At the end of January 2013, UPS management patted themselves for company’s results in an admittedly tough environment. In between regular allusions to “strong” numbers and operational tendencies, Chairman and CEO D. Scott Davis wrapped it all up in the positive:

“Although we fell short of our goals for the year, we did achieve record earnings per share.”

The dichotomy contained in that one statement sums up well the market/fundamental reality contained in the “recovery” after the Great Recession. What he meant was, as we have highlighted on occasion, the difference between operational results and earnings per share. As long as cash flow is being used a source of funds for shareholders (particularly repurchases), management will be “strong” and happy. At some point, however, investment in the actual operations rather than financial operations needs some attention, but that apparently can wait for the real recovery; particularly since it’s just around the corner:

“Here I must admit that in the U.S. we are off to a surprisingly strong start in January. In Europe, there has been some improvement. Forecast for Germany and the U.K. are better, while the Netherlands and Poland are worse. But clearly, we’re starting 2013 in Europe in a more stable situation than last year.”

Good start in the US plus stabilizing Europe must mean recovery as QE is delivering.

Not even six months later, UPS earnings guidance for FY2013 has gone from 6% to 12% estimates to slashed 3% to 7% estimates. Given that dichotomy between earnings and operational results, can we not conclude that the “surprisingly strong start in January” was an illusion of mainstream economics? It’s not as if Q1 turned out all that well, either.

Contained within UPS’ recent guidance were a couple of telling phrases. The first was, “slowing US industrial economy”; not something that was at all anticipated only six months ago. The second was, “overcapacity in the global air freight market.” Given that there aren’t exactly numerous global air freight businesses in every airport across the world, it’s not as if “overcapacity” has appeared as a result of optimism and credit fueling over-investment in that business. Any “overcapacity” is therefore left as a result of durably lacking demand.

This is a word, overcapacity, that should scare the taper back into the policy handbook. Former doves turned hawks would turn dove if overcapacity should become embedded (more than it already is) into US corporate earningsspeak. Overcapacity is synonymous with recession; admission of overcapacity indicates the timing.

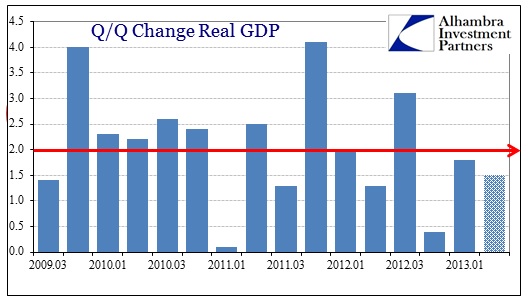

If we go by contemporary GDP estimations, an often un-illuminating exercise, Q2 2013 will likely mark the third consecutive quarter of sub-2% growth. Current estimates vary between less than 1% and a high end of near 1.5%. Even if we give the economy the benefit of “strong” attributes as they seem to be in corporate foresight and pencil in that high-end 1.5%, the trend is quite clear here.

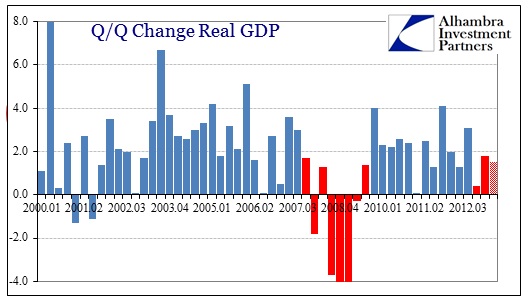

That is more consistent weakness, given that 2% is considered by the academic economist profession as “stall speed”, than we even saw during the entirety of the 2001 recession.

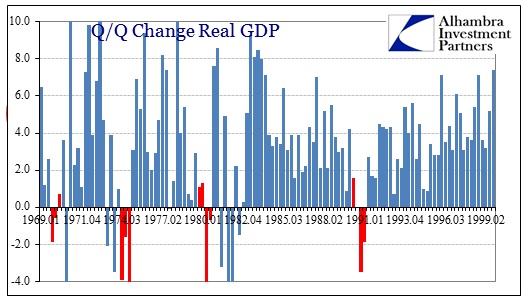

Further, going back to the recession of 1970, the only periods with consistent sub-2% real GDP growth are those where overcapacity is transforming to more organic levels through economic dislocation, i.e., recession.

Even the terrible recession in the back half of the early 1980’s double dip contained more positive quarters than we have seen recently (interspersed with some really bad quarters).

Four of the last five quarters have been 2% or less (with Q1 ’12 right at the 2% level); with Q2 ’13 likely making that an astounding five of the last six.

Again, I don’t see improvement here, nor do I see a recovery (remarkable that four full years after the Great Recession ended we are still talking about it) “gaining traction”. What I do see is asset prices diverging not only from economic fundamentals, but now from corporate rhetoric.

Well, in the case of UPS stock, this latest disappointment (in a string of them) did knock it from its recent high. Maybe the ttm PE of 94.98 will support that price far closer to the high than the low (yes, that is a cheap shot at the stock, but not too “cheap” since the useless forward PE just got pushed from 17.4 to 18-18.5).

Back in March, Larry Fink of Blackrock was conspicuously hyperbullish on the US economy. Perhaps he should have limited his bullishness to where QE can actually have a temporary impact: asset prices.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch