The credit market selloff that began without much notice has begun to draw attention. While there is some attribution to various FOMC members and their renewed hints at tapering, the current move began weeks before and spread quickly to a broad spectrum of dollar-related markets. Treasuries usually get most of the attention but it all begins in funding.

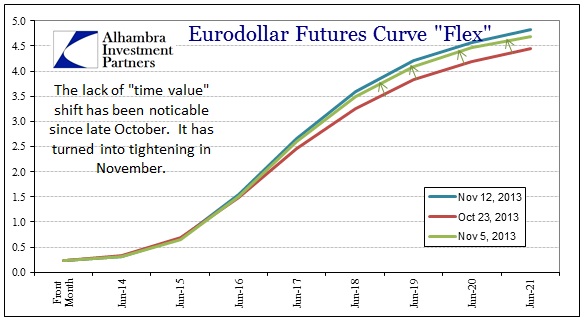

While the tightening has only been slight when compared to the earlier May/June episode, it has still caused pronounced and perhaps incongruous movements elsewhere. First, the dollar reversal is limited to outer years on the curve, however there is a tightening bias creeping up toward shorter maturities that has been more significant recently.

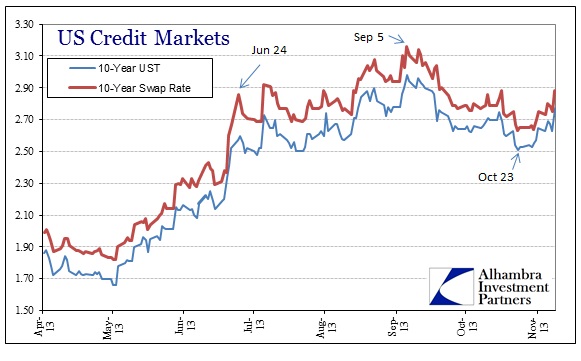

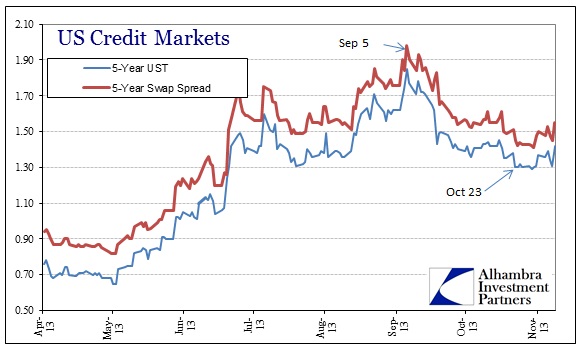

As you would expect given the duration action in eurodollars, the selloff is more pronounced in the 10-year treasury rather than the 5-year (matched books match funding maturities and hedging with positions).

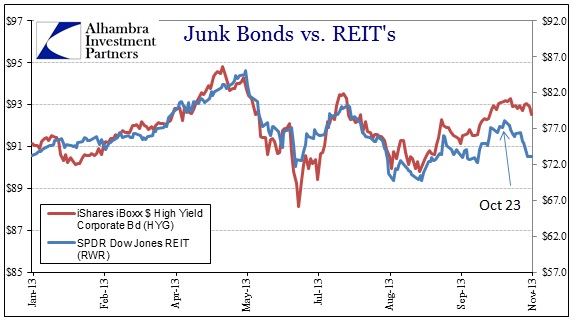

Junk debt is still relatively well-bid, but mortgage REIT’s continue to struggle despite the return of that “reach for yield” after the FOMC surprise. Apparently investors are still quite wary of liquidity conditions and are repricing leverage risk, at least in this one instance.

That also seems to have been applied to the Brazilian real, a very leveraged currency pair. Thanks to the Banco do Brasil, banks are highly levered and long real/short US dollars. As you might expect, tightening in dollars has made that trade a very risky position, which is being reflected in renewed currency “flight.”

Given the very slight tightening in the eurodollar/funding market for dollars, the exaggerated reaction in peripheral credits suggests that various market participants are not extending much depth. Rather, they are very much attuned to the smallest changes in dollar perceptions, making outsized moves in response to marginal changes. We can include gold in that calculation, as well.

Risk, then, is very much still part of the credit/dollar equation, meaning the rally after September 4/5 was rather thin by comparison, as I suggested back in October.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch