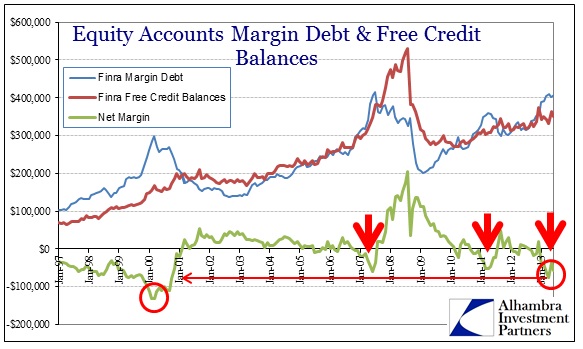

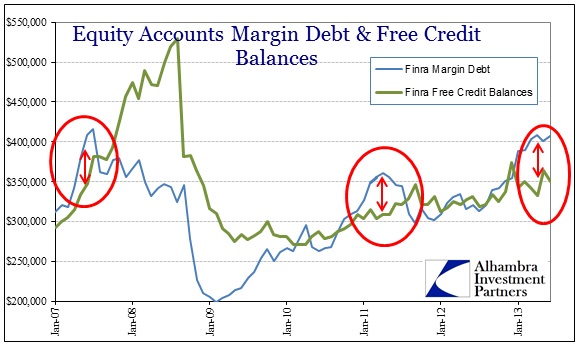

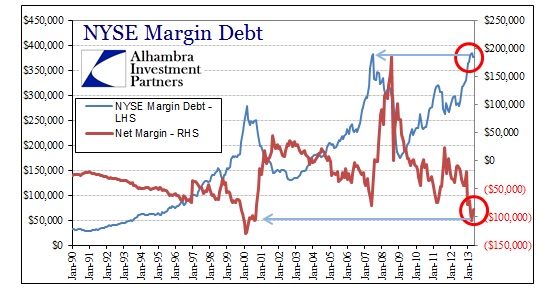

Given the volatility in bond markets and the introduction of the word “taper” it is little surprise that equity investors increased the equity or free cash in their stock accounts. Taking a little off the rapid rise in margin debt usage, the high level of complacency and extended leveraged positions was due for a re-allocation as it was. The last time investors held to such leveraged positions were close to noticeable market inflections (tops).

Net free credit balances which had grown extremely leveraged at -$76 billion in April, reversed almost $40 billion in May through stock sales and increases in cash balances alone. Margin debt was down slightly, but mostly unchanged from the previous month.

By June, only a partial amount was reinvested, about $13.5 billion, while margin debt balances only rose back close to their April high. That can be interpreted as a far more cautious consensus on the new highs we have seen since. The bull case will no doubt look at that the same data and see fuel for a renewed rally, but unless the bond markets fully settle and the economy actually picks up (beyond promises and future optimism) risk-taking and perceptions of risks at such extreme levels may be turning.

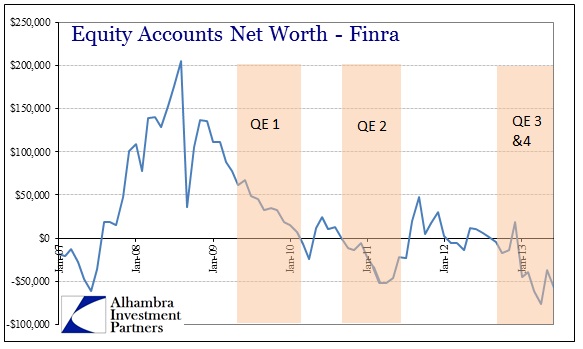

There can be little doubt that QE has played a significant role in investor complacency, reinforcing (or self-reinforcing) the narrative that central banks have banished “tail risks” in the tsunami of pseudo-liquidity. However, the bond market selloff, particularly high yield corporates and now munis after Detroit, beg to differ. The luster of QE has always been the psychological reinforcement that perceptions of liquidity trump every other “market” concern, but liquidity and QE-driven perceptions have been divorced for some time now.

Despite the slight change in stance, risk-taking remains at elevated levels historically. Given that it has taken four episodes of QE to get there, it is not at all clear what it might take to push further on outside of actual improvement – there are no more liquidity promises to be made.

If May’s market action is anything of a guide to how price action will relate to renewed interest in hedging and risk management, markets may be heading for more volatility. Two months certainly do not make a trend, but they were noticeable enough to begin thinking along those lines. I would not be surprised to see a little more risk-taking in July’s figures, though perhaps more caution like that in June.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch