What should most troubling to investors of all stripes and locales is that what is going on in Europe is almost exactly the same as what is taking place in Japan. Despite nearly all outward appearances, Japan and Europe have far more in common than differences, at least where it counts. The Japanese have finally created the monster they sought, “inflation”, while the Europeans continue to seek it out in fear far more every month of the onset of “deflation.” What looks like two geographies and systems moving in opposite directions is actually not, it is instead same problem manifested with slightly different spin.

The concerning part is the very clear economic decay evident now that has replaced most vestiges of unquestionable faith in a monetary fix. There have always been issued the usual caveats from all the “right” people about how monetary policy is no “panacea” and that comprehensive solutions lie in fiscal (but never market) will, but that is and was just lip service. Central bankers want investors to believe in their omniscience, desperately, which is why stock prices are so appealing as an assumed tool (and thus so circular – stock prices reflect the economy, and the economy moves on stock prices through some wealth effect).

What a difference a year makes, in both Europe and Japan last year their respective central banks were glorified as near-miracle workers in overcoming persistent malaise. This year, however, the laudatory sentiments have turned backward. I documented much of Japan’s wreckage this morning; what follows is Europe’s.

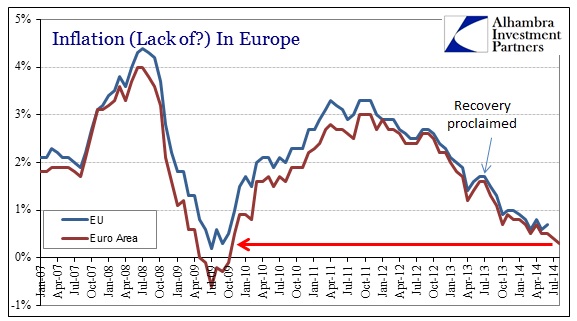

Start with “inflation” and find no recovery at all. The trajectory of official price change calculations is startlingly robust and clear. That unshakable descent belied everything that was proclaimed about an economic system heading toward liftoff.

Instead, most of Europe kept sliding further and further toward the abyss, only covered by Germany’s lock on its still-relevant 1999 undervaluation of the mark. That monetary prison promises to remain as much as long as the financialism that made it “possible” continues to bite – and the ECB is committed to just such a course, as is the European political establishment.

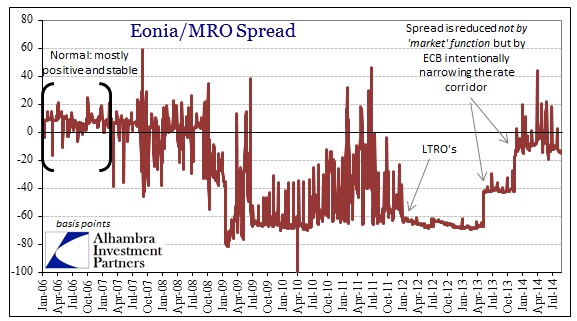

Where it truly gets interesting is that while the ECB has refrained from full-blown debasement (of the QE variety) that does not mean it has been absent. The interest rate corridor in the interbank “markets” has been steadily narrowed and eroded, with the very clear intent of giving up on “curing” fragmentation there and instead just masking it with nominal changes. That includes, of course, the first flirtation with a major negative nominal interest rate that was supposedly directed as some kind of enforcement effort toward lending to something other than a sovereign government.

Now with everything else in the financial system, just yesterday Eonia fixed at a negative rate for the first time ever. Banks would rather lend to each other, and only the “right” banks, at a slightly negative interest rate than lend to the economy (or buy even more Italian government debt). All the ECB has managed to accomplish is to repress further form and function inside the very system it supposedly intends to harness for a more targeted monetary program.

The Eonia outcome simply reinforces the characterization I used this morning about Abenomics, representing all monetarism; “So in the generic sense, orthodox practitioners intend to create a healthy economic trend out of an engineered preponderance of negative factors.”

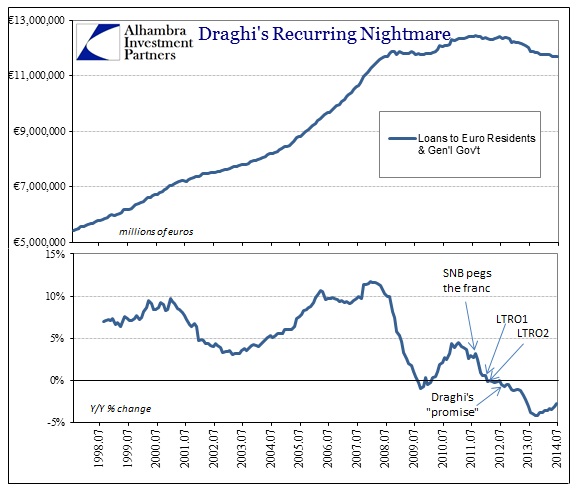

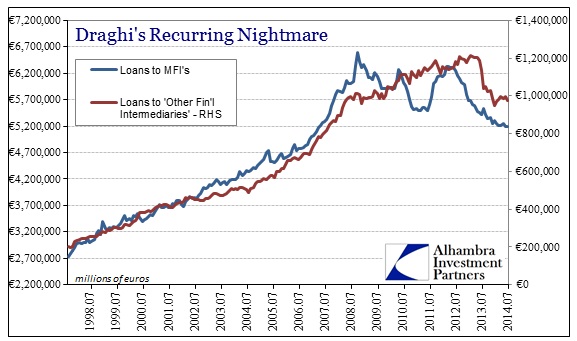

Lending continues to erode instead, charting a course that is suspiciously similar to the official inflation rate. The ECB counts on a numerical fiction (negative interest rates, and even interest rates at all) to drive its expectations, when in fact banks have demonstrated quite conclusively that they are undeterred by that course of intrusion. In ignoring negative rates and in fact, given Eonia, seemingly embracing them, banks are showing the pathway to erosion is not to be interrupted by generic “tools”, inaugurating the distinct possibility that it is those intrusions creating so much harm in the first place. That includes, to the consternation of orthodox economists and their generic ideas about the “money supply”, lending in interbank formats.

Whatever the ECB tries as far as “stimulus” fails in all its intents, primary, secondary and down the line. For awhile GDP and some economic accounts moved higher, but that was just statistical measurements of not contracting further (in that moment), a condition that is wholly unlike recovery. That has been known and obvious for some time now, especially lending and inflation. What has changed is how markets are treating this failure, as if the benefit of the doubt no longer places such prominent faith in central bankers.

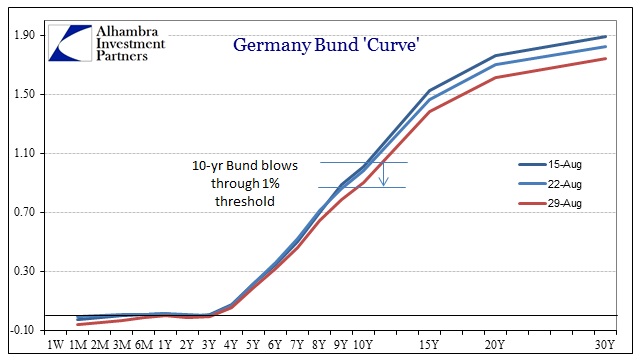

In just the past few weeks, bond curves throughout Europe have flatted, joining their US$ counterparts in UST and eurodollars. In the case of the German bund curve, the speed and degree is quite remarkable.

Two weeks ago, the 10-year Bund was just flirting with a record low of 1%, but now sits threatening to enter the realm of 80 bps. The entire curve has drawn significantly flatter in, again, almost the same speed and elements of the US curves.

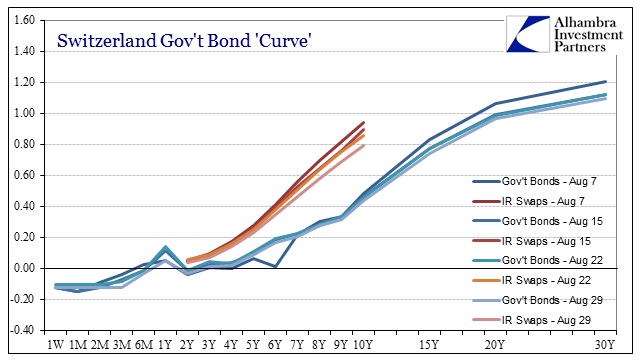

The move in Swiss bonds has not been as severe, but it has never been the general Swiss curve that draws most interest (both financial and observatory). Money rates flatten too with significant changes seen just since mid-August.

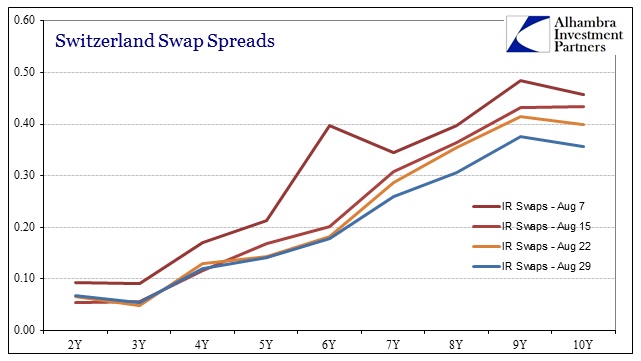

The 2-year note has traded below -4 bps on a couple occasions, which can only bring back reminders of the currency crisis of 2011-12. As such, swap spreads in the Alpine money system continue to compress, thus signaling nothing positive about expectations.

The Swiss curve may outwardly look different than something like the eurodollar curve, but the movements in those two mechanisms are of the same impetus – the time value of “money” is eroding under a regime of diminished expectations. The timing for this, including the steady bear movements in the US curves, time to monetary events, and thus suggest that credit markets are no longer as enamored with “dry powder” and promises of future promises that might someday be within reach.

That is potentially a massive paradigm shift whereby these global positions finally reflect reality, or at least the contours of growing realizations that monetarism doesn’t work. With so many asset prices propped up by exactly that premise, its removal cannot be kind.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch