I want to believe markets are efficient and incorporate “all” the possible permutations as best as possible, but I don’t think that is the case under current conditions. Whatever efficiency there has been, or whatever may have been exhibited in the past, was degraded by financial engineering, and not just interest rate targeting by the Fed and other central bank deformations. That is the how and why the economy and asset prices can diverge so significantly, artificially divorced from the activities of actual and true “markets.”

As Joe Calhoun noted this weekend, we saw (see) the parallel to the “shoe shine” theory in the last decade (currently?), except it was those “far smarter” investors that were captured by flawed assumptions. These Ivy League mathematicians that created an entire “marketplace” out of the Gaussian copula were the height of sophistication, but there was no mechanism by which the actual “market” forces could have or were able to check those assumptions. The weight of actual trading, supply and demand, was distorted by the illogical and ultimately emotional attachment to statistics as something like objective “science.” Instead of seeing an asset bubble and allowing for correction toward less imbalance, and much less artificial gain, “markets” were unable to penetrate such math and were given an “unlimited” supply of “dollars” to simply jump on board the witless conventional “wisdom.” That is a dangerous combination as true markets should always feature more than a little self-doubt and incredulity about everything (the infamous “wall of worry”).

It was “allowed” to continue to enormous effect because of the interruption in actual market setting of risk. There was no way of penetrating the “logic” of the securitization bubble as it wound its way into actual housing; distorting not just finance but the real economy.

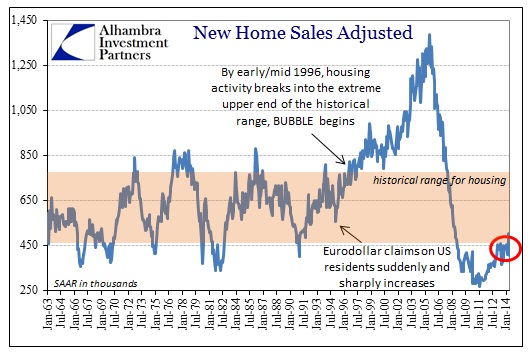

The results were very real and tangible, and they speak directly against market efficiency and very much in favor of huge artificial imbalances:

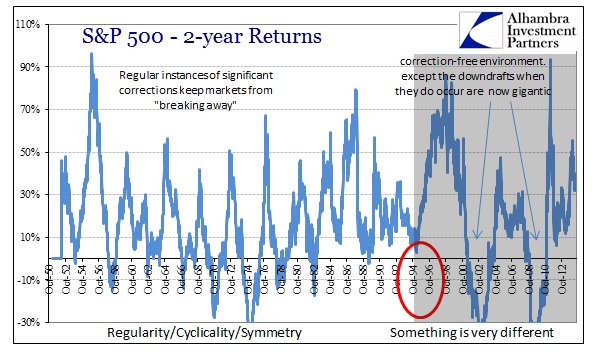

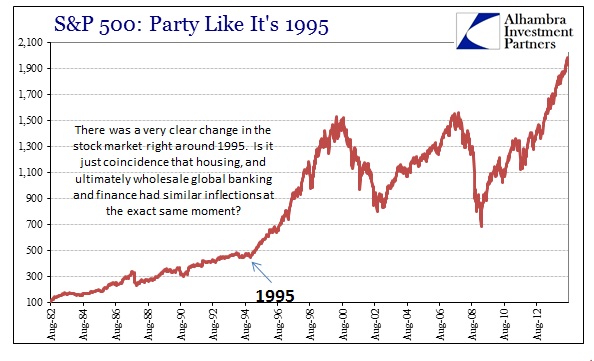

That doesn’t look very efficient to me. Notice the timing and how it correlates well with stocks:

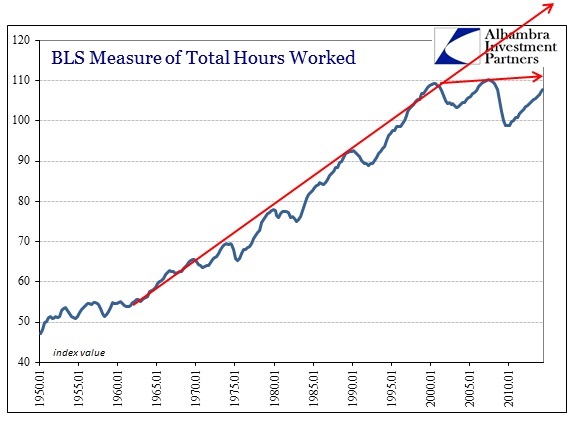

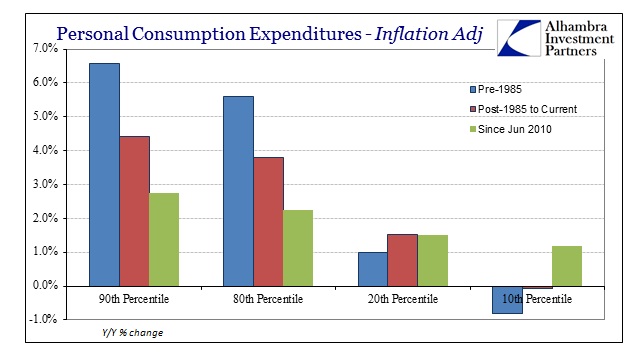

The “smartest” guys on the street ended up exactly as the “shoe shiners” because of the very same flaw – thrice (and likely with a fourth already in motion). Also notice how this degradation of efficiency correlates with slowing growth:

There are more than a few examples of economic factors changing trajectory in the late 1990’s, but especially labor factors like work and wages (and spending). Maybe it is all coincidence and there are unrelated variables, but I think it most likely that there is a very big connection here that runs through market efficiency and pricing (lack of real price discovery in finance is not some trivial means in a fiat regime). Markets would be efficient if allowed to be (at least to a much greater degree), but I don’t see how anyone can say they remain so with at least the housing chart above. There is no way to reconcile that view with what has already transpired.

In fact, the reality of housing construction proves the larger point (OK, adds evidence). Home construction is “trying” to gain back some measure of efficiency, thus the stubborness of it to re-attain even the lower realm of the prior historical range, staying below the bottom for quite an extended period now. That is defying at the very same time the Fed trying to get it back up to where it was through very heavy-handed intrusions in TBA and MBS financing. In other words, the “market” is trying to emerge and the Fed does not want it to because that “reversion to the mean” doesn’t “fit” the wider monetary theory about the economy. Might the same not be true in other cases where distortions appear, including stocks?

Financial resource allocation and market efficiency should be tied together via profits, but central banks offer artificial profit subsidy. That is wholly corruptive, so why should we not see the results of that in greater inefficiency?

The semantics of the words “bubble” or “asset inflation” may be troubling, and probably for good reason, but whatever it may be called or designated there are three huge holes in the theory of market efficiency just in the last twenty years. Perhaps that started all the way back when orthodox economics decided that the cause of the last huge bubble in 1929 was the downslope of too little “money” rather than how the imbalance gained so great an existential danger on the way up.

Again, what were prices saying in October 2007, as housing prices were in June 2006? What about stocks in March 2000? October 1929? I think it plain and clear that there is a direct correlation with the tendency of finance to move far beyond sound money (eurodollars in 1995, prime example) and great and huge financial imbalances. There have been three massive and great market crashes just this century, the years of which coincide next to the longest and most deficient debasement period in monetary history. The tendency of asset prices to be at their lowest efficiency concurs with the heaviest hand of central planning; a statement that amounts almost to a tautology.

Click here to sign up for our free weekly e-newsletter.

“WEALTH PRESERVATION AND ACCUMULATION THROUGH THOUGHTFUL INVESTING.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch