The term consumer exhaustion can apply to several circumstances, but typically they all relate to exhaustion of resources. Households can appeal to wages, transfers, savings or debt, and usually some combination of the four, to maintain living standards and discretionary budgets. So exhaustion, like that of yesterday’s GDP, could be due to any one segment failing more than the others can relieve.

In our current circumstance, American consumers have been grappling with major issues in every one. Addressing two of these, showing structural deficiencies far more potent than any cyclical upswing, Time wrote at the end of January:

In other words, too many of us are living paycheck to paycheck. The CFED calls these folks “liquid asset poor,” and its report finds that 44% of Americans are living with less than $5,887 in savings for a family of four. The plight of these folks is compounded by the fact that the recession ravaged many Americans’ credit scores to the point that now 56% percent of us have subprime credit.

No savings to speak of and a majority of the population with subprime credit? The picture for exhaustion becomes far clearer as we know about the relatively recent reduction in government transfer “benevolence” during the “fiscal cliff” fiasco. That leaves only the job market as a resource to maintain household demand.

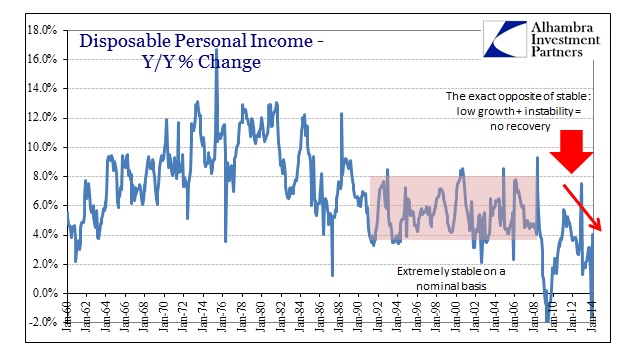

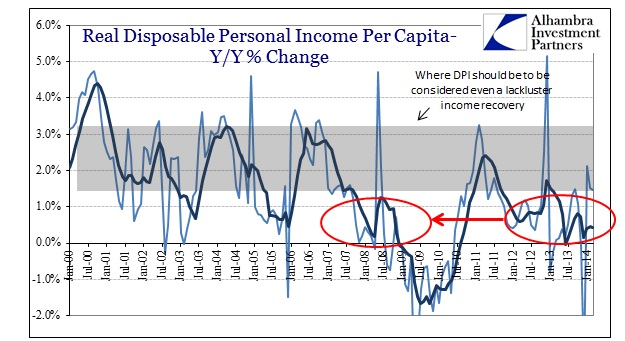

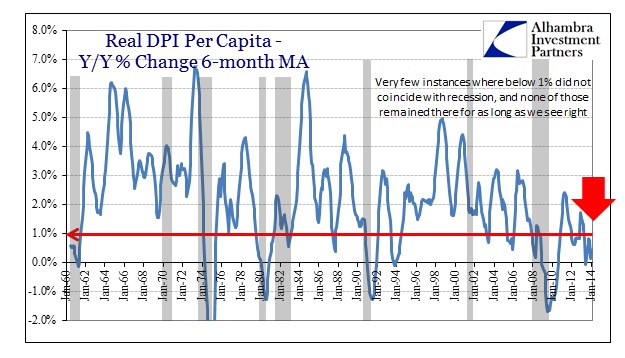

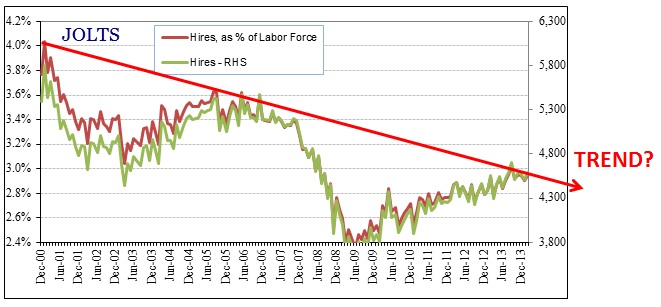

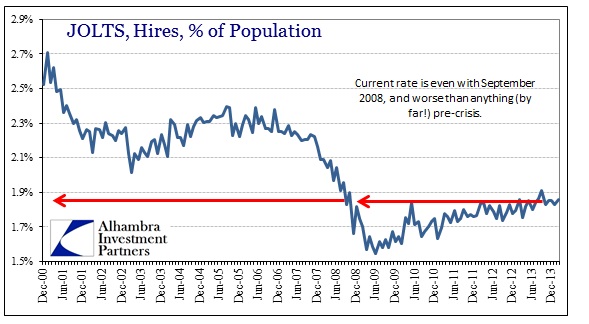

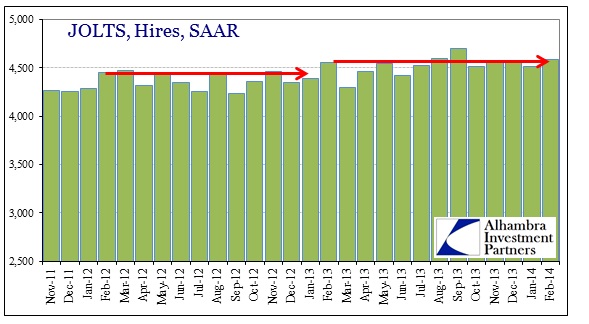

What the income figures show is not what is proclaimed via the Establishment Survey. Even if we agree with the beancount focus solely on the number of jobs, it is more than evident that there is a serious divergence with previous economic eras. Whatever jobs may be available are simply not enough to withstand all these negative structural forces.

So where the orthodox cohort proclaims the labor market is recovering, that does not mean what they think it means. Once again the standard for “success” is only a positive number. That does not itself convey or denote recovery, only the absence of undisputed contraction – a grey area that keeps the dreams of recovery alive even after five years of its conspicuous absence.

There is also a widening disparity between total DPI and DPI per capita. That suggests those with jobs are seeing wage growth, minimal as it may be, but such increases are not broadening out to the wider margins. It has always been assumed (by most economists) that giving some people more income would lead to the virtuous circle of spending begetting more spending, thus leading to even more job creation (that is the very notion behind fiscal “stimulus”) but that is clearly not the case here.

It’s almost as if businesses have resigned themselves to a lower relative level of production across the entire economic spectrum. Less relative production would mean less relative demand for new workers, regardless of whether they pay current workers relatively more.

That can be the case only where profits are rising irrespective of total revenue. In other words, it is inflation masquerading as productivity. If businesses can “earn” more profit per unit irrespective of topline growth, there is no need to commit additional resources toward expanding production, particularly when productive expansion is extremely risky in such a low growth environment. Better to commit financial resources toward financial “investment” and thus maintaining the profit illusion.

The net result of all of this, I believe, is where the profitability mindset, arising from and reinforced by asset inflation, delinks traditional economic circulation. Redistribution, as all inflation is, recombines marginal processes to where actual activity is not self-reinforcing toward a true recovery or actual economic health, but in a sustained period of what seems like slow-growth stasis. That is why the numbers are at least positive, but in comparison to previous periods are reduced significantly. That is why the level of employment now is still below last cycle’s peak, almost six and a half years on.

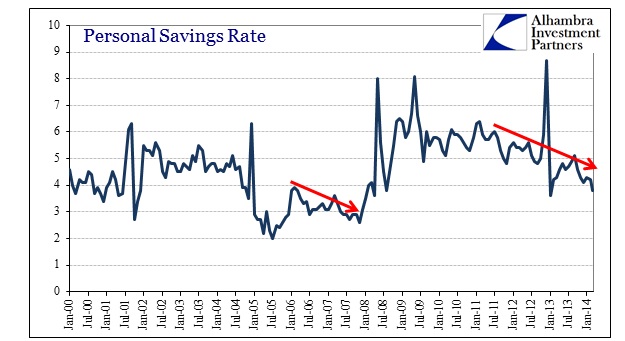

That kind of marginal system is never going to be sustainable, as eventually it erodes from the bottom up. As more and more people are left out of the circulation of earned income, the margins of economic activity strain rather than sustain. The savings rate is perhaps the best picture of that.

In past episodes, particularly the housing bubble, the savings rate fell as households accumulated and deployed large amounts of debt (a very inefficient economic catalyst). Usually, there was at least some marginal increase in wage income and DPI accompanying that trend, but the structural/trend issues have disabled even that inefficient leakage. Now the declining savings rate set against declining income and circulation is consumer exhaustion.

When the Establishment Survey comes out tomorrow and the mainstream narrative is set as a weather-driven rebound (regardless of the actual number), it makes little actual difference because there are more important governing dynamics. Until and unless US companies, so very reminiscent of their Japanese counterparts, become disenthralled of their current production levels this is nothing more than a slower descent into dislocation – the erosion of economic function from the ground up.

An economy is supposed to be one in which participation broadens without ambiguity, not where it actually consumes itself. Such are the wages of monetarism.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch