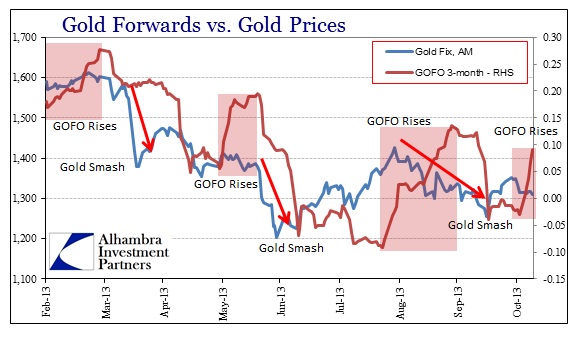

After the overdone debt ceiling/gov’t shutdown passed, gold was “released” from its interbank strangle and forward rates returned negative out to 3 months. The shortage was again prominent and gold prices began to adjust accordingly. They didn’t get very far.

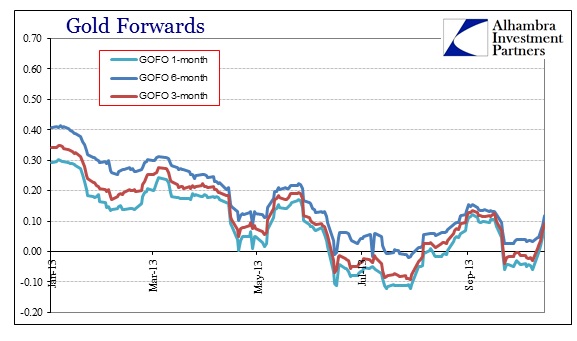

Since November 1, right around the time dollar conditions began to tighten noticeably again, forward rates have been rising in that now-familiar pattern. It appears as if we are setting up with a fourth incarnation (just this year) of the GOF- rise/Gold-prices-drop pattern.

To date, there are numerous factors driving the collateral problem that has plagued the system since the launch of QE 3 & 4. From mortgage bond collateral to international trade considerations, there is enough to hem gold prices into this maddening range.

The usual chorus of the end of the gold bull market is probably just ahead, as is the idea that central banks are “winning.” I also expect more than a little commentary to tie gold prices to the increasing “deflation” pressures not just in the US but in Europe (more on that in an upcoming post).

Gold is stuck in collateral hell, and looks to remain there as long as liquidity and funding dysfunction is prominent. If dollar tightening continues then there is no way to predict how much prices may fall. The last iteration was relatively mild by comparison with the first two, but that was more a function of the mild reaction in dollar funding as it related to relatively mild uncertainty about the US debt limit. If tightening grows as near excessive as it did in May/June, then I would expect some degree of symmetry or proportionality in gold prices unfortunately.

Again, I think this pattern continues until either the dollar market is solved (not likely from what I see) or demand for true tail risk insurance rises enough again to overcome this cage.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch