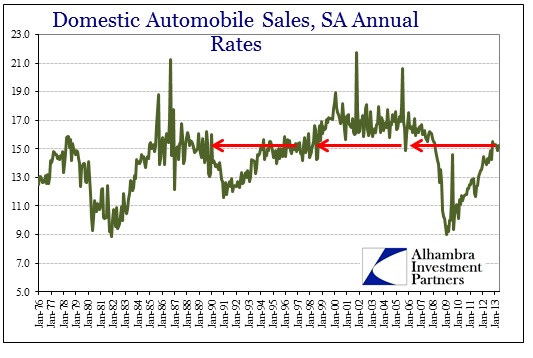

If there has been one consistent source of strength in the US economy it has been automobile manufacturing and sales. However, even that is a bit of a misdirection since the growth in autos since 2009 owe mostly to the depth of contraction in the Great Recession. What looks like rapid growth is really a delayed attempt at returning to pre-crisis levels.

Even for the month of May 2013, the headlines scream a huge pickup in sales over April. Car sales were up 5.7% and light trucks +10%. The annual sales rate hit 15.24 million, up from 14.88 million in April. It all looks good on the surface.

In February 2009, the annual auto sales rate was just over 9 million units. To go from 9 to 15.24 is a pretty solid growth rate. But that May sales rate is still far below the 16+ million we saw during the housing bubble. The current rate is just getting back to levels we saw in the 1980’s and mid-1990’s.

That explains in part why such robust growth has not translated into wider economic success. Like so many other economic variables, the structural shift after 2008-09 was immense, so much so that it has taken four years to just to get back close to pre-recession levels. That speaks to the structural economic problems that existed in the form of asset inflation, and how the Great Recession was not really a recession at all (at least in cyclical terms).

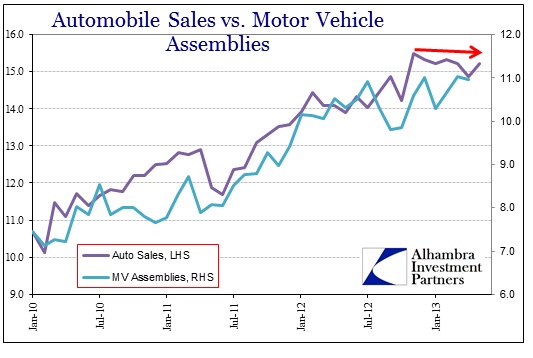

As much as the 15 million level seems to buoy optimism, it was actually breached back in November 2012. Despite the rise in May sales, overall, there has been no growth since that point – in sales. Production, however, has not abated in any consistent fashion (outside of a drop in January 2013).

That has led to another inventory increase at US dealers. So far, they have not scaled back orders for autos (as indicated by factory orders) and new production. They have, however, been upping their incentives while several auto sellers have cut sticker prices. The average cash incentive has been about 8% recently, but many automakers have been offering 10% and more. That would make these the largest sales incentives since 2009.

And that is just to keep the sales pace from sagging.

While we will have to see whether May’s sales are an upturn or the last hurrah, auto sales across the rest of the globe are downright depressive. It is no surprise to see such massive declines in PIIGS nations, but autos have been problematic from German and France to Japan (Abenomics had no magic in May).

France is an economic mess, so the 10.3% decline in May 2013 over April 2013 isn’t really too much of a shock. However, May was not an outlier. Auto sales in the first five months of 2013 were 11.9% below the first five months of 2012. And 2012 was not exactly a robust comparison.

In Germany, vehicle registrations looked a lot like the French numbers. There was a 9.9% decline in May M/M, and an 8.8% decline in the first five months of 2013 over 2012. Commercial registrations dropped by 13.7%.

Finally, the monetary promise of QE-steroids from the Bank of Japan did not translate to domestic auto demand for the island nation. While there was a tremendous amount of hope that April 2013’s 2% increase was the beginning of a new monetary-driven trend, May’s -7.3% Y/Y poured cold water on that premature celebration. Even sales of minis fell 6.3% in May (the first decline in two months).

The larger question here is whether or not the torpor in global auto sales in developed markets means anything larger about the current economic state. Is a healthy global economy consistent with these kinds of declines, slowdowns and structural shifts? This is extremely relevant given both taper talk and hopes of “normalization” in the not-too-distant future.

I can’t find anything normal about this. It is entirely possible that there has been a paradigm shift in consumer appetite for large ticket expenses like autos, but even that would be hard to justify without a huge drive toward urbanization in these countries or a new technological alternative. Yes, people are driving less, but that itself is not necessarily a secular trend either. The lower vehicle miles are clearly related to stressed income, far more than any environmental focus or shifting preferences among the younger cohort.

When you get down to it, vehicle sales are a proxy for disposable income and consumer perceptions about security in their incomes. The primary structural shift, that is driving the US auto sales pattern, is not driving habits but the loss of both income and supplement of debt. It really is that simple.

Unless these auto sales results in “healthy” markets reverse, I will not be convinced that the structural economic issues have been resolved favorably. The auto has not gone out of style like landline telephony, rather far too many formerly “wealthy” nationals just can’t afford them (or at least feel that way).

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch