Quarterly results from IBM are watched because they serve as a proxy for business spending across the globe. Capex in the modern world often takes the form of technology/computer investments. In fact, productivity growth in the past three decades has been driven, at the margins, by corporate investments in digital technology.

Ever since late last year, IBM has been keeping up its EPS growth. While accomplished largely through serious cost cutting and share repurchasing, the company is echoing trends seen in most large, public US firms. Revenue growth has been a major problem, the always amorphous excuse of the “tough macro environment”, leading to this overemphasis on cost and EPS management. Rather than add productive capacity, which is what they want from their customers, IBM appeals to the lowest common denominator of financial investment.

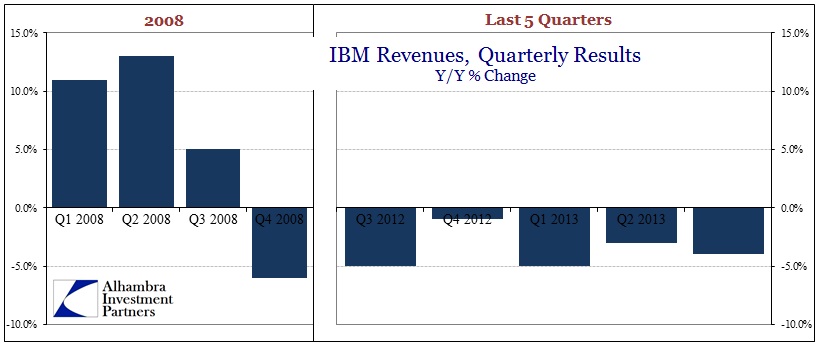

It is the lack of revenue growth that should be most concerning, not just from a corporate standpoint but that “tough macro environment.” IBM has had negative revenue “growth” for five consecutive quarters. While we consider Q4 2008 to be emblematic of a wretched economic climate, in terms of IBM revenues, the last five quarters have been close to 5 straight Q4 2008’s.

Much of the blame in the current quarter has gone to (again amorphous euphemisms) emerging markets. While that is certainly the case with respect to overall results, it’s not like the “advanced” economies were robust. Revenue in Europe was actually up 1%, but that was all currency translations. Absent dollar movements, revenue in local terms was -2%. In the Americas, supposedly the beacon of global economic strength, revenue was down 1% (or flat without currencies). There is no such thing as economic strength from flat revenues. The company managed double digit revenue growth in the first six months of the Great Recession.

Asian revenue was down a rather alarming 15%, but that was mostly due to Abenomics being “successful.” However, even adjusting for currencies, revenue was off 4% in Asia, raising doubts, again, about just how successful Abenomics is outside of messing with currency and internal commodity inflation.

In the BRIC’s, revenue was down 12% in local currency terms. For all the talk about a Chinese revival, CFO Mark Loughridge remarked,

“China was down 22%. We experienced a slowdown in demand across the board, but most significantly in hardware, which was down about 40% and which makes up about 40% of our business in China. While we had some execution problems during the third quarter, we were impacted by the process surrounding Chinas’ development of a broad-based economic reform plan which will be available mid-November. In the meantime, demand from state owned enterprises and public sector has slowed significantly as decision making and procurement cycles lengthened. We believe the changes will take time to implement and do not expect demand in China to pick up until after the first quarter of next year.”

While China was the most obvious problem, there was nothing good out of Brazil or India. It would seem, if IBM revenues are a good proxy, that global corporate investment has been in hibernation for a year, but also may be accelerating to the downside in those “growth markets.” That could be trouble if dollar conditions get volatile again.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch