Following up on the repo warning from two weeks ago, we have gotten confirmation in the form of repo fails. In the US treasury repo market, the primary liquidity conduit in the US dollar wholesale money, we have been seeing indications of dramatic shortages in available collateral for some time. It was first noted back in March in the week just before Cyprus, reappearing recently.

What has been odd about the shortage is not that it has occurred, that has been expected given the size of QE 4 and its removal of usable collateral, but that it seems focused on the 10-year maturity. Given the fact that so much of this market is OTC and opaque, we have only secondary indications to tell us about how liquidity is flowing. In both the March and most recent episodes, the repo rate reached the -3% fails penalty indicating desperation.

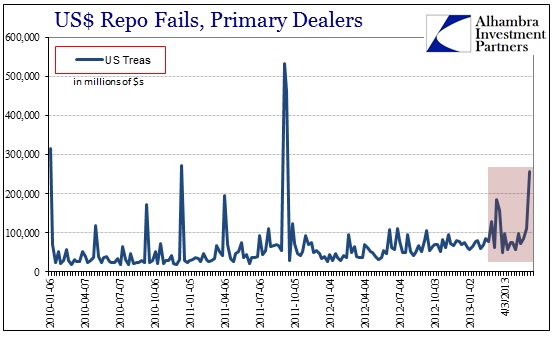

Accompanying the negative repo rate, we have seen now two spikes in repo fails (with the most recent June data even greater) that confirm the negative repo rate.

A rapid rise in repo fails is an indication that repo counterparties are, at the margins, “valuing” repo collateral more than cash. They would do so only in cases where the supply of usable collateral is hard to come by. The fact that the fails rate rose in both cases where we saw the 10-year UST repo trade against the 3% failure penalty indicates the degree to which there is a 10-year shortage (and indicates it may not be limited to the 10-year maturity).

We know that QE is playing a role in this regard, as the Federal Reserve takes in usable collateral and “locks” it away in its SOMA portfolio. It is hard to estimate just how much QE is playing a role in repo shortages, but there can be no denying it as a primary factor.

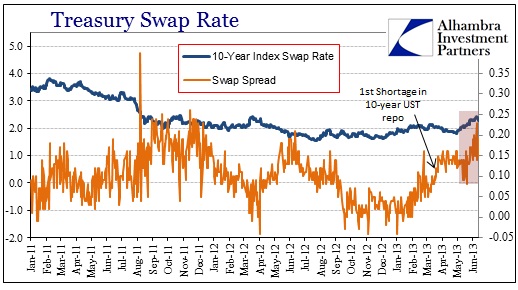

Where this gets really “interesting” is the implications across markets. Again, the fact that the 10-year is in such short supply is a potential indication about where collateral demand may be colliding with this supply drainage.

Interest rate swaps are the largest class of derivatives, and banks have been heavy takers of the floating side. We know this again through secondary means, but as banks have been betting, ironically, on QE keeping rates low they may be overextended on these swaps – meaning as interest rates and swap spreads have been moving upward and decompressing, respectively, banks may be experiencing margin calls. Since the most dramatic decompression has been in the 10-year treasury swap indication, we can make the leap to a heavy increase in demand for like-maturity US treasury collateral. In other words, as the spreads blew wider anybody on the floating side has been getting margin calls to post more collateral against the declining market value of the floating side of the swap.

This is a major problem for the banks if interest rates continue to sway in the volatility range we have seen. It is also a massive impediment to unwinding QE, thus taper talk is not just misguided (in terms of the “improving” economy) it is dangerous.

Collateral cascades and the daisy chain rehypothecation collapse in 2008 caught the Fed and other central banks completely unprepared. With QE now reversing effective liquidity against a volatile backdrop, liquidity reverses back toward unstable again. Whatever minimal improvement the FOMC imagines better be worth it.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch