Persistent whispers throughout the autumn that the Bank of Japan was thinking and even planning (I suppose that meant more modeled simulations) to raise its intervention quota beyond what was judged only months ago to be monstrous and more than sufficient had an anesthetic effect on Japanese “markets.” Despite what was serious consternation about the damning resistance of Japanese companies to raise wages, followed closely by a worsening trade situation, the Nikkei stock index pressed forward to a new high, a level not seen since 2007. Failure was more powerful because it hinted more and more and more monetarism.

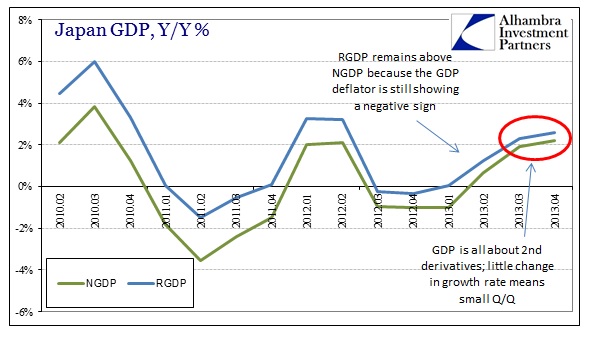

That only lasted to the end of the year, as 2014 has seen both Bank of Japan hesitation and economic data increasingly unfriendly to that seemingly long-gone period of early 2013’s unbridled euphoria. In February 2014, GDP growth was counted at just less than 1% Q/Q for the last three months of 2013. That missed expectations, those mainstream predictions (+2.8%) of success because some central bank simply did something, by a strikingly large amount (which should not be surprising given the track record of orthodoxy). Just-announced revisions have cut that growth rate even further, now only 0.7% Q/Q.

It wasn’t supposed to be this way, as economists were pointedly assuring in their basic theory. In recording that wide miss to expectations, CNNMoney summed up convention:

A falling currency lowers the price of a country’s exports, making them more attractive to international buyers by undercutting competitors. The strategy should boost Japan’s flagship brands and give them a reason to raise wages.

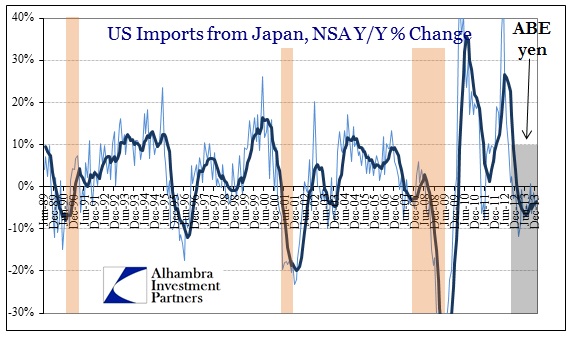

It’s these results that should be more punishing for mainstream economic practitioners, as there are little excuses left to be had. It’s not as if the yen’s devaluation has not had enough time to “work its magic” since the yen began its clear descent all the way back in October 2012. Instead of producing an export-led turnaround, we have seen Japanese export growth lag even the yen’s fall.

On this side of the Pacific, the US Census Bureau still records shrinking imports of Japanese merchandise; yen devaluation not even registering the most minor “beneficial” disruption.

As a result of this eye-catching rebuke, CNNMoney further posited that, “Should growth continue to stagnate, attention may turn back to the Bank of Japan, which could come under pressure to increase the size of its stimulus program in an effort to support the economy.” Failure is courted as success in the eyes of these artificial “markets”, which itself is telling given that the Bank of Japan, like all central banks, has proclaimed inflation as both necessary and the standard of attainment itself.

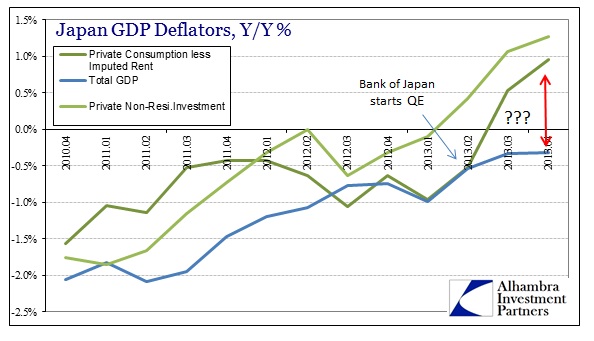

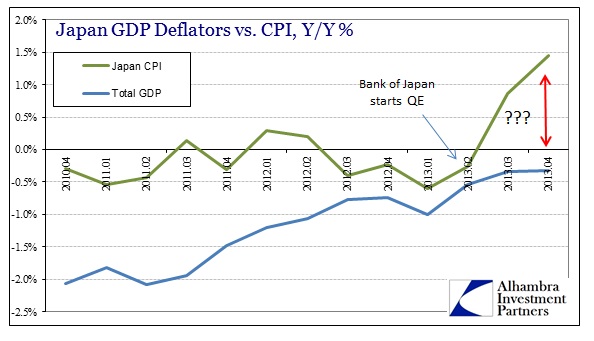

Where economists were “encouraged” by the CPI’s near-attainment of the 2% price change target late last year, it actually highlights another problem with the numbers, already weak as they have been. GDP, in particularly, still remains susceptible to changing inflation paradigms, rendering what is supposed to be a simple calculation much less so. In other words, GDP in the fourth quarter was still being “deflated” under a deflationary regime – the GDP deflator was still negative.

That was an odd calculation considering the CPI running already close to the target, but also as every sub-index of deflators was shown as positive, save government consumption (a large proportion of GDP, to be sure, but enough to keep the overall deflator negative?). More curious still, the trajectories among deflators diverged in rather noticeable fashion.

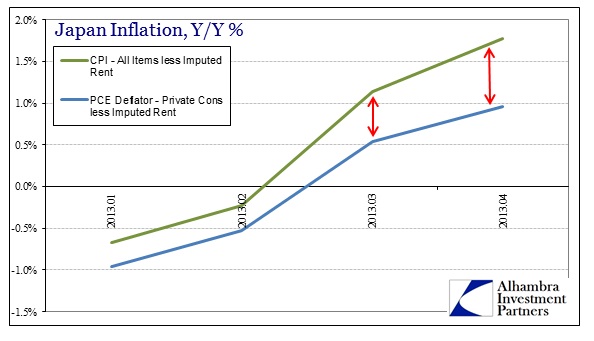

Even where the GDP sub-deflators ran positive, they still are showing much less “inflation” than their CPI counterparts. Of course, the two data series are not directly comparable, nor are they intended to be, but that does not rule out the validity in any and all analysis of conflicts in both basic trend and degree. Despite these basic differences, if they are showing ostensibly contradictory results that should invite scrutiny.

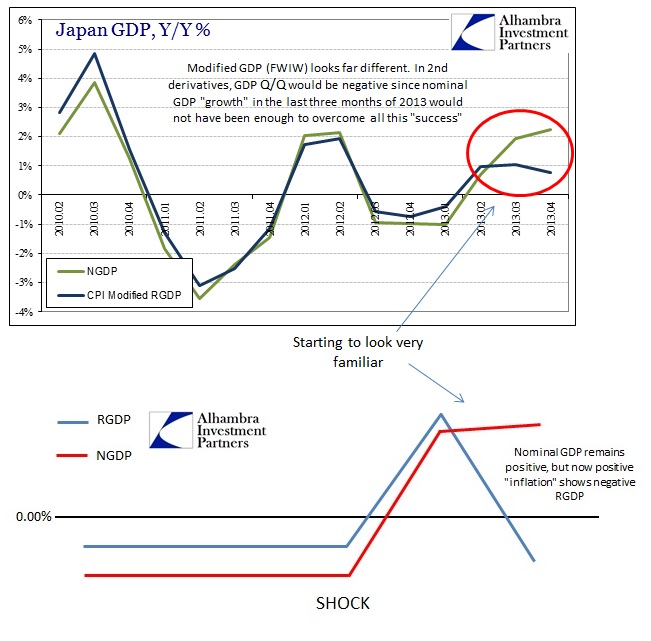

Where I am going with all of this is to offer another explanation of what we are seeing in Japan that more closely resembles other data, particularly the implosion in the trade deficit. As bad as GDP was versus expectations, it may, in fact, be much worse if inflation (which, again, they want) is being understated to such a degree. To show this, all we need to do is substitute the CPI for the GDP deflator (recognizing the limits of this substation given their divergent constructions and intended uses) to come up with a very rough approximation.

I don’t pretend that this is an accurate measure of GDP, but that is beside the point of the exercise. I merely highlight that GDP changes may not be trending in the manner surmised by monetary practitioners because of their apparent willingness to try have it both ways – they use the CPI as validation of QE’s effectiveness, then something very different in calculating GDP which, in the end, actually serves to boost it. Solving for like terms in this way shows this very clearly, and, which should be of great concern in Tokyo, how the ultimate trajectory for GDP as it runs headlong into yen devaluation may not be what they have been predicting.

With the tax hike looming and the current account deficit in total disarray, would that really be such a surprise?

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch