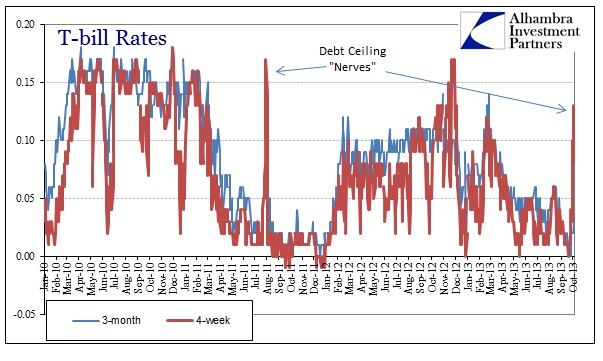

Now that the drama in DC is reaching a semi-crescendo, everybody wants to pay attention to the t-bill marketplace. The rapid ascent in shorter-duration bills is certainly abnormal but not at all unprecedented. Bill rates traded much the same in the 2011 version of the debt drama. Money market funds, now ultra-sensitive to any potential “losses”, are likely the primary culprit as they shift their portfolio mix away from any potential missed interest payment.

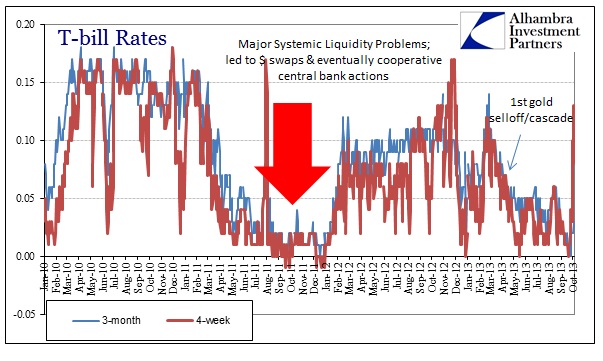

Rates in this iteration have already surpassed their predecessors, but it is the previous action in t-bills that should have been far more newsworthy. On September 17, the treasury auctioned 28-day bills (4-week) at 0.00%, matching a record low from the panic in 2008. Bill rates have been unusually low since the end of February – not at all “normalizing.”

These short duration t-bills are essentially risk-free equivalent securities, highly favored as repo collateral. Any sustained drop in t-bill rates is more than indicative of a collateral squeeze.

While the treasury will not auction any security at a negative rate (yet), t-bills can and do trade negative on the secondary market. As firms need collateral in rehypothecation chains they sometimes become willing to pay for the privilege of holding government debt, dependent on the severity of the collateral shortage. That happened in the worst days of the panic of 2008 as liquidity from any source was in demand; it occurred again in September and December 2011 during the height of the euro/sovereign crisis. There have not been any negative t-bill rates in 2013, but we’ve seen zero on a few occasions.

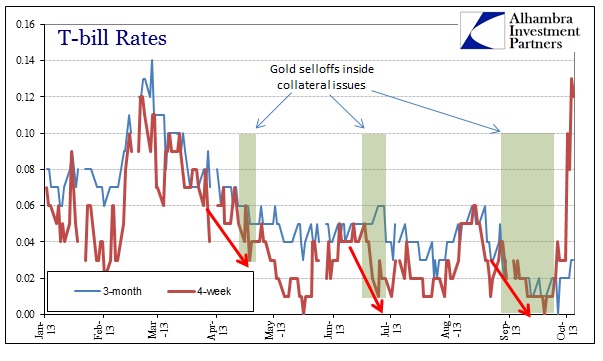

The timing of this extra demand for risk-free collateral fits exactly with the collateral narrative I have been developing throughout this year; particularly gold prices.

This includes the recent drop from August 28 highs in gold. As long as collateral remains under pressure, and there is no sign that conditions are about to change, gold will have a tough time moving upward in any sustained fashion (despite any physical tightness).

Finally, it is also worth pointing out that sustained liquidity impairment is a hidden risk inside the interconnected asset markets. It makes leveraged positions that much riskier and more susceptible to reversal without a depth to the liquidity “book” backing the whole of the dollar financial regime. In 2011, t-bills were signaling trouble in liquidity months before the debt ceiling provided a proximate cause for a 20% equity market correction.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch