The pestilence of the wholesale “money” system, the eurodollar standard if you will, is that the “dollar” is no longer anything like one and that these “markets” for it are not directly observable. That leaves observers and interested parties to gloss and gleam related second or third hand accounts, hopefully piecing together the right parts at the right time enough to elicit the right theory.

So it is an accumulation of “evidence” that starts to move opinions and analysis in one direction or another. That was certainly the case last year, as global dollar tightening was shrugged off in both stocks and any economic context – but not so in those places with more direct experience.

With the dollar moving upward again at more of an accelerated pace, the idea of liquidity is starting to attract attention – with very good reason. We are certainly nowhere near the violence of 2013, but it may not take as much this time as I think that liquidity itself has been degraded and eroded under constant pressure from all sides (including regulatory and profit pressure of credit without a persistent QE “crutch”). As the quarter ends and liquidity recedes in window dressing, shaking the foundation of the reverse repo program (more on that later), there are a few more indications to add to the worldwide bearishness in bond curves that suggest far less sanguinity and placidity than apparent to the mainstream and convention.

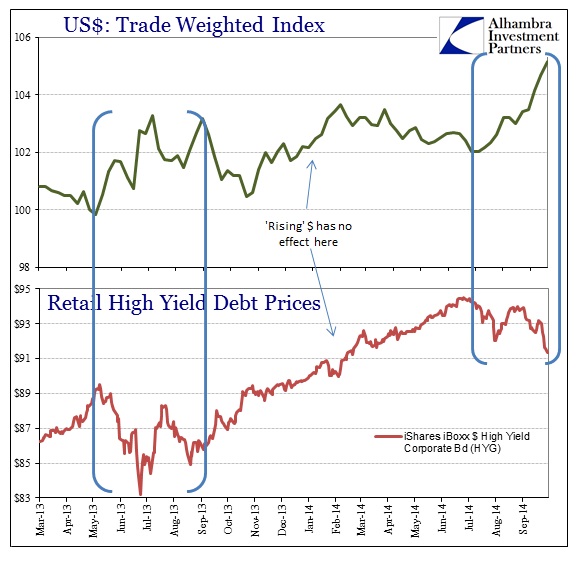

High yield credit has taken to stumble, timing that move to about where the dollar began its latest, precipitous rise. The timing very much echoes the pattern, if not the degree, to which this correlation of liquidity held in 2013. Obviously, though, given the interim between these two periods, the rising dollar had no imprint on high yield prices and complacency at the end of last year. That would suggest the possibility that liquidity may not have been the primary variable during that time, though other indications (see below) suggest that liquidity may have simply drawn focus elsewhere in the world.

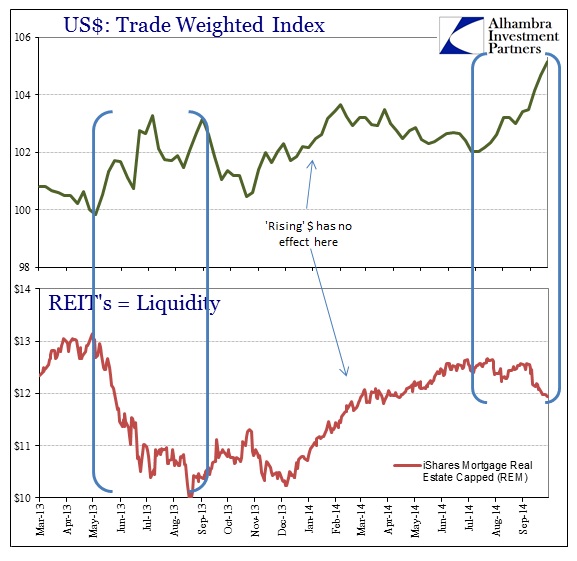

That theory is reinforced by the trajectory of mortgage REIT’s, themselves a rather decent barometer of liquidity function. Again, the two primary periods of the rising dollar offer a compelling bookend to the middle period where the rising dollar may have had more of a destabilizing impact outside simply US credit.

The Brazilian real, for example, seems to have taken the brunt of all three dollar periods. That may seem like a redundancy, but the dollar as it is in the trade-weighted index does not necessarily convey its effects on individual currencies. In other words, if the dollar index is being pushed around by only the euro or yen (the two, by far, biggest components) it may not necessarily lend itself to broader liquidity interpretations. That we see here the dollar and real in pretty close correlation with the time periods in question seems to have brought out the global liquidity idea once more.

The concern should be not just that the dollar is rising, or the real is devaluing again, but the pace at which it has gathered and the level from which it begins. Brazil can ill-afford another burst of devaluation pressures on internal prices while already on such an unsound footing in its domestic economy (regardless of how economists see “global growth”).

Tightening dollar conditions, if that is indeed what we are looking at here, would begin in the farthest reaches first before working inward. That they may have already started to pace US domestic high yield and even mortgage REIT’s even to relatively small degrees suggests that illiquidity may have spread farther than first thought. In terms of the repo context, I believed that more of a systemic issue than actual participation in an individual circumstance of wider dollar disruption. The spread, even minor as it has been, to all these other markets and locales, in addition to flattening curves everywhere including eurodollars themselves, may force me to rethink that repo position.

Instead of repo indicating a systemic weakness of its own accord, it may turn out related to whatever we see here in terms of broad dollar function. As always, this has to relate to the global dollar short, which is what the eurodollar standard and the current “reserve” currency is really all about. The renewed squeeze may be on, if ever so slight at the moment in its downstream impacts.

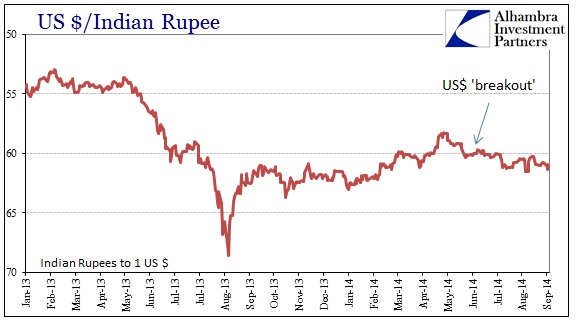

Even our old friend the Indian rupee has gained a slightly downward trend. That has to be an unwelcome event for the Reserve Bank of India given the rather drastic measures it took last year and earlier this year to try to get the rupee back up toward pre-tightening levels. Again, slight in its appearance but in tandem with all the others.

The accumulation of “evidence” in the various places is only suggestive at this point of liquidity under some possible duress. Some of that is likely uncertainty about the Fed’s position in short-term “markets” and some of it is certainly related to more than a little disappointment in the efficacy of these central banks to provide what they promised. Uncertainty of any changing degree is bound to be disruptive, so we will have to see how far this goes in the weeks and months ahead.

Click here to sign up for our free weekly e-newsletter.

“WEALTH PRESERVATION AND ACCUMULATION THROUGH THOUGHTFUL INVESTING.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch