They say the road to hell is paved with good intentions, but that is not the only ingredient in the asphalt used to make the highway to Perdition. Typically, intent is augmented (or actually degraded) by a degree of incompetence that masquerades as complexity. The breadth of that observation is staggering in the current circumstances as Japanification has seemingly gained speed in the “developed” world of late. Of course, such problems in these end markets hold nothing good for national economic systems further down the supply chain, so it isn’t odd to see Brazil again in recession alongside Europe and Japan (and whatever is taking place here).

The interventionists, both monetary and fiscal, got exactly what they wanted in Japan as “inflation” has most certainly replaced “deflation” – to no avail other than an acceleration of impoverishment. The mainstream narrative has instead fallen upon “mistiming” as the explanation for this dangerous failure, despite last year’s unequivocal assurances that it would all work as intended.

Prime Minister Shinzo Abe’s plan for Japan’s economy to generate self-sustained growth on the back of his three policy “arrows” of massive monetary easing, spending and reform appears to be faltering – but no magic solution is in sight.

But gloomy economic data suggests the plan is not succeeding as hoped and the only short-term contingency plans appear to be further central bank stimulus or delaying a second rise in the sales tax set for October 2015.

“Abenomics is in trouble – because it’s not happening fast enough,” said Robert Feldman, head of research at Morgan Stanley MUFG in Tokyo, who like many others says Abe must move faster on steps such as labour market reform to boost productivity.

It isn’t insightful to happen to notice that wages are not moving in tandem with prices; what would be useful is actually defining why that has occurred in direct opposition to all stated and proclaimed plans and intents. A full part of that failure is that last phrase in the quoted passage above, “Abe must move faster on steps such as labour market reform…”

“In a sense, the first arrow of monetary policy easing was a way of buying time,” Vice Economy Minister Yasutoshi Nishimura told Reuters. “I want companies themselves, led by shareholders, to exit unprofitable businesses and shift to new growth areas.”

The entire point of monetarism is the opposite of what Nishimura is trying to solicit. Debasing the yen was meant to make Japanese businesses profitable, at least in nominal terms. Why, then, would they “need” labour market reforms and a government-drawn road map to what is and isn’t “profitable”?

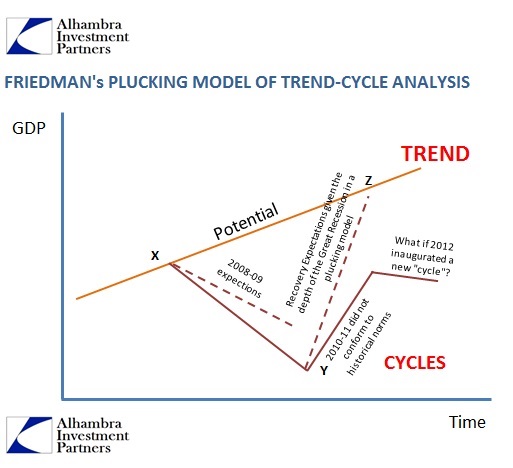

But the Vice Economy Minister is correct in that most of monetarism is about time – but to do what is unclear in the real world. This all goes back to the most primal of central banking impulses that bank panics and financial disorder are themselves causative of economic deficiency, and thereby the removal of financial irregularity will allow economic function to return to normal. That is the oversimplified essence of the mainstream Keynesian position as I examined yesterday via Brad DeLong. The economy grows on its potential path, only to be temporarily disrupted by “shocks.”

Removing those shocks, then, is supposed to free the economy to re-assert its prior potential pathway. That is what they posit as the business cycle, with trend playing a durable role uninterruptable by the vagaries of markets and finance.

That assertion, however, has been challenged, to say the least, by Japan’s last quarter of a century. There can be no doubt that the initial stages of the Lost Decade(s) contained exactly those kinds of financial disorder that central banks have theorized. But there is equally no doubt that such disorder is also so far in the past as to have little relevance to right now.

If orthodox economics accepts that premise, then it will also have to accept the idea that financial intrusion and dysfunction can actually disrupt trajectory. If the mainstream monetary premise still resides within the idea that lingering impacts from the previous financial disorder, so far now in the past, are to blame for current deficiencies, then the space of time now is sufficient for that to apply more to potential than cycle.

What I mean by all of that is that if the Bank of Japan sees “deflation” as the primary problem, then “buying time” with QQE until “inflation” becomes a “solution” more than suggests that Japan is still gripped by financial disorder spanning two and a half decades. And if that is the case, then what do we make of the economic potential after having suffered under such persistent financialism?

It is entirely possible that economic potential is harmed, vociferously and deeply it seems, by the downsides of financial dominion. “Buying time” does absolutely nothing of freeing the economy to pursue its fullest trend because that trend itself has been harmed perhaps irreparably. What would instead be required is that the actual impediments to organic growth, overpowering financial interference, at least be removed in a first step toward actual healing.

That applies to Japan and everywhere else that monetarism has succeeded in plotting a highway toward economic stagnation (and worse). But what has been lost in the all the focus on QQE is that these discrete episodes, destined to failure from the very start, contain within them an expiration – a predetermined end that results often enough in catastrophic failure. Japan has close experience with more than one huge “setback” to go along with its repeated monetary and fiscal “stimulus experiments.”

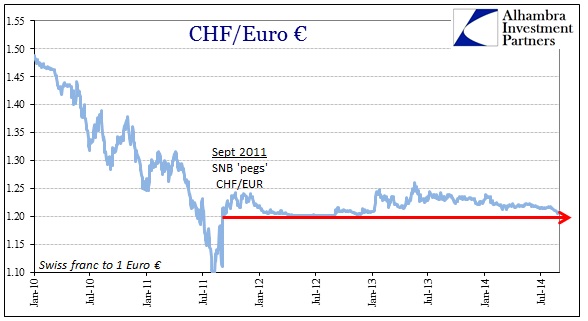

That turns attention toward other “ticking clocks” where such “buying time” may be reaching closer to the end. If economic potential is indeed corruptible and disrupted by unending financial influence, then economic station is never to be improved as potential is more of a dream and fantasy than actual and reachable target. In Europe, at least, it appears as if the actual clock on the ECB’s time buying that began in 2011 with the LTRO’s is winding itself down toward zero once more:

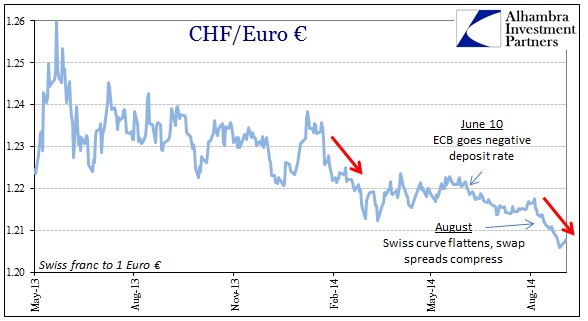

Undoubtedly, some of the most recent favoritism toward the Swiss franc is due to the ECB’s negative nominal deposit rate (which, ironically, was intended as a “stimulus” toward lending, as laughable as that is now with the euro again approaching 1.20 and Eonia itself having gained experience below zero too).

Even with that “liquidity preference” in full bloom, to use Keynes’ own construction, there is a lot about the most recent descent (ascent of the franc) that coincides with the dramatic bear flattening in cash bond markets and IR swaps suggesting more than a little change in investor expectations. Like Japan, the central bank “magic” seems to be wearing off. To put an emphasis on that point, the Swiss economy “unexpectedly” showed no growth in Q2, meaning that the franc’s recent movements aren’t so much related to the economy (or differentials thereto) as finance.

It all comes back to the lack of true recovery in every one of these places. We are now seven years into the paradigm shift and have yet to see anything like a return to trend anywhere – as if the global economy has been rocked from its axis, unable to revisit prior levels of stability and function. With so many coordinated deficiencies taking place all at the same time (the Great Recession was global, as is the lack of recovery from it) that screams financial problems; I highly doubt every single economy experienced and continues to experience the same “shock” at the same time, marking the same exact “temporary” disruption from trend.

Instead, it looks more and more like Japan was a pioneer in financialism under duress, if only economists would deign to observe it.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch