Earlier in January, despite the auspices of assurances from the Banco do Brasil, the Brazilian government auctioned its newest 10-year government bond (NTN-F) at a record high yield. Almost immediately there was an attempt to soften such a blow, as the Brazilian commentary network was filled with, “it wasn’t as bad as expected.” The “when issued” yield came out at 13.3899%, but there were whispers of 13.5% in the days ahead of the auction.

It has been a troubling nine months in the land of the Amazon, although a good part of that downward trajectory began in the year before. There are parts to the trend that are local and idiosyncratic, but those pieces fit within the confines of the larger dollar system. So Brazil, a resource heavy economy, begins with a current account mess and a central bank that is as “precise” in its stewardship as every other “developed” counterpart. Beyond that, the Brazilian government is typical of the heavy hand approach.

Since 1971 (and even the years before) emerging markets have been placed on a debt standard. In 1970, for example, Brazilian companies or the government would have had to appeal to the central bank’s gold holdings or deposit gold in an account in London to pay for any imported goods, particularly petroleum. At the completion of the transaction, Brazil (as proxy) would have gold removed from its London account and oil would be delivered. That was the end of the transaction as it was self-extinguishing (as with any involving hard money). Gold was the exchange mechanism that kept trade relatively honest (relatively is a looser word than it should have been under Bretton Woods).

After 1971 (and again, this started before Nixon’s ultimate decision), Brazil would appeal to a bank in London not for clearing gold balances but for a line of credit denominated in dollars (eurodollars) in order to purchase petroleum. So in an import transaction, a London eurodollar bank would create a deposit account on behalf of Brazil, create “dollars” on the bank’s balance sheet in that account, debit them from Brazil’s deposit account and transfer them to the petroleum exporter. Obviously, this was not self-extinguishing as it left a liability for Brazil at the end, and it also allowed Brazil (or any such nation) to buy far more than they could afford to pay under gold limitations.

It was a disaster in the 1970’s as this was repeated throughout the developing world, leading into the Latin Debt Crisis that began raging as soon as 1976. It would not be fully resolved until 1994.

There is, however, an intermediate step in that transaction chain. Brazilian companies, and even the government, don’t necessarily transact directly with the London eurodollar bank. There are Brazilian and Brazilian subsidiaries of foreign banks in between. In the native example, the Brazilian bank obtains dollars from the eurodollar market and then loans them to the Brazilian company. That puts the Brazilian financial system “short” the US dollar (as were European banks in the 1990’s and 2000’s housing bubble), particularly since that age-old mismatch between asset maturity and liability rollovers is ever-present. The Brazilian bank is borrowing dollars short-term and lending them longer-term, earning carry (they hope, at least in a more stable dollar environment).

When the dollar becomes tight or more expensive, the ability of the Brazilian leg to perform in the real economy becomes imperiled. It also leads to “selling” reals (or dollar assets, if available) to raise dollars.

Given that global dollar system, you can easily imagine why Brazil would run into problems in 2012. But you can also see why dollar tightening beginning in May 2013 would be a far larger problem.

Starting in May, the real began a serious devaluation as dollar supply in eurodollar markets dried up under a new regime of uncertainty (related to the psychology of QE). The Banco initiated “emergency” measures, mostly limited to indirect swap intervention, and expected that would calm the situation enough for the storm to pass. At first, as is always the case, these policies seem to work. But then reality re-asserts as nothing has fundamentally changed. Brazil is still a mess internally, not the least of which because of its position in the global supply chain as global trade contracts, but also as the dollar market tightens in that area.

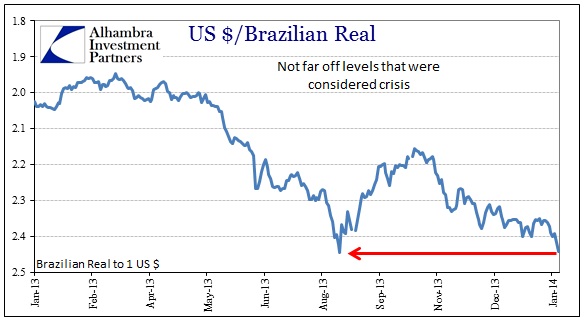

The flatter yield curve in dollar markets is still tightening for eurodollar trade. Since December 17, the short end (where all the money is located) is still selling off, even if slightly. That exacerbates these conditions to the point where the currency starts to spin out of control again. The real, which the Banco indicated it would be “comfortable” inside a 2.30 to 2.40 range, has suddenly broke back down below that 2.40 level to where it was at its worst devaluation this past summer (chart above).

Since October 23 when eurodollars turned tighter again, the Bovespa is down about 16% while local interest rates and inflation have risen. Brazil has a mighty dollar problem and the Fed no longer cares – as it seems increasingly clear that message was sent earlier via the World Bank.

The emerging market crisis in general is exactly that, as Brazil is but a large and hefty example. These countries have their own internal imbalances and dysfunction, but it is the dollar that is turning these problems disastrous. Coincident timing confirms that without ambiguity. In all the major “hotspots”, the currency (and thus inflation and financial conflagration) times exactly to changes in eurodollar markets due to dollar policies in Washington at the FOMC.

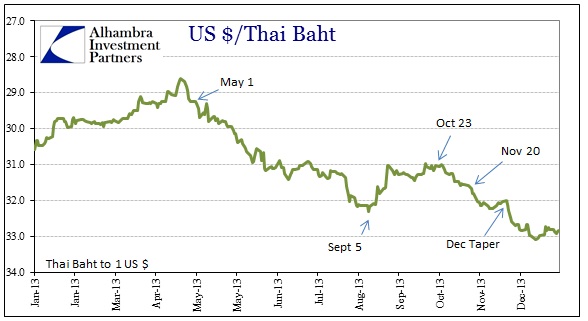

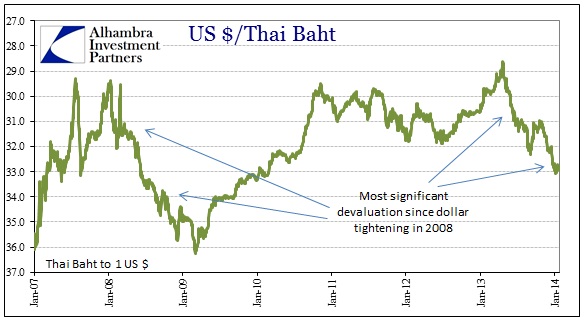

Thailand is a political mess, but it’s currency movements are closely tied to the dollar, including the panic tightening in eurodollars in 2008.

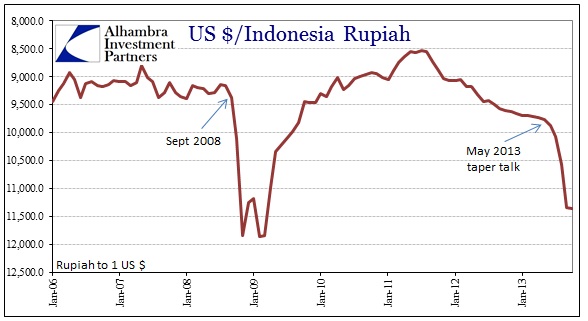

Indonesia has its own brand of local flair in this crisis period, but, again, the currency and financial difficulties trace back to the first incidence of “taper talk” in May 2013. And, like the Baht, that is a replication of the 2008 pattern.

There is a systemic element to the dollar system that is not appreciated in most commentary of the emerging market “meltdown.” That is where it will ultimately end, but, more importantly, that is the mechanism of feedback into the US system. There is no insulation in a global financial system as intricately interconnected as this. Dollar trouble for Indonesia and Thailand is a symptom of a wider disruption, not a cause of the disruption itself. That is a distinction that cannot be overstated.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch