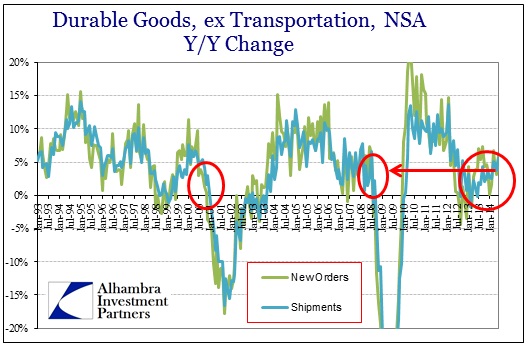

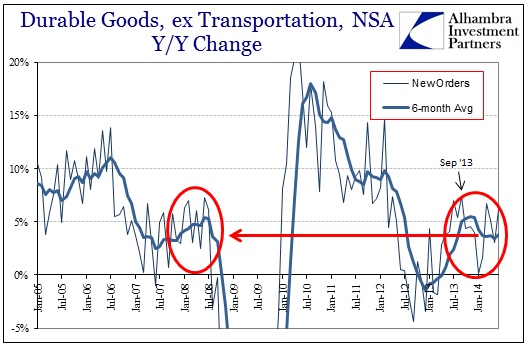

The durable goods report has become one of the most boring and uninteresting of all the major data series. There has been little change in the pace of growth, as these segments are clearly stuck in the rut that seemingly captured everything in the middle of 2012. While there is growth, it is nothing like what we should see in a true recovery or sustainable growth environment. In June, once more, same story.

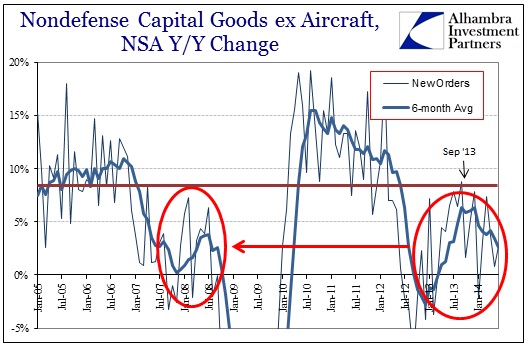

Some observers want to see acceleration, especially most recently, but the chart immediately above should put that notion to rest – with prejudice. However, capital goods may be breaking out of that boring and listless pattern, starting to impart, potentially, significant changes in business outlook. The problem, for both the economy and its cheering section, is that the direction looks to be downward.

I pay a lot of attention to the consumption side (which is probably not the most suitable word here since there are no “sides” but rather different facets to the same system) not because it drives the economy as related by the “aggregate demand” adherents, but rather due to the difficulties in peering through the maze of what constitutes growth in production. Capital goods are an element, but not the only one. There is simply no satisfactory measure, let alone comprehensive, of gains in supply capacity which would give us highly useful and far more relevant insight into the actual creation of true wealth.

Thus, we are stuck overanalyzing the symptoms of wealth, namely consumption, which is all the more difficult as a result of so much manipulation in that arena. That said, I don’t really find it surprising given the disappointment recently in wages and related consumer spending that capital goods might (emphasis on might) be trending dangerously downward. That seems to be the growing consensus of actual economic direction, at least foretold outside of regression models. It’s not enough to entertain full judgment at this point, but the trend has become distinct, free now from aberrations and winter or whatever possible distortions, and thus needs careful study in the months ahead.

At the very least, should cap goods continue to falter, durable goods might become interesting again; though I doubt most would use that particular descriptive label, favoring instead those like “unexpected” and “mysterious.”

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch