Joe Calhoun passed along the data for residential remodeling permits (according to the BuildFax Remodeling Index) for November 2013 (latest data available) and it was ugly. Total permits issued were 2,542,000 (seasonally-adjusted annual rate), 20% below October and 18% lower than November 2012. As usual, this “unexpected” decline, actually collapse, had a convenient though not-convincing excuse.

“We saw a lower-than-expected November 2013 in all regions but the South, which may have been an after-effect of the October government shutdown,” said Joe Emison, Chief Technology Officer at BuildFax, “although we still expect 2013 to be a bigger year for remodeling than 2012.”

I find it implausible to the point of comedy that the government shutdown made for a 20% reduction in remodeling activity; and in November despite the shutdown’s wimper of a conclusion in the middle of October! That is hardly even trying, so we may have to forgive BuildFax for simply having a bad day. At least Mr. Emison was careful enough to add the positive spin right after, though, once again, it amounts to lowering the bar.

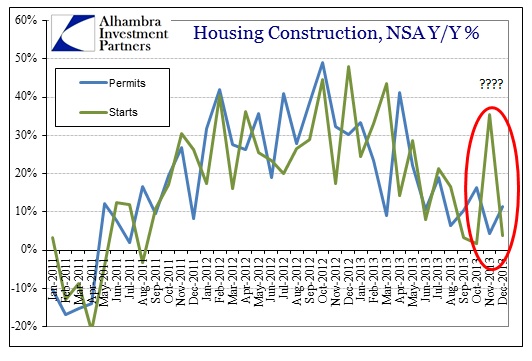

I can be just as implausible and connect the collapse in remodeling with the November surge in housing permits. Going back to last month’s data, which actually was affected by the government shutdown though only in the timing of the release, there was an obscene level of volatility in permits. Maybe, avoiding all common sense here, there was simply a rush of people to buy new houses as a defense against month-old fears of the illogical extremes of unused government labor resources?

Of course, that suggestion would not comply with the mountains of empirical and anecdotal data that imply otherwise, nor this thing we call reality, but economics is a creature of math, models and academics rather than anything real. I hesitate only slightly in blaming economics because Mr. Emison is the Chief Technology Officer, but it is his index and technology in pursuit of an economic output that caused this in the first place.

It is perhaps far, far more likely that the collapse in mortgage activity and pipeline levels at every major bank is beginning to have an impact on this segment of the real economy. Remodeling, after all, is very closely correlated to home equity and mortgage finance. Given the timing between interest rate movements and application processing, it would make much more sense that we are beginning to see the real economy impacts from mortgage collapse – a headwind that appears to be set for 2014. That would also connect remodeling activity with new home construction, apart from the volatility in the data (which is actually expected and not at all atypical).

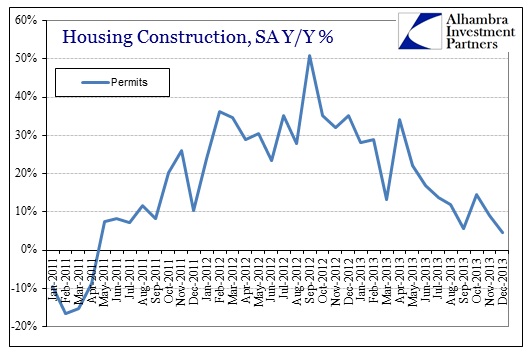

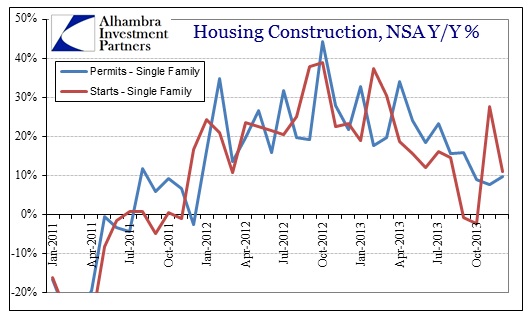

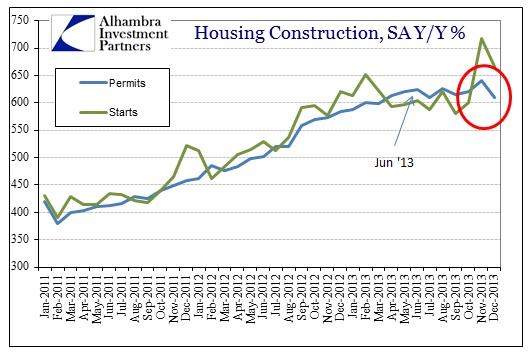

The charts should be familiar by now, so there is little commentary necessary.

I do think it is worth pointing out, however, that the level of permits issued (according to seasonal adjustments) appears to have marked a potential new direction (lower). There is a clear break in trend right in June 2013 that seems to have finally pushed the level lower. I would expect, given the decades of history on this account, that the level of starts will converge lower toward permits. That was true in early 2013 just as this slowing trend came into focus.

Or fears of the October 2013 shutdown could linger for a year or two more, having “unexpected” impacts in still more of the unlikeliest of places.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch