression in Europe, anecdotes of slowing industry in China, and a dramatic decline in Australian resource fortunes. While Europe is certainly one end user market, the pace of expansion has been erased in the US as well.

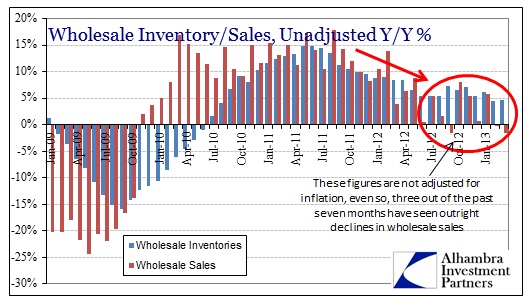

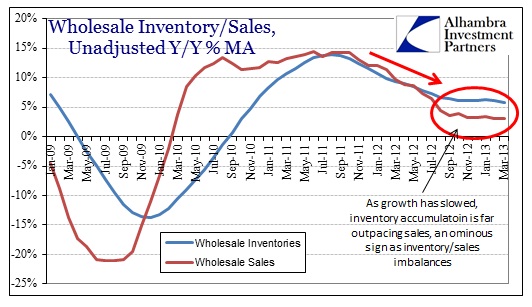

Wholesale sales of both durable and nondurable goods in the US fell in March 2013; the third monthly decline out of the past seven months.

While wholesale sellers have been finding difficulty moving product, they have still been accumulating inventory. This is the normal course of the first stages of recessions, as wholesalers (and retailers) take a cautious approach to their inventory levels and only allow them to draw down reluctantly. That is until it becomes clearer that they have to discount prices to move them as inventory accumulations simply grow too far.

At some tipping point, wholesalers, acting on end market demand levels, stop ordering new production in an effort to reduce inventory levels.

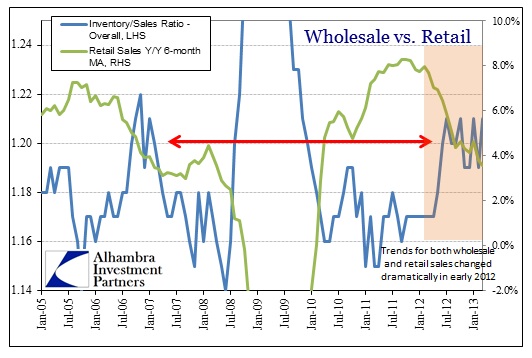

In terms of the supply chain, we see that retail sales began a steep descent at the beginning of 2012, followed closely by wholesale sales. That fed an inventory accumulation that hit into not only global production, but domestic production as well.

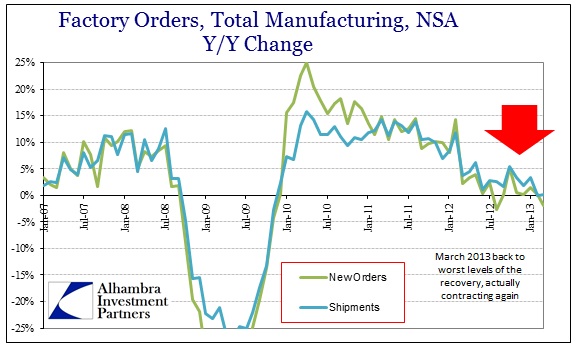

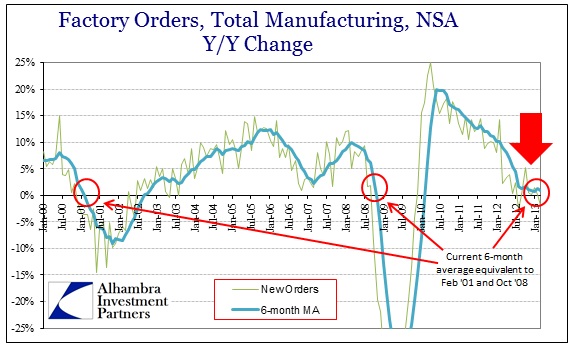

Despite a modest bounce toward the end of 2012 and into the very beginning of 2013, factory orders have again descended. Given the nature of the relationship between orders and shipments, we should expect that manufacturing shipments will also begin to decline in the coming months (they have barely been positive, +0.02% in February and +0.18% in March; in real terms shipments have contracted in three of the past four months). Perhaps that explains the latest Chicago PMI reading below 50 (for the first time since 2009).

What is crucial here is the inventory accumulation. The 2013 decline in new orders across manufacturing is a very good indication that wholesalers are indeed reaching their limitations. The extension of weakness up the supply chain into retail sales suggests that even the current declines in orders are likely not enough to re-establish inventory balance. This is classic recession behavior, and current production levels show as much.

So we have Europe in a re-recession/ongoing depression and the US goods economy at recession levels. It should then be little surprise that resource countries and those most directly situated in the global trade supply chain are facing drastic “headwinds”. It remains to be seen whether the US service economy eventually follows, but it does make you wonder what all the global stimulus has actually accomplished (or wrought?).

From what I can see, the service sector is relying on QE and the “wealth effect” to remain on only a slight upward trajectory. As we have said time and again, this bifurcated economy does not resolve upward on that wealth effect – too many Americans are left outside the comfort of monetarisms. It works the other way, as the malfunctioning economy eventually overcomes the artificial and limited lifting. However, it does make this process unique in the historical series as it seems to have lengthened considerably the timeframe for these processes to play out. In other words, the entry into contraction, in contrast to typical cycles, is much shallower and less sharp.

It seems as if we are on track to “ease” into a recession. From there, barring any massive positive “shocks”, I would expect more classical behavior. The global trade systems, particularly sensitive commodities, indicate as much, as does the US goods economy/inventory cycling.

Stay In Touch