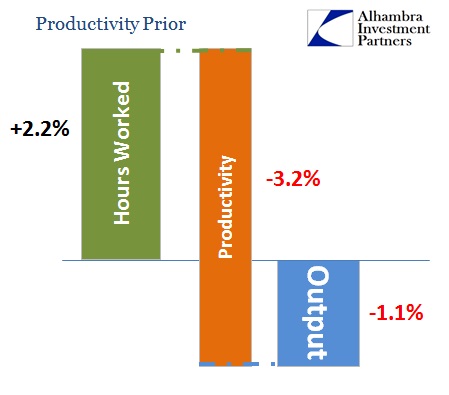

The BLS updated its figures for economic and labor productivity, including the revisions for the first quarter. As it stood prior, the calculation for productivity was among the worst of the past four decades. Given that GDP was already revised lower in the interim, that meant that productivity estimates were going be also sent further downward. Since productivity is a plug measure bridging the separate calculations for output and labor utilization, that meant rather optimistic estimates for the labor market were highly at odds with the net results.

The implication, for my analysis, was that labor growth was being over-counted with regard to overall output. The fact that productivity was so deeply negative in order to plug the difference was an indication of exactly that, especially to such a historical degree.

The latest revisions are about what you would expect, as the BLS only revised total hours down by the smallest possible amount. Hours worked continues to move along at a steady rate despite these heavy indications that the calculation might be off.

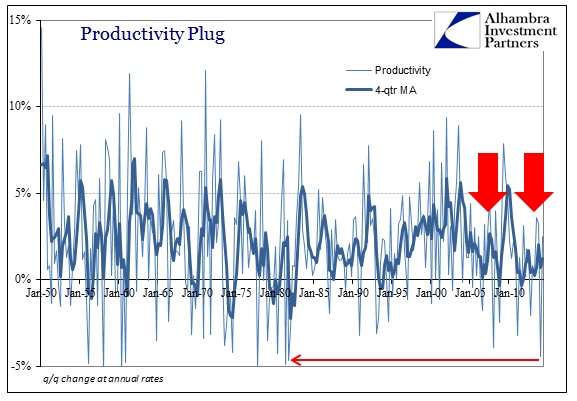

The net result is a negative productivity measure that is extreme in historical context as there are only a handful of periods with a worse showing; none in the past thirty-three years.

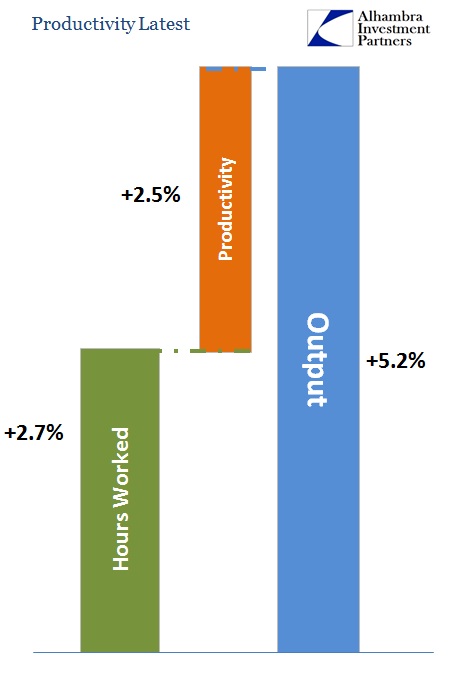

In addition to that, second quarter productivity was measured at a weaker rate than anticipated given all the euphoria over GDP. The primary “culprit” in failing to live up to expectations was the labor piece. Total hours worked was estimated to have grown a further 2.7% (annual) rate from the first quarter. That meant, given a 5.2% rise in “output”, productivity was only left with 2.5%.

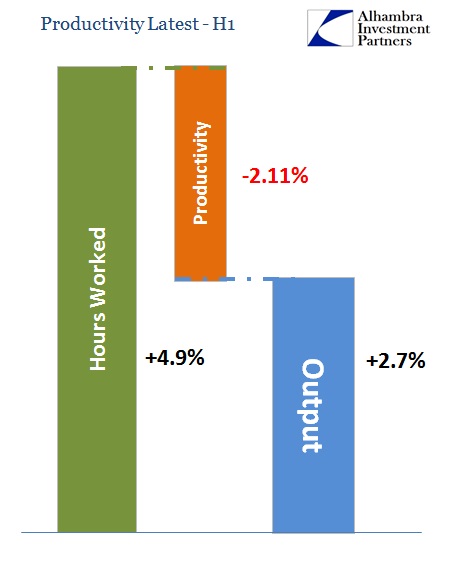

A more measured observation of these figures might, once again, conclude that the labor piece is being overly optimistic. A downward revision to total hours would bring the productivity plug back in line to its recent average. When including the large decline in the first quarter, together the first half of 2014 productivity is acutely negative (-2.1%) and quite below the already disgraceful 1% in 2012 and 0.9% in 2013 (both of those figures were revised lower in the latest GDP estimations; total hours worked were left mostly unchanged, of course, which meant that productivity bore the adjustments).

Just to get productivity back to zero would mean cutting the advance of hours for the first six months of this year at least in half. To reach 1% would mean preserving only one third of the estimated growth in total hours.

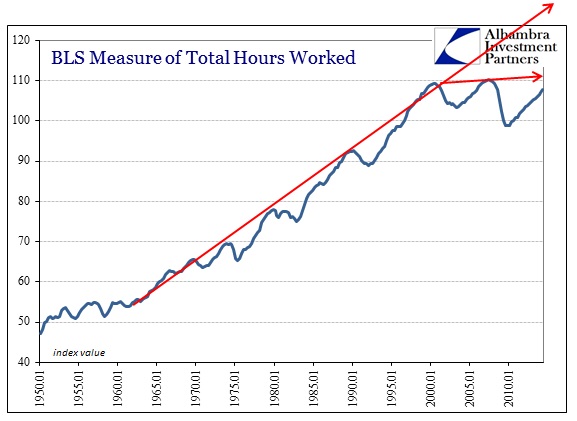

That would, of course, present a huge problem to the “recovery” narrative as it largely rests upon these kinds of distorted figuring just to gain a seemingly (and only by appearance) satisfactory level. When the Establishment Survey finally reached its prior cycle peak a few months back, after 76 months, that was taken as a sign of recovery when it was nothing of the sort. Recovery means not just remarking past highs but reconnecting with past trends that were only supposed to be temporarily set aside.

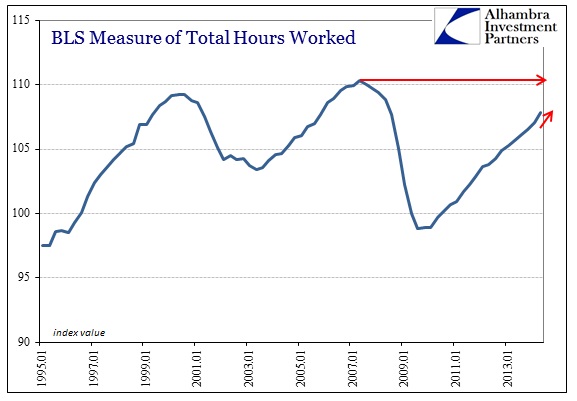

Curiously, however, the BLS’ figures used here for hours worked show no such favor. In fact, the index value for the second quarter of 2014 is still 2.3% below the prior peak reached seven years ago. But what’s truly amazing is that there has been a clear change in “trend” with the inauguration of this century (coincident to the bubble economy?).

The BLS definitions here are different than its payroll survey, as it is broader and captures more labor classifications:

Labor productivity, or output per hour, is calculated by dividing an index of real output by an index of hours worked of all persons, including employees, proprietors, and unpaid family workers.

That, however, only makes it worse as it indicates a more broad-based decline in trend likely centered in “proprietors.” That matches other, non-governmental surveys and studies that have noted a significant deficiency in entrepreneurialism, but nothing like what we see here. Something clearly has changed in the productive capacity and utilization of labor.

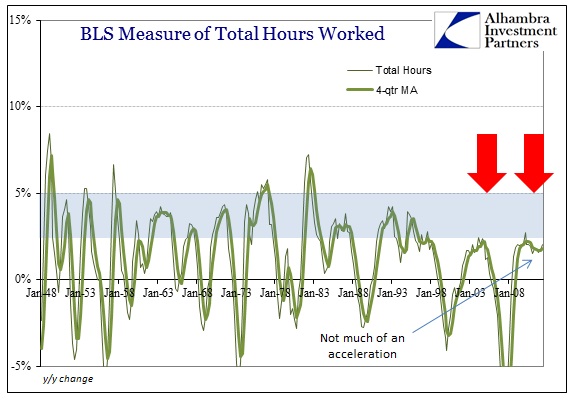

Furthermore, despite the outward appearance of growing labor strength from those other payroll measures, recent indications of hours worked (which I still believe are over-estimated) show nothing like the acceleration of the Establishment Survey.

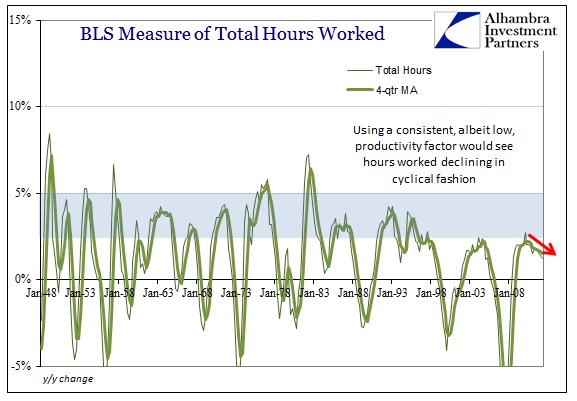

In fact, year-over-year growth rates have seemingly topped out for this “cycle” at a level far, far below the historical paces. That those lower levels also coincide with the lower calculations for productivity offers a hint of structural problems not only with the economy but its potential – one more data point to add to the weight of evidence of “someone shaving off the peaks.” It also suggests a very good reason, if the Establishment Survey is valid, why consumer spending is not correlating as it normally would. It seems as if in the past payroll growth and overall hours worked, including all these additional labor outlets, were more closely related. Now, however, again assuming the validity, there has been almost a total disassociation.

Keeping in mind that all of this data may itself be flawed, we have to at least begin to admit the possibility of a confluence here of both structural (trend or potential) problems with cyclicality.

The net result of all of this refiguring of revised figures is that there are clear problems in the economy that are not consistent with the “recovery” idea as it supposedly accelerates. On the one hand, the idea of acceleration is itself on shaky ground given that it requires so much oddness in secondary relationships just to maintain it. More importantly than that, broader economic indications show that the economy is actually further behind than the mainstream narrative would have it. The reasons for that in this specific case (broad measure of hours worked) is a separate topic, but I don’t believe it unrelated at all to overgrown financialization.

The larger point is as I suggested a few days ago about the nature of recession; clearly whatever or however you wish to define it, the US economy, like Europe, Japan and elsewhere, is in nothing like a recovery. There are positive numbers but that itself does not conform to economic health – more is needed, especially the encouragement and creation of true wealth which would be apparent in the exchange for labor, and thus income. The absence of that wealth is as we see above, where labor suddenly stops holding its relative “value” and the economy simply wastes resources in non-productive pursuits (like the endless churn of ledger money and credit through expansive bubbles).

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch