Yesterday the Fed conducted the first test of its newly-minted Fixed-Rate Reverse Repo program. The auction drew $11.809 billion in bids (all accepted, thus the “fixed rate” rather than “fixed allotment”) at 0.01%. Since this is a reverse repo, the Fed is “borrowing” cash from the system, collateralized by the UST’s in its SOMA holdings.

Most commentary continues to focus on this program as an “exit” strategy, but, as FOMC officials themselves have noted, this new program includes new features. Primarily, this was likely a test to see how well or smoothly nonbanks were able to participate. That is the biggest “innovation” here, bridging the monetary mechanical divide (which was statutory) between banks and nonbanks.

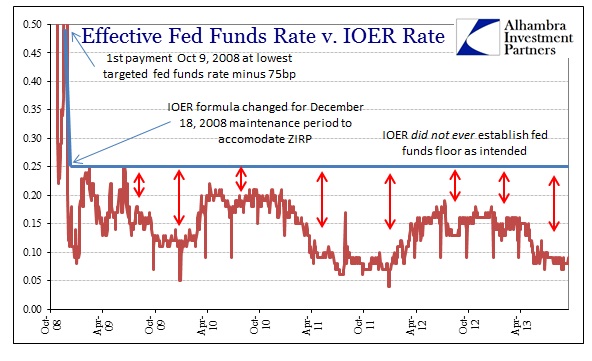

When the Fed first began paying interest on “reserves” (IOR and IOER) in October 2008, the Fed explicitly stated,

“Paying interest on excess balances should help to establish a lower bound on the federal funds rate.”

It simply never happened that way. The fed funds rate has largely ignored the IOER floor because, unlike Europe where the ECB can set a floor with its “deposit” rate, the presence of nonbanks in the US market offer a statutory problem. The Fed cannot pay nonbanks IOER because nonbanks cannot “park” reserves with the Fed.

Instead, nonbanks “park” idle cash with banks, who then “park” it as reserves with the Fed. Banks have been earning a positive spread because of this statutory prohibition. Nonbanks lend to banks at the fed funds rate, meaning this interbank statutory-driven intermediation can only occur below the IOER payment rate. If the fed funds rate moved above the “floor” (in reality, even close to it) banks would simply stop accepting federal funds because there would be no risk-free spread to scalp.

Without any “risk-free” alternative, nonbanks compete for t-bills and repos, pushing those rates down as well. All of this is undesirable from the central bank perspective, particularly when it intends to create a rate corridor with a hard floor (negative rates are not good, so the floor is intended to circumvent their unwelcome appearance).

The Fixed Rate Reverse Repo opportunity, then, is a “risk-free” alternative to the bank/nonbank intermediation. Instead of lending at the current below-floor federal funds rate, nonbanks could lend to the Fed at the Fixed Rate of the reverse repo – assuming that rate was above current fed funds. In other words, if the Fed put the Fixed Rate at the same level as the current IOER, in theory, the federal funds effective rate would follow and establish that floor. No bank/nonbank divide.

Another benefit of the program, which is intentional, is the deliverance of collateral by the Fed out of SOMA. This program would add collateral back into the system, raising hopes that it could help with the collateral shortage. While the first part is technically true, I don’t think it would be all that helpful unless MMF’s suddenly become very interested in securities lending (which might happen, as securities lending/receiving services are being added at clearance banks to fill this needed role). Since nonbanks are the target of the Fixed Rate Reverse Repo, the collateral they gain isn’t likely to circulate, and certainly won’t be rehypothecated.

That by itself may be enough to reduce collateral pressures since nonbanks would be competing less for “market” collateral in traditional repos (which MMF’s are a heavy presence), but that isn’t knowable now and may not factor additional QE withdrawals. And, again, it is fully dependent on the Fed getting the factor correct in its calculations, which will be, as it has been, the most important variable. Recent history is not kind in that regard.

At the June 2003 FOMC meeting, Alan Greenspan noted of central bank operations in atypical markets, including at the Zero Lower Bound,

“One [unknown] is that I don’t think we know enough about how the private financial system works under these conditions.”

They proved that in October 2008 and again in December 2008 with the “floor” that didn’t work. Maybe this time they can get it right, but make no mistake this is another monetary experiment, not unlike this summer’s unceasing taper talk.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch