The Japanese administration is facing increasing criticisms as frustrations grow. This is contrary to the established narrative that everything is on the right track in Japan, and that Prime Minister Abe’s economic programs, including the Bank of Japan’s epic monetarisms, are wildly successful. Nowhere was that narrative more evident than recent commentary about Japan Inc.’s revival through current earnings.

The star of the show was Toyota. As the Financial Times noted, the critiques from some of Abe’s advisors dimmed what “should have been” the unblemished luster of forward economic progress.

“The critique marred what should have been a good news day for Abenomics, as the premier’s policy programme is known. Toyota, a beneficiary of the currency devaluation that has been one of its central effects, capped a generally strong earnings season for Japanese manufacturers by adding Y20bn to its already record net profit forecast, raising it to Y1.67tn.” [emphasis added]

Again, the truth of Toyota was that the company sold fewer cars, but “benefitted” from currency devaluation turning lower production into higher revenue. The mainstream narrative posits such changes in currency as evidence of success, while Toyota conclusive and unambiguously proved otherwise. But to economists and mainstream observers, revenue is like a number on a spreadsheet – if it goes up, it can be nothing but good.

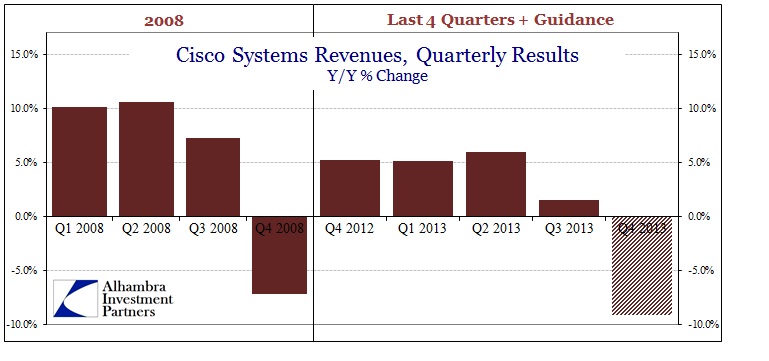

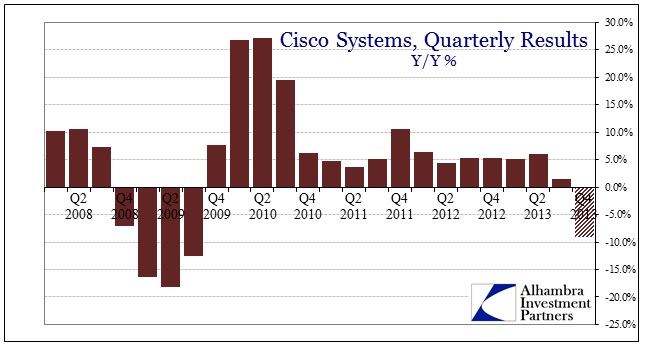

In reality, there was not much difference between Toyota’s results and Cisco’s. If Cisco’s current guidance is anywhere close, the company will be selling far fewer products in the next quarter – very much like Toyota (and Japan, according to the latest GDP report there). However, Cisco is not “aided” by US dollar devaluation, so where Toyota is lauded as a success story Cisco leaves monetarists searching for further answers. Headwinds continue to be “unexpected.”

Cisco itself provided its best answer, including the very process that keeps the recovery at bay. In responding to incentives created in no small part by monetary policy that appeals to the financial senses more than anything, Cisco upped its stock repurchase program from $1.1 billion to $16.1 billion, or a 1,364% increase. As revenue estimates further dim the closer we get to 2014, companies apparently opt to proportionally increase their stock “investments.”

There is another element in common with Toyota here, as well. Earlier in the year, both companies expected far better days (thus the “unexpected” weakness). Toyota was anticipating the unleashing of the Bank of Japan’s QE, while Cisco was expecting great things from the Fed’s brand of distortion.

In the company’s earnings report from only a few months ago, in May 2013, CEO John Chalmers was excited.

“Cisco is executing at a very high level in a slow, but steady economic environment. We are especially pleased with our ninth consecutive record revenue quarter. We are starting to see some good signs in the US and other parts of the world which are encouraging.”

Clearly, not only was Cisco over-estimating the ability of QE (good signs?) to create economic growth, they had no idea how bad dollar tightening would wreak havoc. Orders for the next quarter in emerging markets are down 9%. But orders are also off across the board, including -2% in the Americas; -4% Europe/Middle East. So those good signs were nothing but overwrought expectations of central banking efficacy. Further, if Cisco followed through on those “good signs” and increased production levels in anticipation of demand, then its failure to materialize leads to exactly the kind of problem that we currently see (disinflation and the deflation danger zone) “unexpectedly” troubling central banks again.

In context, Cisco’s results look very much like the other bellwether companies I have highlighted, with the consistent theme of revenue being worse now than 2008.

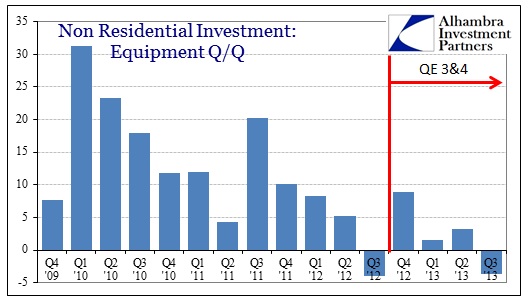

These revenue results from Cisco and IBM, while anecdotal, conform very highly with the economic estimates for business investment provided in the last GDP report. In other words, the anecdotes are agreeing with the empirical results, and that is not what was expected out of a QE-comony.

No matter how hard economists try to tell us the recovery is coming, the opposite happens. The economy is slowly progressing alright, but in the “wrong” direction. The major problem outside of the structural changes begun in 2007 that were never allowed to fully run their course, is that monetary distortions are having further negative impacts that will make these structural changes that much more disruptive.

Cisco is not alone. Cisco is Toyota, or IBM. These companies view revenue in a real world sense, not as a simple number in a calculator. They know their customers are demanding less and less, despite all the policy “stimulus.” Revenues have meaning, as does uncertainty and distortion.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch