It’s that time of year where the world awaits the World Bank. Or maybe nobody cares anymore since the economists of that institution have cried “recovery” a few too many times. Like clockwork, global GDP forecasts are being lowered on US weather. From Bloomberg today:

The World Bank cut its global growth forecast amid weaker outlooks for the U.S., Russia and China, while calling on emerging markets to strengthen their economies before the Federal Reserve raises interest rates.

While making that observation at the outset, the article then contradicts itself only three paragraphs later:

Developed economies, where domestic demand is improving as fiscal pressure eases and labor markets recover, are providing the global expansion with momentum just as their developing counterparts fail to accelerate.

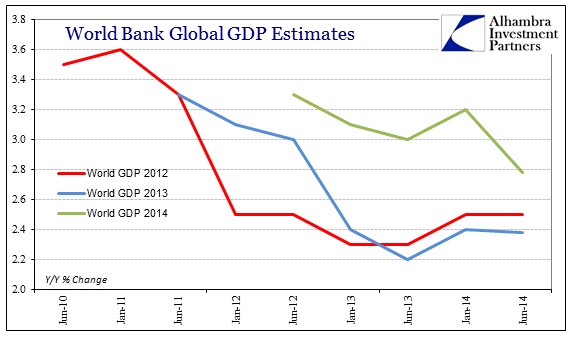

This may be another case of semantics, where “momentum” is being used as the same thing as “traction” in this respect – reduced expectations for growth are now the same thing as momentum and traction. The forecasting ability of the orthodox economics profession may have something to do with all this confusion. After all, it is simply accepted that growth will accelerate and the recovery will come (after missing now its fifth year) so a princely amount of tortured logic is necessary to maintain just such an optimistic stance.

Economies around the world are still facing a struggle towards recovery, despite improved conditions in financial markets, the World Bank said Wednesday, as it sharply cut its global growth outlook for 2013.

The above statement was issued in January 2013 as the World Bank also “slashed” its outlook for global growth.

The world economy will grow 2.5 percent this year, down from a June estimate of 3.6 percent, the Washington-based institution said. The euro area may contract 0.3 percent, compared with a previous estimate of a 1.8 percent gain. The U.S. growth outlook was cut to 2.2 percent from 2.9 percent.

That was from January 2012, just the year prior. The recurrence of cutting growth forecasts is beyond repetitious, entering the territory of basic incompetence. However, since these forecasts are made via statistical modeling of the highest elegance and sophistication, the “science” of economics countenances no retribution or accounting.

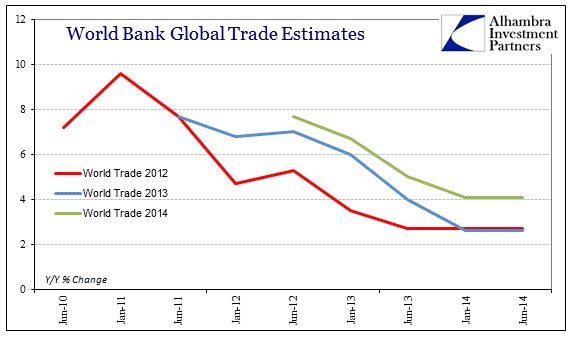

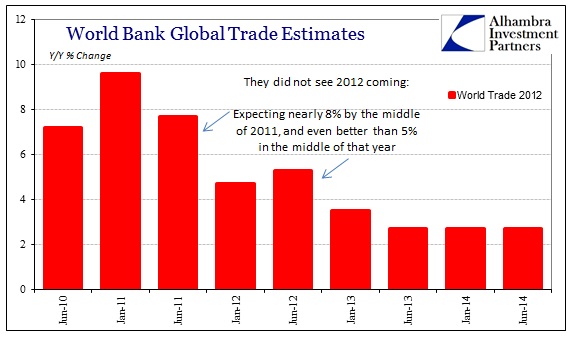

If you look at recent history and the pronouncements from the World Bank, this pattern is very deeply established. Optimism starts out strong, under the mathematical and very scientific cover of “some central bank did something” before falling apart under the strain of actual empiricism. While that has certainly been the case with global GDP expectations, the World Bank forecasts have been downright atrocious in the vital area of global trade (which may, in fact, be more important as trade more often than not drives GDP and not the other way around).

I think the clearest example of this modeling weakness is the track for 2012. Nobody at the World Bank, or anywhere in the orthodoxy, saw the 2012 weakness coming. It was a total blindspot as expectations simply continued on for growing and robust recovery when in fact the US and global economies did the exact opposite (including a full-blown recession in Europe that was also “unexpected”). As you can see above and below, that optimism persisted at the exact same time the slowdown was actually taking place.

The impact on the global economy from the 2012 slowdown is still reverberating today and is the proximate cause of most (if not all) emerging market difficulties. If the global economy had recovered as it was “supposed to”, following the commands laid out by “coordinated” central banking, there would be far less uncertainty in China, Japan and nearly everywhere else.

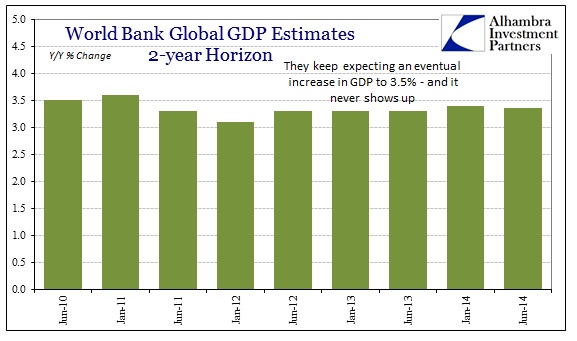

That is the key (though not only) flaw in econometrics as models only extrapolate in mostly straight lines. There has yet been identified a “jump” formula or regression copula that even incorporates the idea of inflection leading to recession (or worse). Instead, all these forecasts start with the same exact baseline, itself formed out of nothing more than “stimulus” expectations.

If you go back and view all the forecasts from the World Bank since the “recovery” began, they all have the same terminal view on GDP. In other words, the growth rate at the end of the rolling forecast ranges all tally at about 3.5%. These orthodox economists simply take it on faith that 3.5% will show up, but when it doesn’t they never alter their extrapolations – they just move it another increment further down the calendar.

Inflection is an important part of true economics because the real world is not limited to academic exercises of statistical simulations. In other words, failure is a very real option. But it is one conspicuously absent from World Bank, the ECB, the Fed, Bank of Japan, etc. ad nauseum.

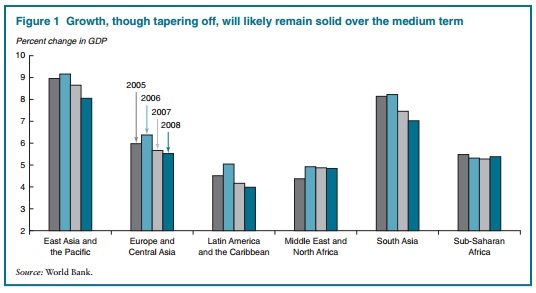

In 2007, the World Bank held much the same faith-driven optimism as today. The graph below charts their contemporary expectations for the coming economy:

The following year, 2008, was only “supposed” to slow from 2007, and even then only slightly across the globe.

And the unwinding of the U.S. current account deficit and its mirror surpluses in oil-exporting countries and East Asia could also be disruptive if sudden movements in capital markets, perhaps abetted by collective policy inaction, drive the rebalancing. Even so, these risks appear manageable, and the promising environment for growth makes this an opportune time to focus on long-term issues.

It perhaps is not possible to be more wrong in one single summation. The risks were not manageable at all, driven not by “collective policy inaction” but rather by too much previous and ongoing policy intrusion everywhere. Their entire “understanding” of the economy is, like the Establishment Survey, limited to variation around some assumed benchmark; itself nothing more than a regression equation ill-fitted to past history. Going back now at least seven years (you can add the dot-com bubble to this thought, as well) it should be unambiguously clear that modern economics is wholly incapable of seeing the downside for exactly that reason – common sense is never allowed to penetrate the numbers. These maxims need to accompany every single forecast that makes its way into even the briefest of public consciousness.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch