The big news this morning seems to have been Best Buy’s “shocking” numbers. The narrative now is likely to get refocused, as the wagons will be circled and Best Buy’s horrid results will be blamed on idiosyncrasies. However, Best Buy was not the only retailer to report a disastrous holiday period, it’s the only one that has gained wide attention.

HH Gregg’s sales metrics were absolutely awful but ignored despite being a direct competitor to Best Buy. The company made a conscious decision not to get into a price war with retailers like WalMart and Best Buy over consumer electronics. While everyone else was discounting to a high degree, HH Gregg was more inclined toward profits and less about the old, traditional traffic/volume strategy. That may have worked in 2005, but in 2013 the economy isn’t conforming to expectations or even manipulated perceptions.

With per capita income once again declining, consumers outside of the asset inflation bubble created by monetary policy are struggling, to be understated. And it only gets worse in 2014, factors that consumers were more than aware await.

Against that backdrop, HH Gregg’s same store sales declined by a massive 11%. While it was expected that durable goods spending, which has been up recently, would spill over and perhaps bolter consumer spending in other segments, consumer electronics spending at the retailer fell 20% while computer and wireless comps were an amazing 25% lower. Home appliances and furnishings did actually perform to expectations, growing 36% Y/Y, but it was clearly not enough as consumers were tight in terms of discretionary spending.

Best Buy, then, was supposed to be solid evidence that the discounting method was the key to success. Where HH Gregg stumbled, it was only due to its competitive strategy and therefore did not represent the holiday season. Most analysts were very optimistic over Best Buy’s results, with Citigroup analyst Kate McShane predicting, “Best Buy likely took share during a very promotional holiday.”

Comparable sales at Best Buy, which includes online sales, fell 0.8%. Same store sales of computer electronics fell 6% domestically, showing that the discounting wasn’t much of a factor in terms of overall consumer spending power. And that also runs contrary to the established expectations since there was supposed to be pent up consumer demand for goods like the newly introduced, next generation gaming consoles (and how that would drive sales in big screens and other peripherals). The results may have been better than HH Gregg, but, as with so many other factors in this economy, that is a much reduced standard.

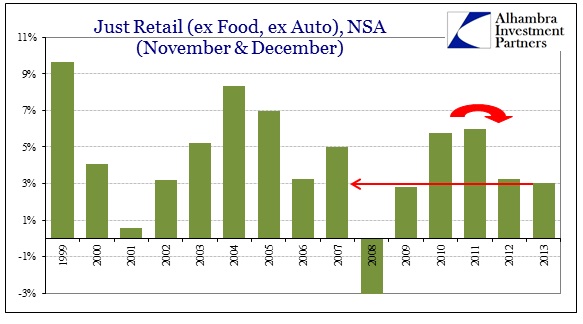

Unfortunately, despite the annual ritual of rampant optimism, holiday sales look downright ugly – 2009-ugly. Best Buy and HH Gregg are not likely to be outliers, as even Target’s CEO issued a statement in mid-December of how “pleased” he was with his company’s results to that point. That had never happened before.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch