The December ISM Non-Manufacturing PMI came in more than a bit lower than expected. Part of that has to do with the lingering expectations that the economy is turning upward, with some recent indications and Q3 GDP showing an assumed rebound forming. However, as noted over and over, it has been an inventory illusion propagated by QE-induced near-hysteria.

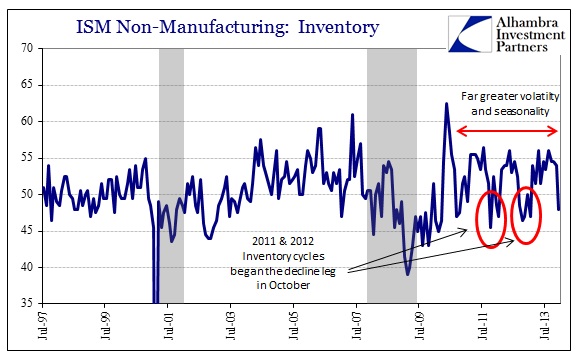

There are innumerable examples of this, including many recently, but perhaps the most striking is the detachment of the inventory cycle in 2013 vs. the previous three “recovery” years. Going back to 2010, the US economy experienced an economic soft patch in each and every summer followed by a seasonal pickup toward the Christmas holiday. The 2013 results defied that pattern, as inventories swelled across the retailing industry.

The implications are obvious. If QE is indeed just a psychological ploy, those businesses that “bought into” the narrative are going to be left with unsavory levels of inventory. That should lead to another post-holiday let down (both in terms of expectations and actual production), but in an already weakened environment. Such a combination is very much what expect in the latter stages of any cycle.

As my colleague Doug Terry noted in yesterday’s ISM, the level of New Orders has slowed into contraction. That was the “first sub-50 print since 2009 when we were on our way out of recession.”

Further, as Doug points out, there has been only one occasion where New Orders in the NMI dipped below 50 and no recession. So not only is this an indication of the absolute level of inventory drawdown, it adds to the notion of the inventory-QE illusion wearing off.

The inventory subcomponent also indicates as much, particularly since the “normal” inventory downturn that has occurred beginning in October in previous years did not show up until December this year. That again adds to the story of overwrought retail optimism surrounding the holiday period.

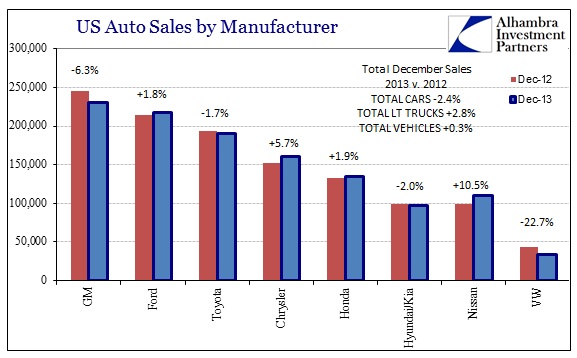

And in a twist, the lackluster holiday sales have extended to autos. Even though November saw better numbers, it was expected as more than a one-off sales event. Again, extrapolating in a straight-line, auto sales were anticipated to be quite robust in December. Even though holiday sales and traffic were flat to significantly declining elsewhere, that did not seem to affect auto expectations.

“There is a buildup,” said Michelle Krebs, senior analyst for the automotive pricing and information provider Edmunds.com. “We’re seeing some of the highest inventory levels in years, but we’re also expecting sales next year to be 16.4 million, and December is a huge month for sales. Considering the estimates for next year, inventory isn’t at an alarming level yet.”

“We expect December to finish strong,” said Larry Dominique, president of auto industry forecaster ALG and executive vice president of TrueCar.com. “Consumers are taking advantage of low lease rates and inexpensive financing, which continues a shift from buying used to buying new.”

Those end of December sales never materialized, as December 2013 auto sales were basically flat over December 2012.

“This month did not live up to expectations,” said Jessica Caldwell, senior analyst for auto information provider Edmunds.com. “We thought there would be a strong ending to the month, but that didn’t come to fruition.”

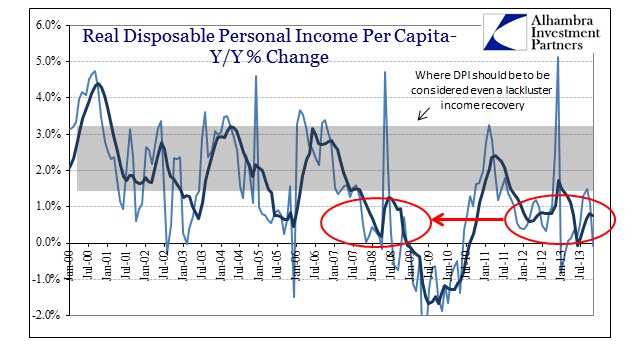

I don’t believe that the consumer spending lull was limited to autos, particularly since autos have been the one real “bright” spot in the US economy since 2009. It appears, in autos as in the rest of the retailing segments, that the consumer bought as much as possible in the big deals and discounts of November and that was it. Consumers have been tapped out by a lack of income and it is starting to show across a broadening spectrum. If auto sales disappointed, what is left to support the QE-illusion?

Actually, to be more precise, there was a pocket of immense strength even in December 2013. Luxury car sales were up 14.5% over December 2012. Merry Christmas in the bifurcated economy, the only bastion of the bastard “wealth” effect. For the rest, it’s a lack of everything, from jobs to income to sales. Now the cruel part is waiting to see how bad the downswing in the inventory overhang will become and how much or far that will ripple into everything else.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch