Earlier this week, Bloomberg published an article that examined the case of the missing link. It was not devoted to human evolution in a biological sense, but rather unintentionally to the emotional need to resist change. The title of the piece is, America’s Role of Consumer of Last Resort Goes Missing, and it continues from there on the theme of the global economy and the US priority.

Overall, the theme is summed up as, “A rebounding U.S. is giving less support to global growth than in the past. “

Given the economic data presented today throughout the world, the latter portion of that quote seems to be fully supported. Growth in Australia, measured in GDP, fell below 2.5% again, the third consecutive quarter. Since Australia depends on resource extraction for marginal growth, the decline (-3.3%) in the “terms of trade” portends an extended rough patch ahead.

“Net exports were responsible for 90 percent of the growth in the economy in the past year,” Treasurer Joe Hockey told reporters in Canberra today after the release. “As mining investment drops from around 8 percent of GDP to somewhere around 3 percent over the next three years, that’s going to create a growth hole in the economy over the next few years.”

In Brazil it was far worse. Brazil has additional problems that include financial imbalances, but for the most part it too is a resource nation. GDP in the latest quarter is estimated to have declined 0.5%, the worst since 2009.

“Investment in Brazil is taking a very large hit right now,” said Marcelo Salomon, economist with Barclays.

“There is a non-negligible likelihood that we see, once again, negative quarterly GDP growth in the fourth quarter, leading to a scenario of a ‘technical recession’ [two consecutive quarters of negative growth],” Nomura economist Tony Volpon wrote in a report.

While it would be nice if recessions followed such mathematically precise courses and definitions, the economist’s point main point is valid. Brazil has seen a collapse in investment due to both financial uncertainty (to put it mildly) but, perhaps as the more root cause, the unwinding of the resource/global supply chain process. There is no urge to invest in Brazil because there is no steady demand today and that does not appear to be likely soon; an extremely powerful indictment on conventional central banking.

Finally, GDP in Europe was confirmed at +0.1% in the third quarter. While Europe managed to post a second consecutive positive number, Y/Y GDP is still -0.4% and many countries still are stuck in a recession uninterrupted after almost two years.

In answering Brazil’s unfavorable GDP number, Guido Mantega, Brazil’s finance minister, summed all this up as,

“The world is not having an easy year . . . 2013 is still a year of crisis, probably the last year of the global crisis.”

That comment, while predictably optimistic (haven’t we heard the same thing for years now, always next year?), would seem to conform to the premise of the Bloomberg essay referenced at the outset. Despite a purported rebound in the US, the rest of the world is struggling. To explain such a dichotomy does require exactly this kind of contortion – that the US transmission system for global growth must have changed in the years since 2008-09 – in order to preserve the ideology.

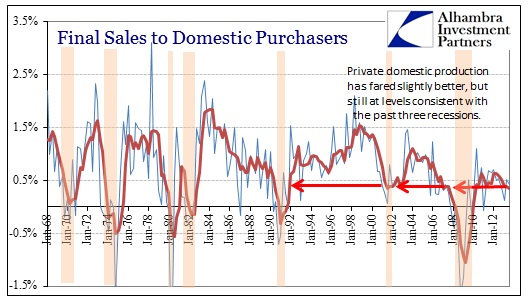

Rather than resort to reaching for rationalizations in order to hold on to the mainstream and preferred paradigm, might it be something far more simple? Rather than a broken economic transmission, is it not possible that the US is not rebounding at all? After all, the second part of that Bloomberg equation is unquestionably taking place – there is a struggle for global growth that is precariously perching upon the precipice of recession (if not already there). Why do we need to invent a new explanation for that rather than simply look (more objectively) at the state of the US economy?

Perhaps the world economy is struggling because the US economy is. That makes more sense, free of the need to invent convoluted justifications.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch