In trying to sound modest and even magnanimous, Ben Bernanke in November 2010 penned an oped in the Washington Post justifying the recently implemented QE 2. Toward the end of his piece he acknowledged that the Federal Reserve and monetary policy could not work miracles. But given that obsequious qualification, the Fed Chairman was very clear on what he expected:

“This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.”

All of these finance-related variables are supposed to lead inexorably toward one goal, “economic expansion”. Whether it is stock prices leading to confidence or corporate bond rates and business investment, all of these are expected to create economic expansion, the virtuous circle of capitalistic risk-taking.

Now, more than two and a half years and two additional QE’s later, the standards are changing. The Dow is up, you see, and that alone now means monetary policy is successful. That has been the most common refrain coming from all corners of the QE world – stocks are up, so monetary policy must have worked.

Except that stock prices are only one step toward Bernanke’s 2010 standard for success, as he himself defined it. Not only is it the standard promoted by the Federal Reserve, it is also what the public at large expects out of its (in theory the Fed works for the public) central bank. Stock prices don’t mean much to most of the working and unworking world of 2013. If they had, the proportion of unworking would be far greater, and those that are working would actually be taking on increasing quality job positions.

If monetarists and their supporters are left to appeal to stock prices as the measure of success, then they have softened their standards to fit the reality of economic circumstances rather than admit the obvious. Again, stock prices were themselves only one step in the process, not the full extent of it.

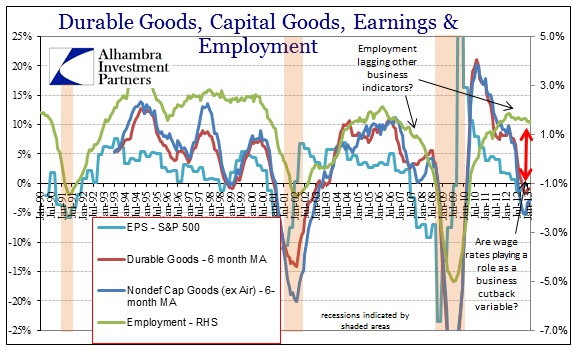

Stocks are supposed to reflect fundamental values, not the fuzzy creation of potential money by central banks – PE expansion is a wholly different indication. The myriad economic accounts that are currently at levels typically associated with recession belie the use of stock prices as a measure of real “economic expansion”. Once again, the cart is before the horse here.

Whereas stock prices are an easy target, the monetary side has also lowered their standards as to what actually constitutes “economic expansion”. While there is little doubt that in 2010 Bernanke meant a full recovery that extends into the full economy, including employment (the whole idea of the virtuous circle is not a limited appeal to small segments), there has been a process of rolling back even these expectations.

What we are increasingly seeing is an effort to lower the bar through comparison. Basically, the monetarists are now reduced to impishly proclaiming “at least we’re not Europe”. Instead of a virtuous circle tied to a full-throated recovery, we should fully and completely celebrate the wisdom and genius of not being in a re-recession/depression. The bar could not possibly be lower than that.

In the piece cited above, the author commits the logical fallacy of begging the question. The US is not in a depression (obviously according to his own observations) and Europe is, so the difference has to be monetary policy? It could not possibly be massive public debt loads and over-reliance on government redistribution, or massive labor disparities inside the European “Union” itself? Nor could the strangling euro that treats Germany the same as Spain and Greece be responsible?

I will say it again, the fact that central banks are still engaged in massive “easing” and “stimulation” now four full years after the end of the Great Recession is dispositive proof that Bernanke’s standards from November 2010 have not been met, at all. And as far as stock prices as a metric, asset inflation is again proof of nothing more than monetary imbalances that will have to be corrected (same goes for housing, taper and all).

We need an economy that works, and puts people to work in appealing jobs. The illusion of prosperity through asset inflation and artificial market pricing (including the large premiums the Fed has been paying for MBS and UST) is not what the US has been expecting. We are still waiting for a recovery – not unlike the Japanese going on their third decade of QE and monetarisms. But at least for the Japanese the Nikkei is up 50% 30% this year (just don’t look at a longer chart).

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch