It is easy to get carried away with modern finance, diving into the immense flourishing of finance that has taken place. Conceptions have become far more complex, sometimes unnecessarily so, leading to impairments in distinguishing forest and trees. In credit markets, we focus narrowly on spreads and curves because that is where the “action” seemingly takes place. That leaves observation without enough deference to the elegant simplicity of just nominal.

Only a few weeks after launching QE3, then-Chairman Ben Bernanke spoke about nominal returns in the context of his rigorous repression upon them. In a theme that became far too rote (due to the inability to live up to expectations, including his own) Bernanke essentially offered what seems like a contradiction, that in order to “achieve” good rates of nominal return “savers” had to accept periods of just such subjugation and dearth:

Only a strong economy can create higher asset values and sustainably good returns for savers.

Low rates in the orthodox view are the necessary condition to create “good returns for savers”, so they must accept paltry in the short-term in order to gain something better. By this logic, the Japanese experience makes little sense, though the commonalities are becoming more and more uncomfortably visible. It also demonstrates how deeply embedded the idea of monetary neutrality is for economic theory, as supposedly the economy is to blame for “needing” low rates in the first place.

Testifying before Congress during the unleashing of “taper” in May 2013, Bernanke again returned to this theme, this time with a little wrinkle:

A premature tightening of monetary policy could lead interest rates to rise temporarily but would also carry a substantial risk of slowing or ending the economic recovery and causing inflation to fall further. Such outcomes tend to be associated with extended periods of lower, not higher, interest rates, as well as poor returns on other assets.

Again, the basic foundation of his argument for creating “losers” (savers in his case) via redistribution is first accepting repression in order to gain normal and better returns after the economy has recovered and re-established its “potential.” But he also adds that it is premature tightening (or you could even infer not enough “stimulus” as a variant) that leads to “extended periods of lower, not higher, interest rates.” Thus the key in the orthodox formula is some magically proportioned stimulus via interest rates (both real and nominal).

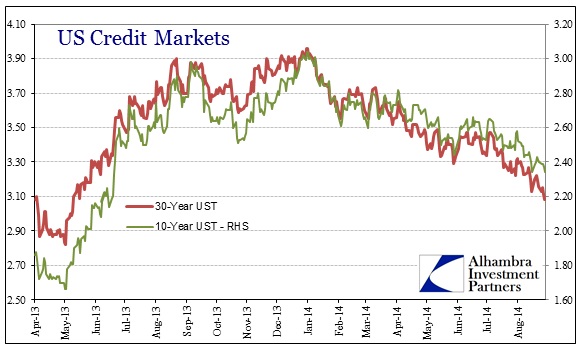

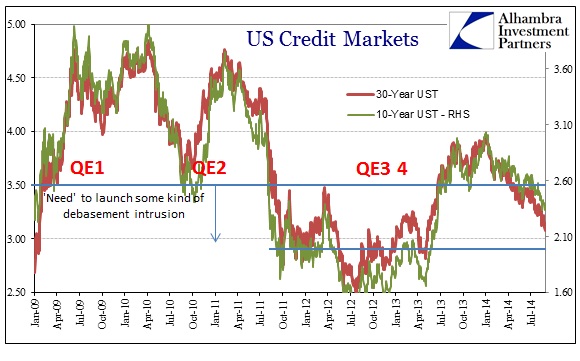

As the calendar turned to 2014, nominal interest rates (as well as curve flattening and spreads) turned against Bernanke and his equality here. Nominal yields have moved more than a little lower in the belly and out, suggesting that credit markets are not as enthused about his intrusive nature and that of his successor. It seems as if nominal yields (before last week’s profit-taking) are heading back close to levels that have triggered monetary action in prior periods.

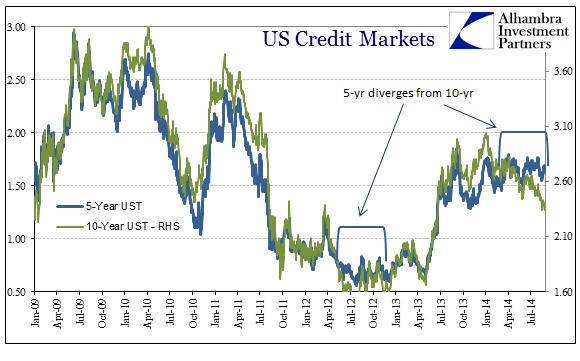

Where the 10-year has done so, the 5-year has remained on a relative straight-line, which is in terms of simple math the reason for all the flattening. But where a divergence between the 5-year and 10-year on a nominal basis might seem to suggest growth concerns much further out in time, the fact of the matter is more about monetary manipulation than anything of fundamental “value.”

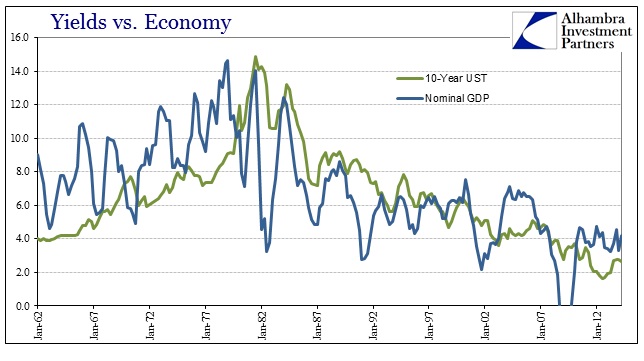

The last time the 5-year “disagreed” with the 10-year was during the last go-around with the euro and just before the FOMC unleashed QE3. And while the 10-year UST may seem like a longer-term instrument relative to where expectations are anchored, as my colleague Doug Terry has noted on many occasions the 10-year bears very strong resemblance to nominal GDP.

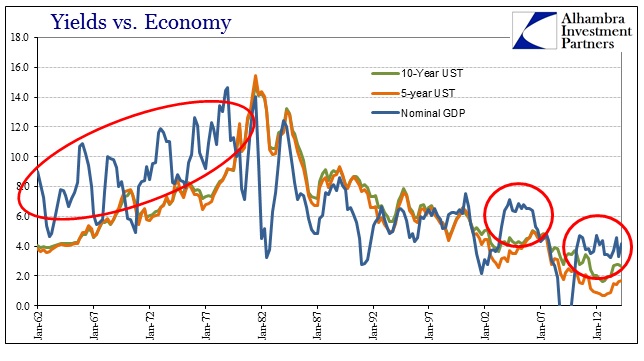

However, if you go back and add the 5-year to that same relationship, some noteworthy changes have occurred since the early 1990’s.

During the Great Inflation, nominal GDP remained steadily above nominal yields (both 5- and 10-years) which makes sense given some persistent manner of inflation discount or concern. Seemingly that gave way to a much closer track between credit and GDP at least until the “recovery” after the dot-com recession, as well as one more time in the current circumstance. That would suggest credit markets grew under some kind of arrangement where nominal GDP is no longer as “convincing” as it once was during the 1980’s and 1990’s, while also resurrecting something very much like the procedure during the Great Inflation.

Some of the current orthodox convolutions about this matter tend to involve the “demand” for UST due to the record track of the trade and current account deficits, but those explanations take no account of how actual “dollar” flows work in the eurodollar standard (and thus don’t really apply here). Rather, there is more than a hint of a suggestion that credit markets either saw inflation that wasn’t fully counted by official measures (meaning real growth was less than presented) or that the “bubble” nature of that growth was not very compelling in coming around to Bernanke’s assessment about where higher rates come from.

I think it is/was probably a little of both, as commodity prices are “balanced” in the CPI via processes that should never be paired together – you don’t offset rising cost of living with hedonics. Sure you get more for your money but in economic terms it still costs more to purchase an item (the base prices of automobiles have risen precipitously this century; where you get more features in that base automobile it still costs a lot more just to obtain “a car”). In that important sense it is disruptive, in economic accounting, to try to combine all price changes regardless of sourcing.

As to the latter possibility, that credit markets saw less growth than presented by GDP, that is bolstered by the obvious divergence in more broad accounts. GDP no longer correlates as well with earned income or even the generic payroll count, starting right around the same timeframe as discussed above.

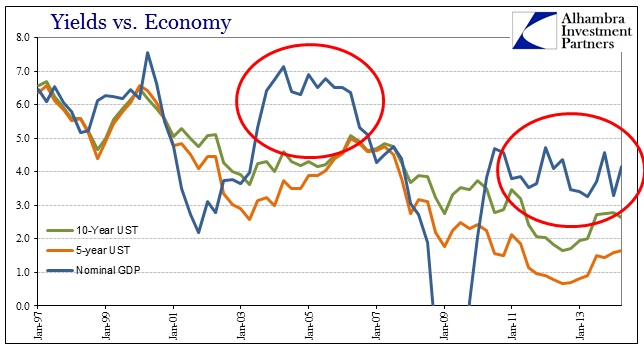

It is here that the 5-year in context is quite revealing. During these same periods where credit yields underappreciate GDP’s picture of the economy, the 5-year opens a noticeable spread with the 10-year, or a steeper yield curve in that section. In the orthodox construction that suggests credit markets are far more optimistic about future prospects, but the simple lay of nominal yields completely nullifies that interpretation.

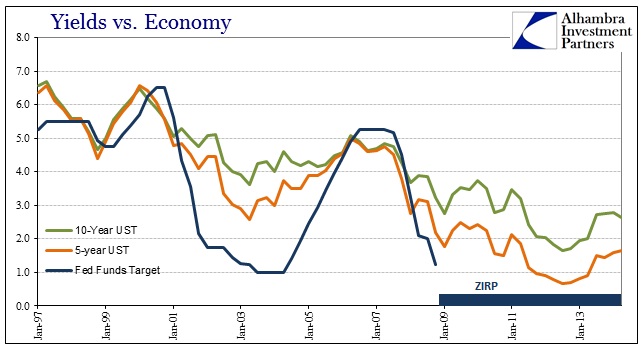

Where the yield curve has drawn steeper, the outer years barely budge – it is the inner maturities that “make” the curve seem to be creating the optimistic position. There is little mystery as to why that might be the case given the pattern of discrete monetary intrusions.

In other words, in what amounts to historical anomalies, the treasury curve only steepened because the Fed pulled the bottom out from under it with its artificial targets. It wasn’t the “market” turning optimistic about each recovery episode, but rather the Fed trying to “fool” agents into thinking that was the case (the economy really is just a bunch of meaningless numbers to these statisticians). However, that doesn’t mean such manipulation was purely illusion, as there was clearly strong interference and corruption in economic flow. Unfortunately, such bubble “appeal” is not the same thing as real economic health, which I contend credit markets were more than signifying in the behavior of nominal yields.

In fact, you can actually see this take place at one additional point, as the recovery after the 1990-91 recession marked the first such monetary activism as Alan Greenspan took to “filling in the troughs without shaving off the peaks.”

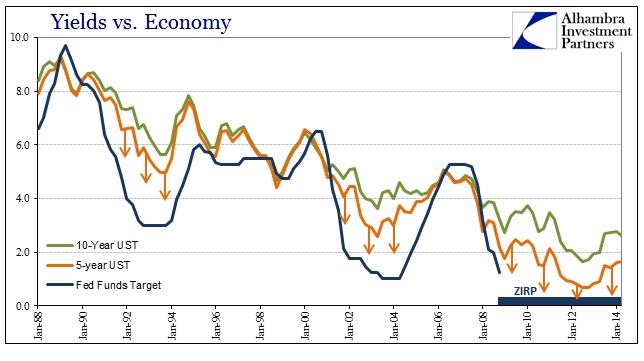

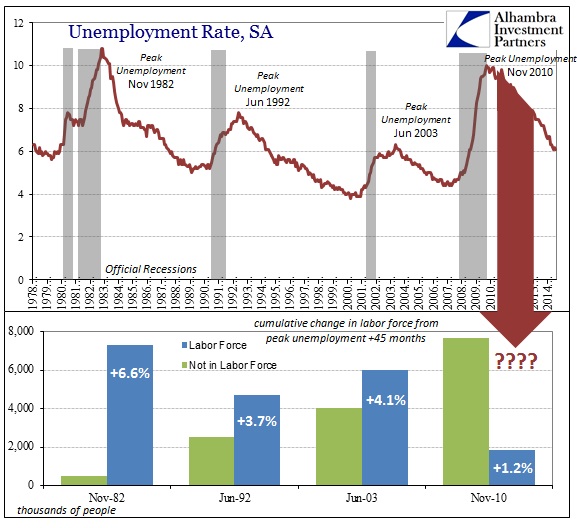

So what we have are three isolated episodes where the yield curve is “pulled” steeper from the short end rather than “money” gaining a time premium consistent with economic health. Alongside that rather “fake” yield steepness, is it mere coincidence that the labor market suddenly gained the notion of “jobless recovery”, now practiced in each of the last three “cycles”?

That extends Bernanke’s “high returns” observations all the way back to sometime long before the turn of the millennium, as low rates persist in exactly the way he related (though for not the reasons he would ever admit). There is another way of looking at economic correlations with nominal yields, which then adds the very real possibility that credit markets (outside of shorter maturities that are far more susceptible to such monetary “gravity”) have been increasingly convinced of “shaving off the peaks” going back far more than a decade.

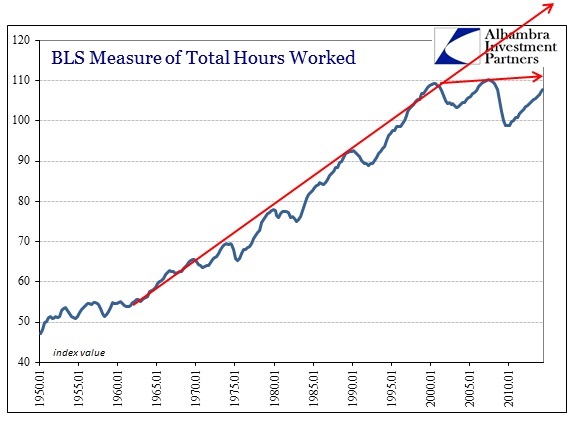

The long-term track of total hours confirms, I believe, the view of credit markets in both the current “recovery” and that which occurred during the housing bubble. In other words, credit markets are more likely to dismiss bubble growth as exactly that which perplexed Bernanke, “Such outcomes tend to be associated with extended periods of lower, not higher, interest rates…” That also inverts his notions of monetary neutrality, as the economy is not to blame for low yields given that the natural track of nominal rates have never actually run back to “better returns.”

The shorter term run of nominal yields in the outer part of the curve right now suggests the confluence of both structural and cyclical views in this direction as quiet a warning; that growth due to bubbles is over-estimated by badly calibrated inflation metrics and that positive economic numbers are not really substantial and convincing. Forcing the yield curve to steepen is not at all the same thing as the yield curve steepening on its own for the “right” reasons, again amounting to greater time premium for “money” which aligns more closely with true wealth creation and actual economic advance. This artificial steepening drawn upon by repression in the shorter years is very good for carry trade and thus asset price inflation, but not so much for wealth and actual economic potential as price discovery (especially for risk) is more than a little impaired. Even Bernanke admitted as much, though his active participation in the foolish attempt at misleading credit proves that his insights were as thin as the foundation he laid (like Greenspan before him, and Yellen thereafter).

Economists want to see secular stagnation as some “unexpected” phenomenon to worry about over the long-run, with the here and now immune to such apprehension, but the historical relationships in the nominal realm recommend very much otherwise. Bernanke and his kind may see interest rates as nothing but pure numbers, and thus ripe for such manipulation, but they carry very deep meaning that can’t be disrupted without profound and ultimately troubling consequences.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch