At its most basic element, the economic plan sounds plausible enough to almost be convincing. In the Japanese version, pointed more toward an export economy than internal consumption, monetary policy expects to devalue the yen, which should lead to a favorable re-configuring of goods parity. That, in turn, is supposed to increase internal production levels which then creates increased demand for labor; thus growing national income both via external and internal means.

The pernicious side effects of yen devaluation (cost inflation) were well-known in advance, but it was calculated in the models that the “positive” offsets would more than overcome this deficiency. The plan worked as advertised, at least on the surface, up until that crucial final step.

But it was messy from the start. The yen devaluation began even before Abe was firmly elected and had promised to wreak more havoc. When the Bank of Japan finally began to buy JGB’s, it was marked by dramatic volatility in that market, as well as swelling uncertainty and even partial revulsion in normally placid Japanese repos. To calm such stricken operational functioning, the Bank of Japan altered its planned path of monetary intrusion, increasing the monthly scale of QE to “reassure” yen credit markets.

Back at the beginning, the BoJ had planned for ¥50 trillion in purchases as an annual pace. Because of the near-turmoil at the outset, the BoJ drove its monthly purchase rate to ¥7 trillion immediately. Just with some basic math here, that pace will easily exceed the annual “limit” in just over seven months, or right around now. Of course, the BoJ is not beholding to any kind of rule in its QE stride, but psychology matters most in central banking. Even the threat of a Japan taper is enough to roil yen markets, as has been the case in the past week or so.

Despite all this maneuvering, what has the BoJ actually accomplished? Despite a rapid and serious devaluation, there have been persisting rumors that there needs to be more. That is the universal feature of every monetary “solution” presented; it always ends by needing more.

Official inflation rates have come back above zero, as has GDP growth (even on an annual basis). Since those statistics were developed under the simple assumption that positive numbers correlate with a “healthy” economy, such is likewise assumed about the fate of the Japanese economy as it conforms to that simple plan laid out at the beginning here. But these are extraordinary times and simple assumptions are more than dangerous. And, as I would hope central bankers are paying attention, the economic and financial systems are just a bit more complex than can be modeled.

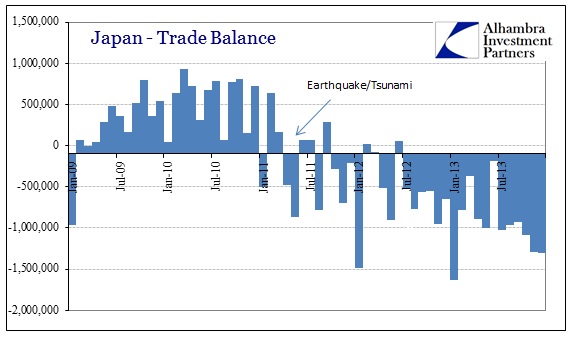

Export activity has only grown nominally, meaning there really isn’t much need for additional labor; thus no income growth. There is more to export proficiency than currency-driven ideals of cost competition, so the Japanese balance of payments has only grown worse. A country that was habitually in a surplus has seen deficits that have only expanded under yen devaluation – the exact opposite of expectations.

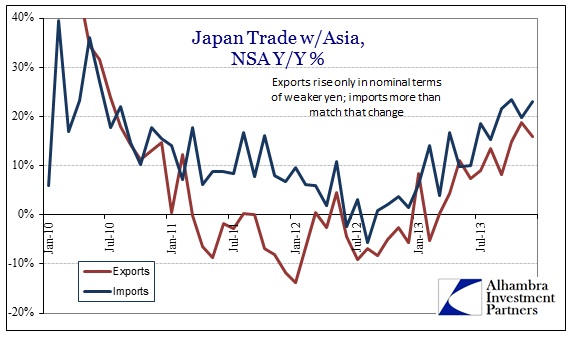

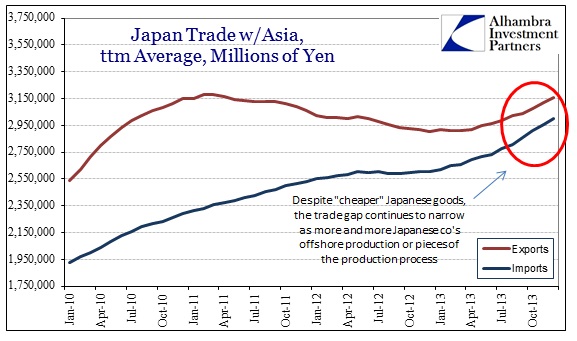

Instead of realizing an impulse to make more Japanese goods internally for export, Japanese businesses continue to offshore production under the veil of constant currency instability. The once-favorable trade comparison with the rest of Asia, Japan’s primary “client” for decades, has turned into an enormous drag.

Despite impressive sounding growth rates, they are only a façade. Imports to the rest of Asia were up 16% in December Y/Y, following an 19% increase in November, but that was nowhere near enough to keep up with import growth (+23% December; +20% November). Worse, those growth rates were under the averaged yen devaluation rate which more than suggests that the actual volume of export trade fell.

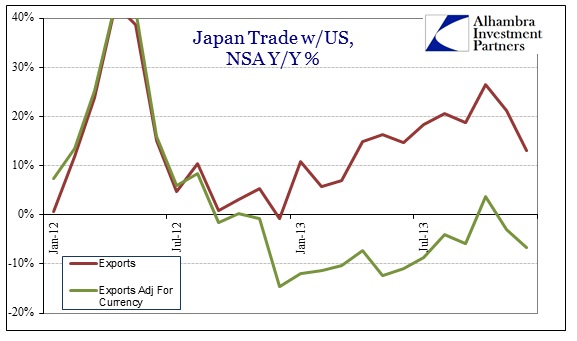

That was certainly the case in terms of trade with the US, an easier comparison to make with only one currency translation involved.

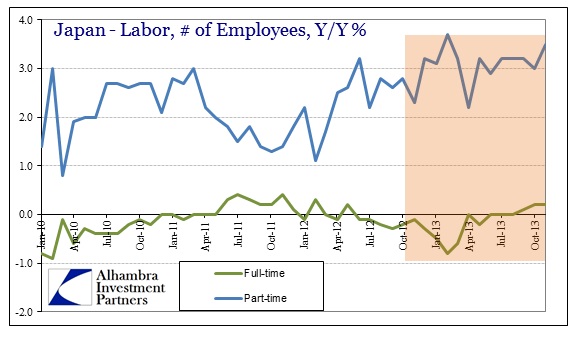

As a result, internal mechanics in Japan continue to disfavor labor utilization. Like the United States, Japan QE seems to correlate with an increase in part-time labor utilization.

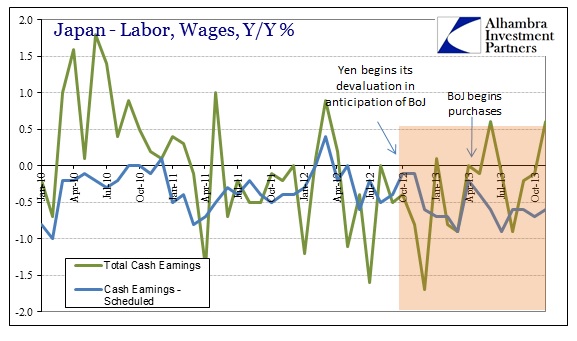

Overall, earned incomes continue to decline but financial-driven gains are on the rise (such connections never seem to make it into the simple planning or modeling). Companies have been paying additional cash bonuses, but certainly not at any rate that signifies this QE-driven process has had an effect.

Regular hourly earnings continue to contract, and that simply cannot hold up an economy under increasing cost pressures that will include a large tax increase coming in only a couple of months’ time.

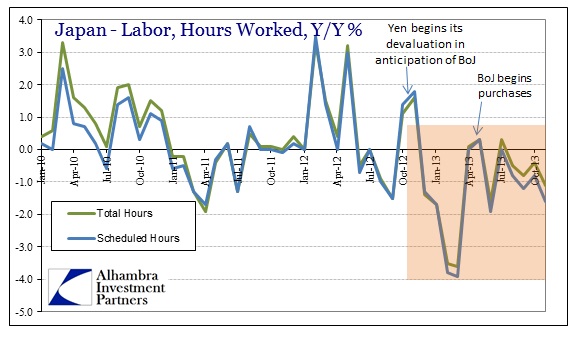

With less actual export or internal consumption volume, there is simply little need to expand beyond labor already internalized in the economic system. Total number of hours worked continues to drop which should be an obvious sign of maladjustment to the monetary applications.

This divergence between real measures of economic volume and statistical concepts like GDP and inflation highlight very well that currency-driven “inflation” is just a simple change of numbers; nothing deeper, at least not favorably. Companies have more yen but less for their workers to do, and they see the currency instability as a net negative. The world is too complex for simple central bank plans. That counts not only in the real economy, but also, as the repo market turmoil and attendant QE pace adjustment demonstrate, in financial terms.

These lessons apply, as we well know, to any central bank that intervenes in this spreadsheet kind of approach. Simply changing numbers around does not necessarily lead where you expect or even want. Instead, far more often than not, it leads only to reducing the standards by which you are judged. In this age, despite a very obvious and apparent lack of demand for labor all over the world, orthodox economists are patting themselves on the back for reducing what passes for a functioning economy to the point that the vast majority of people in the world have no experience or memory of what a recovery actually looks and feels like.

A real recovery is obvious and always involves a rapidly increasing demand for labor, not just reshuffling the means of counting it.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch