Maybe using the word “troll” in this sense is overdoing it, but in more than one way it seems deserved given what has been presented. The retail picture so far at the beginning of the back-to-school season has been, at best, mixed. But you don’t get that idea from most of what is presented. As Thomson Reuters starts its latest analysis:

Did the American shopper spend his/her August vacation time at the mall? It sure looked that way as the Thomson Reuters Same Store Sales Index actual result for August 2014 jumped 4.5%, beating its final estimate of 4.0%.

Those figures sound tantalizingly good for anyone with an optimistic outlook looking for confirmation that such anticipation is anything more than disappointed hope as it has been so reliably for far longer than can be counted. However, the deeper details in the very same “report” contradict what was said at the outset, quoted above. In fact, one need not read very far into the presentation to find that all is not so well. With only one paragraph in separation, that sunshine is followed by actual “realism”:

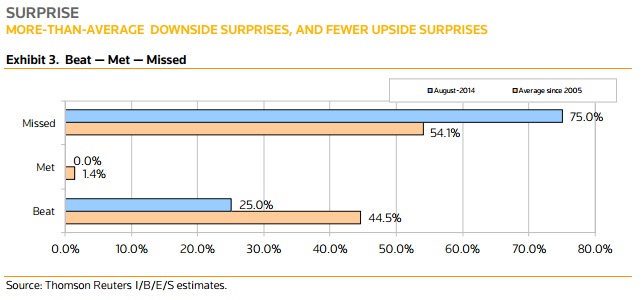

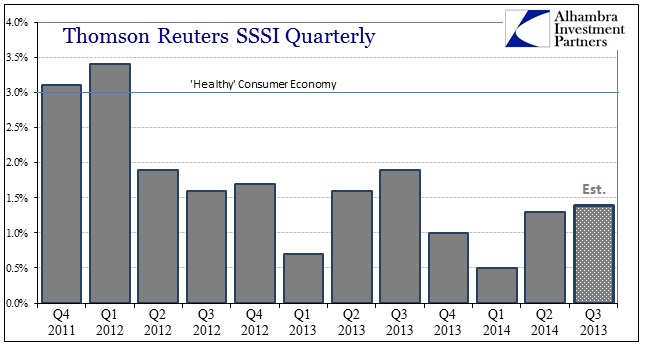

Now for a little sobering reality. Although the overall numbers were good, the bulk of retailers (75%) missed their SSS estimates. Looking ahead at the third quarter ending Oct. 31, the Thomson Reuters Quarterly Same Store Sales Index, which consists of 76 retailers, is expected to post growth of just 1.4% (vs. 1.9% in Q3 2013).

Not only is the SSSI looking squarely at another horrid back-to-school season overall, that expectation for a paltry 1.4% is actually down from only one month ago when it was expected Q3 would show 1.6%. So the net effect of the “American shopper spend[ing] his/her vacation time at the mall” was to deliver weaker-than-anticipated hard dollars. These are not sentiment surveys about how shoppers feel, or how businesses feel about shoppers, or even how shoppers might look to businesses to buy feelings. These are same store sales; as in hard dollar figures delivered by each existing establishment.

Thomson Reuters itself notes just how badly this “rebound” has been versus expectations. Clearly analysts have bought (pardon the pun) the idea that Q1 was only weather, and were expecting far better of Q2 for it (that never came, see below) figuring just such warmth would deliver momentum that would propel the economy further onward and finally upward. When those retailers that “miss” on revenues are about 50% higher than historical averages, the degree of over-optimism is indeed indicative of the blemishes in the entire process of forecasting, tracing back to centralized modeling.

Even with all this narrow framing intended on either trolling, at worst, or cheerleading, at best, the wider context tells the real story. As Thomson Reuters itself makes plain, the threshold for what can fairly be called economic “health” is about 3% on its SSSI. The index hasn’t even been close to 3% since Q1 2012 – meaning after this current quarter concludes with enough optimism-dashing reality, it will have been two and a half years since economic health has been shown via retail channels. And still no bright shining path to actual recovery from the “recovery.”

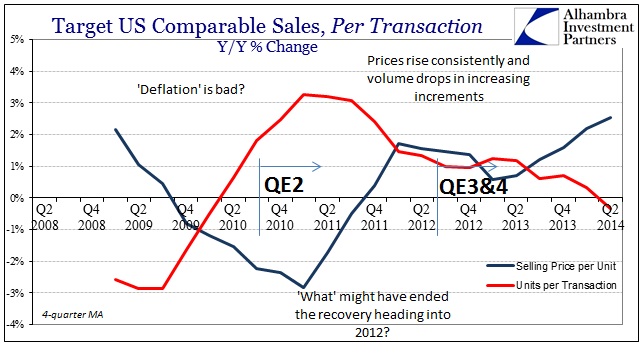

Rather than indicate hopeful optimism, this instead elicits the same kind of interpretations presented by the big box retailers I presented yesterday. The SSSI currently consists of 76 retailers, yet this wider measure of hard dollar results features almost exactly the same pattern that showed up “unexpectedly” in Target’s revenue. That would seem to suggest a confirmation toward my analysis that the price behavior shown by Target is, in fact, representative of the wider economic problem of incoherent (made so by monetary intrusion) prices with incomes as they are.

The reason shoppers are not spending and consumerism, despite all the persistent and declarative proclamations, remains dormant is that whenever people look to engage in trade they end up obtaining less stuff for more currency. Notwithstanding what some claim as the best jobs market in decades, there is no income for such an “inflationary” appeal to do what was/is intended – foster economic progress as suggested by all these misleading statements.

At least Thomson Reuters is consistent in their lack of awareness of wider context. They wrote nearly the same sunshine analysis in February 2013 of, oddly enough, cold weather helping the retail industry to what they expected were nothing but better fortunes.

Across the board, retailers posted significantly better-than-expected advances in same-store sales in January, with the cold weather helping the index record its biggest advance since September 2011.

Retail sales posted a better-than-expected gain during January, as the Thomson Reuters Same Store Sales Index registered a 5.8% jump over year-earlier levels. Although including the results from the drug store sector pushes that same-store sales growth rate down to 5%, that is well above the final estimates of 3.5% and 3.1% ex-drug stores, and marks the best performance for same-store sales since September 2011 when SSS jumped 5.6%.

As with their current descriptions, such blatant framing curiously ignored that the wider retail industry had already witnessed a broad downturn. The five quarters prior to the above positive description for January 2013 had only seen a deficient 2.3% quarterly average on the SSSI. Worse, however, the average of the five quarters thereafter (including that January 2013 “better-than-expected”) was less than half of deficient, which we are left to describe as nothing other than a recessionary 1.1%. So we have largely the same descriptions being applied consistently during what has amounted to a tremendous decline in retail activity.

On second thought, this all has to be trolling. Maybe that is the right word to more accurately describe the operational ends of rational expectations theory.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch