The taper-driven bond selloff in May/June related to tightening in eurodollars and funding markets. As we know now, dollar conditions were extreme in some cases, leading to desperate turmoil across the globe. From the TIC flows, the pace of selling of dollar assets by foreign holders was epic back in June.

What that tells us is foreign holders were unable to finance their US$ positions, and so had to either sell outright or obtain replacement (more expensive) funding. Since the volume was so large, it looked far more the former than the latter. I still don’t think people appreciate just how great a disruption that tightening really was – particularly if your only indication of financial markets is stock prices.

What we see in the data since June largely fits the overall direction of conditions: there was a respite in July then renewed selling in August, putting a “tightening” scare into the FOMC. Beginning September 4, the rush of dollars appeared to reinvigorate various credit markets, including currencies. That was reflected in TIC, as foreign acquisitions of dollar assets rose an impressive $62 billion. But that doesn’t tell us the whole story.

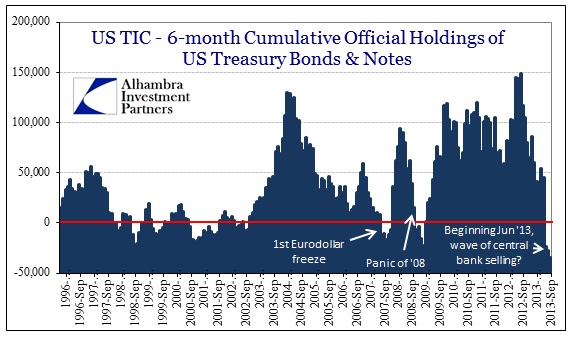

Looking at flows on a 6-month basis, rather than the volatility of 1-month, a few oddities become clearer. First, central banks are removing US Treasury bonds and notes at a pace not seen since the 2008-09 crisis. That would suggest either an unwillingness to hold US$ “reserves” or a need to raise US$’s for their constituent financial concerns. Given the scale here (shown immediately below), it seems to me foreign banks are appealing to central banks for dollars.

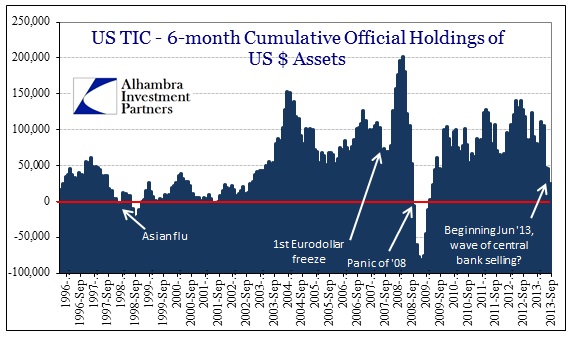

That hypothesis is strengthened by behavior in “official” holdings of all dollar “reserve” assets. Official holdings grew at the slowest pace (over a 6-month period) since the panic, again as central banks and foreign treasuries not only sell US Treasury assets in the aggregate, they are purchasing other US$ assets in very much reduced quantities.

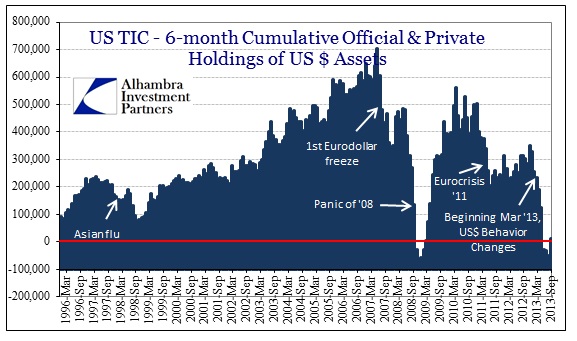

Finally, however, combining both public and private flows of US$ assets and holdings yields a very conspicuous comparison.

The dollar funding issue in 2013 has been as extreme as any we have seen in decades, even rivalling the 2008-09 event. This amounts to a serious shortage of US$’s that has yet to be resolved. It may take another month for that to show again, since the most current data is for September, as eurodollar tightening didn’t resume until October 23.

The timing of the escalation in dollar funding fits exactly with connected indications we have seen in repo markets, gold and eurodollars. Whether or not this is being driven by Fed policy mystery or technical factors in global dollar markets, there is a funding problem that exists outside of most people’s perceptions. I believe that there is a bit of both going on, as uncertainty over taper cannot be dismissed, but also that eurodollar markets are still in the process of receding post-2007. The confluence of them in 2013 is also tied to the dramatic decline in global trade volumes.

Implications of all this reaffirm the lack of depth in credit markets as they rallied after September 4; the bond market dichotomy I described last month. Without a dollar resolution, we might expect renewed problems in emerging markets and even domestic credit markets.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch