You have to wonder, given the circumstances today, if there is such a thing as a perpetual Minsky phase. The Minsky moment was first theorized as a point in the “cycle” in which borrowers, lustily seeking geometric leverage progression, begin to experience trouble simply maintaining debt. From there bidders are increasingly more difficult to find, making price momentum suspect, and then subject to reversal, eroding the very price foundation (straight-line extrapolations of “permanent prosperity”; which is nothing like prosperity) upon which all that debt was based – eventual collapse.

We have been through this before, several times in just the past decade and a half. It increasingly looks like we are heading again toward that precipice. This includes not just the developed world (US, Europe and Japan) but also the “titans” of the emerging world. The most evident candidate in that class is China, itself having undergone a momentous and historic transformation in just the past half-decade. I wrote last week,

Even while its primary export markets were enthralled within crisis in 2008 and 2009, the Chinese managed 9.6% and 9.2% GDP growth, respectively. After rebounding some in 2010, GDP has been slowing since (matching both the US and Europe). Meanwhile, credit growth has surged as government authorities enacted textbook “stimulus” to try to manage the economic situation. After reaching 180% debt-to-GDP in 2011, credit growth spiked in 2012 and 2013. Current estimates place the ratio at about 210%.

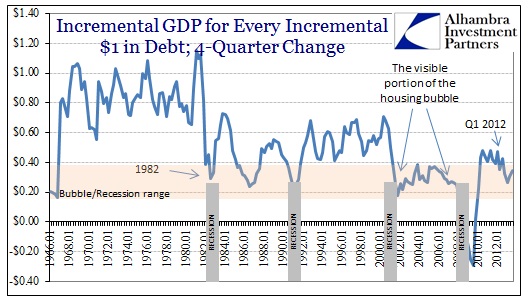

Another way to measure that credit intrusion is by assuming and viewing as cause and effect. In other words, you estimate how much incremental GDP growth does each incremental dollar (or whatever unit) of credit “create.” This is a simplistic ritual too much akin to orthodox economics’ implicit assumption of a closed system. However, eventually if you include enough of the governing dynamics, including all financial outlets, you eventually arrive at an enlarged but mostly closed system.

What I mean by that is eventually everything in finance has to have a real world relation at some point. Getting back to the ancient version of the equation of exchange, all money can flow to the real economy, as currency or credit, or the financial economy largely as asset prices. But in the end, asset prices are not self-serving, they “foster” real economic growth even if it is just malinvestment. So even in a situation where credit and “money” are pushing asset prices upward, there should still be some “leakage” of that asset inflation into the real economy.

If an economic system requires huge doses of asset inflation “leakage” to create even minimal levels of economic advancement, It would be an extremely inefficient system where chronic breakages would be the norm, not the exception. That was the suggestion of Larry Summers, picked up by Paul Krugman, late last year. They are finally seeing the inefficiency, though they have yet to derive its true cause (and it’s not anything other than the dominant philosophy that resides in the Marriner Eccles building in DC).

The Chinese, unfortunately, have seen fit to adopt this philosophy and take it to the extreme. In recent years, that has meant such inefficiency, again as I wrote last week,

There is a growing disconnect between the Chinese economy, as measured by GDP, and credit growth. In both 2012 and 2013, GDP growth measured 7.7% both years. That was the slowest pace since 1999 – the fact that it was repeated across two years should be far more concerning in the context of that credit growth. Bloomberg estimates that each additional $1 of credit generated $0.83 of GDP in 2007. By 2012, that rate had dropped to $0.29. By the first quarter of 2013, it had fallen again to $0.17. All of this stimulus, driven by “money” growth, is exhibiting a marginal utility stall.

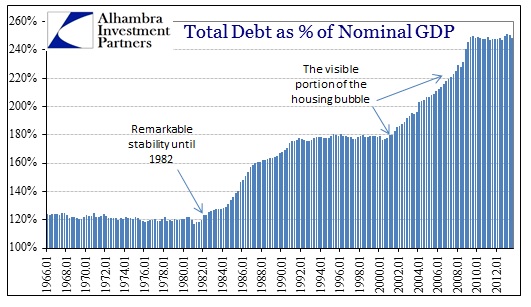

The US is assumed to have been different over the same period, as deleveraging is repeatedly cited as a factor for sluggishness. Yet, that is only the case with a narrow definition of systemic leverage. If we include total household, nonfinancial corporate, federal government and state & local government debt, there has been no such deleveraging at all.

The age of debt becomes quite clear, and it coincides with the Great “Moderation.” That would suggest, and strongly so, that any such “moderation” was a mirage, simply the upward slope of one Minsky cycle after another. The problem now is that after each Minsky moment and collapse, these “cycles’ conspicuously lack any debt reprieve. Credit and monetary expansion simply goes back into overdrive and the economy becomes more and more inefficient in leverage terms.

I think that is most clear in the nearly two years since the start of 2012 (the data from Z1 only goes to the 3rd quarter of 2013) as just how inefficient the economy’s leverage usage has become. We are now down at housing bubble-levels of inefficiency, also corresponding to what would normally occur in recession, except that there is very little GDP expansion to any of it now. It cannot be the case that the US economy “needs” so much debt to grow, rather it seems far more logical, given all of these global credit regimes, that inefficiency is itself a condition of such saturation. It appears as if a Minsky system writ large; a governing dynamic of a governing dynamic.

In other words, as Minsky hypothesized of individual cycles, thus we may be seeing on even a grander scale. Incremental debt worldwide is simply “absorbed” just to maintain previous debt regimes, not to restart a new cycle. Thus you see what amounts to an almost stair step downward, first in 1982, then in 2001. If the current pace of debt and GDP (or even slower growth, including recession) are maintained for much longer, we get the next “step” down in the coming quarters.

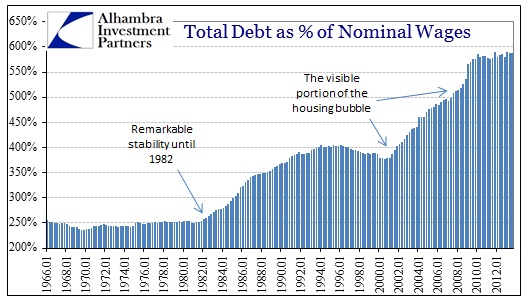

Perhaps the most challenging aspect of all this monetarism is relating it back to the real economy. That is the ultimate and primary function of an economic system, to foster labor specialization. It is particularly worrisome, then, to see that credit’s relation to wages get farther and farther away. That too suggests, also very strongly, the inefficiency in the economic system relates more to the growth of finance – as “money” or credit circulates not as wages but in alternate financial channels.

In very basic terms, what all this means is that the enlargement of the financial economy is a positive feedback loop. The larger it gets, the more inefficient the real economy becomes, thus requiring more inputs that run increasingly through the financial economy. That enlarges it further, creating more inefficiency, and so on. The “flaw” is thus not inherent in the modern real economy, as suggested by Summers and Krugman, but rather in the Great “Moderation”, or at least the monetarism that conjured it and now seeks its permanent placement.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch