For my mind there are two actual explanations for tapering QE, neither of which follows the mainstream idea that the economy has gained sufficient “footing.” That provides the cover by which QE’s taper can be sold while preserving “credibility”, but it does not line up with anything else outside of the straightest line in the Establishment Survey. Instead, tapering is very likely to do with intermediate concerns of economic growth and immediate concerns with funding technicals.

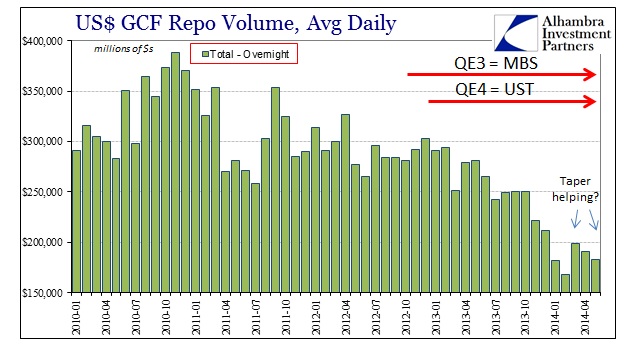

This is probably the most obvious in MBS repo after QE3 transactions started settling in the TBA market in October 2012.

The primary complaint against QE has always been the collateral scarcity that it takes to influence MBS spreads in order to “support” mortgage markets in the textbook manner. I think the chart above nicely confirms that. However, last year’s midyear bond selloff, which hit MBS particularly hard, essentially dried up the mortgage pipeline. That has more implications, all negative, beyond just repo collateral, no doubt requiring more than a few adjustments in dollar rolls.

It is noticeable that repo volume has come back significantly starting with March 2014. MBS issuance has been steady at the collapsed level, so it is not as if there has been a restoration of the mortgage pipeline, as homebuilders are clearly aware. There are a couple of other potential explanations, but none that is as obvious as QE tapering. Simply put, the Fed is no longer taking out almost all MBS collateral from repo circulation thereby allowing some breathing room back into the complex.

This is not to say, if this is the correct interpretation, that all repo will be “fixed” at QE’s end (which can’t come soon enough), but rather a diminishment in funding market pressure that would have been useful prior to the fireworks.

That is because it is not just MBS pipelines that have dried up as the treasury is issuing fewer bonds as well. Since QE4 targeted UST, you can figure the same type effect on repo markets there (which has been a recurring theme for not just funding credit, but gold and eurodollars too).

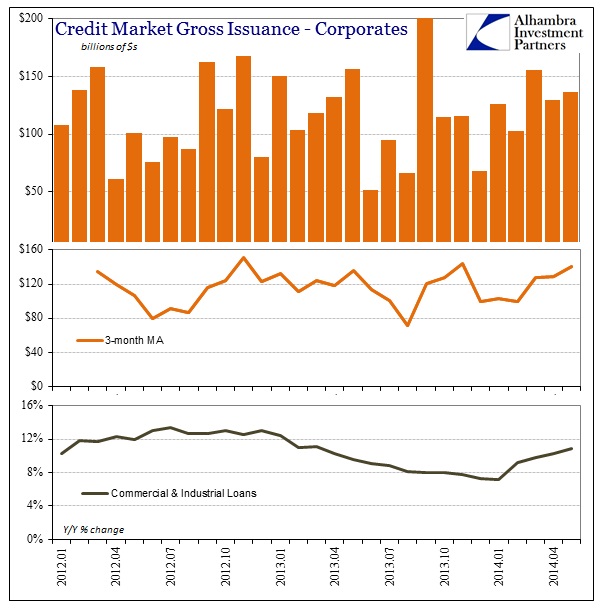

Could that be why UST buyers at Euroclear in Belgium suddenly appeared? That is certainly possible, though I still hold with interest rate derivatives resetting (collateral calls) and Dodd-Frank pushing swap dealers overseas (rather than on domestic exchanges as intended). Whatever the funding market deliberations, gross issuance in credit has been curtailed – except in the corporate segment.

There seems to be little shortage or disruption in credit flowing to companies, even accounting for last year’s bond disruption. That would appear to suggest very little correlation with the economy, but perhaps far moreso with stock repurchase behavior especially in Q1 ’14?

What is unseen in all of this is the shock absorption capacity of dealers. That is to be expected, like insurance capabilities you don’t really know what they are until they are needed and put to use.

It has become more and more apparent that dealers in these credit markets have removed a significant amount of balance sheet capacity to absorb risk. To create liquid credit market conditions requires banks to provide warehouse services with which they can add and remove, repo and rehypothecate issues in MBS, UST, corporates and even equities. The dealers act as a shock absorber on the system. If, for example, an MBS in TBA began to trade significantly lower because of whatever reason, at some point a dealer should step in much the same fashion as a market maker in stocks.

The dealer’s capacity to engage as that liquidity arbiter is very different now than it was before the crisis. For the most part, discussions about unstable conditions are centered around the fact that dealer inventories in many categories are far below where they were before 2008. In corporate bonds, the Fed itself estimated that dealer inventories have been reduced by 70% (though other observers peg that around 40%; either way, it’s a significant reduction in capacity).

Funding for dealer capacity comes directly from repo. Cheap leverage, both funding and regulatory, is necessary for dealers to maintain a larger proportion of available balance sheet capacity for just this sort of vital market function. I have little doubt we have seen an actual episode of just this reductive constraint – this is likely why the relatively minor threat to QE last year produced massive and seemingly disproportionate funding ripples not just in domestic bond prices, but global currencies, EM stocks and pretty much everything financial. The MBS market, in particular, was crushed in historic fashion; so much so that banks no longer want anything to do with mortgages (which is probably a silver lining, but there are far less destructive ways to go about that; like actual market forces for once).

Which makes all of this even more infuriating.

Dealer capacity is the one (maybe not the only one, but one of the few) feature of the banking system where we actually want a significant devotion of capacity and resources, ie, leverage. Banks operating their warehouse capacity is an unquestionably beneficial bank function, though it got out of hand as hedging that function turned into raw and colossal speculation (remember, hedging and warehousing is proprietary trading and there is no easily discernible distinction between hedging and speculation as an accounting matter – that is why the Volcker Rule intended to ban all of it). Credit trading dries up so they simply go elsewhere to gain returns in a zero-rate environment. A true, productive market for money would allow productive banking to be profitable, which would actually enhance economic growth rather than encouraging debt as a solution to everything.

Banks become less shock absorbant, less productive in terms of allocation, but more likely to engage in risky functions and then hide it all under legal and accounting regimes. That is a debt policy of rate suppression.

So the Fed (and Dodd-Frank) seems to have one more time encouraged erosion in the one capacity we want, and hypersensitivity and proclivity in the more dangerous directions. The tradeoff was supposed to be a robust recovery, as that would allow wide margins to go back and clean up the plumbing mess. Again, taper cannot finish soon enough, but we need to be aware that the system has already been altered.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch