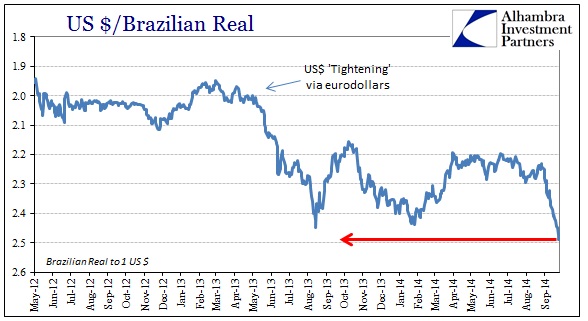

After enduring quite a bit of restlessness even into the early part of 2014, the Banco do Brasil (Brazil’s central bank) believed it had regained order in its currency “market.” Going back to the dramatic and global tightening episode around Chairman Bernanke’s taper threats in the middle of 2013, the real was caught in a very dramatic downdraft that has put the country into quite a bind. The resource/export economy is already suffering the effects of a decided lack of “global growth”, so the hit to prices coming from currency devaluation was more than unwelcome to the point of being dangerous.

As is usual from the orthodox handbook, central banks act under those conditions with very predictable measures. Though Brazil’s monetary framework as it relates to dollar procurement is highly idiosyncratic, Banco did what it was “supposed” to do according to the manual, undertaking a regular dollar swap auction while consciously refraining from mobilizing actual dollar “reserves.”

While the orthodox opinion continues to believe that the build and maintenance of global “reserves” was a highly beneficial arrangement, supposedly fortifying against just this kind of currency “run”, we have seen these “reserves” become nearly useless and thus meaningless. The moment Banco mobilizes those “dollars” to meet “market” demand is the moment the currency crisis becomes far more dangerous – not less so. What’s more, they know it which is why they appealed to the swap framework.

The downside of the swap program is that it is highly inefficient. Central banks don’t care as much about such considerations in the short run as their entire intent is to “buy time” for conditions to normalize on their own. For the real, it was not until February that it began to move back away from the lows reached during the worst parts of the dollar tightening. That began a period of seeming stability, though Banco renewed the dollar swaps past the “soft” expiration at the end of June; again conforming to the orthodox playbook of gradualism.

The lack of real volatility against the dollar seems to have fortified Banco’s resolve to belatedly recognize its own inefficiency, and thus start to wind down its swaps intervention. In early September, the central bank announced its intent to further draw down its swaps intervention. There had been little evident disruption or disorder in August as it began this track, so they seemed relatively confident in their position (as all central banks are under these circumstances).

The bank said it will auction as many as 6,000 currency swaps – derivatives that provide protection against losses in the real – as part of its strategy to renew $6.677 billion (4.09 billion pound) worth of swaps that expire on Oct. 1.

Last month it offered as many as 10,000 contracts per day to roll over some $9 billion worth of swaps that expired on Sept. 1, renewing about 88 percent of those contracts.

If the central bank keeps the new rollover pace intact until the end of the month, it will be able to renew about 76 percent of the Oct. 1 maturities.

At that point in early September, you can understand, at least outwardly, why Banco was so confident in its own version of dollar “taper.” Again, there had been about six months of pretty stable currency conditions and that seemingly confirmed the efficacy of the affair.

The regular sale of swaps has been part of a successful central bank program of intervention in the foreign exchange market, which has helped the real BRL=BRBY gain more than 5 percent so far this year.

Almost as soon as those crowing words were written, the real crashed once more. It seems that the “market” was not ready for such “tapering” of dollar aid.

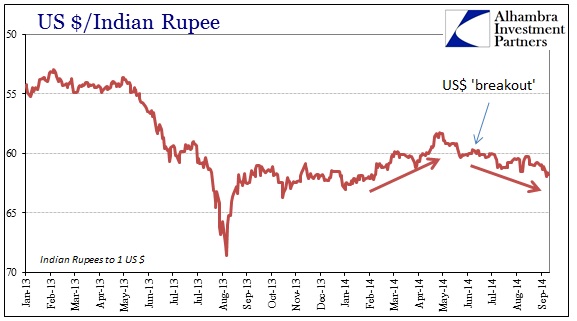

Of course, this is not all happening in a vacuum, the real world complexity beyond ceteris paribus, since the dollar is again “rising.” That means, in context, that there is again an apparent tightening of availability and the cost at which those “dollars” (mostly eurodollars) are on offer. For the real, that means a condition where the “dollar market” is once more under direct pressure at the same time the central bank is unwinding. The net result is devaluation worse than the worst part of 2013.

The further implications of that are as all central bank interventions ultimately find themselves. Nothing about the real/dollar mechanism had been “fixed” by the swaps intervention, as again Banco only covered up dysfunction and only partially and temporarily. Given that the real has sunk so far so fast while Banco is still engaging in about 76% of the swaps it did in June certainly suggests how little effect the central bank can have in terms of actual “dollar” function.

So Banco do Brasil read the seeming stability in its currency during most of the middle of 2014 to be of its accord when, in fact, it was simply the absence of dollar tightening at that moment. That is not to say that there was no effect at all, as it was likely the swaps contributed to that stability, but that is not anywhere like the same thing as offering an actual solution.

It also highlights the severe limitations in how central banks operate against acute crisis. Just like the Fed’s reverse repo program, Banco is very much behind the curve in calibrating its activities. If the goal of such a “successful” program was to “help” the real gain against the dollar to at least partially reverse last year’s devastating devaluation, then how does one judge the same program now that the real has devalued more than 10% in just a few weeks to a level worse than what the central bank was trying to counteract in the first place? Central bank programs are bureaucratic by their very nature, and thus are not suited for real time conditions – an axiom that fits not just Banco and its “dollar” swaps but applies universally to all “emergency” measures that sound so good to those that design them with ceteris paribus conditions.

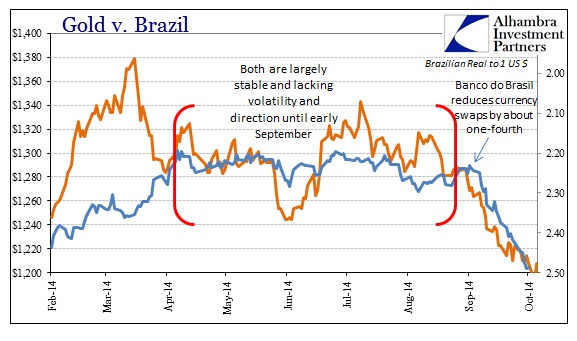

More broadly, the dollar disruption with Brazil I think highlights a lot about what we have seen in recent weeks with other “dollar” indications like gold. The conventional interpretation is that the dollar is “rising” in value, but that is clearly a surface examination as it is doing so only in the context of the global dollar short and thus availability.

The behavior of the real alongside gold is very revealing of that. Given that gold largely showed no imprint from collateral issues in US$ repo but is highly correlated with the Brazilian real more than suggests the foreign “dollar” market as the marginal price setter. And since central banks all counted their dollar chickens long before they hatched, the dollar shortage again takes center stage while Janet Yellen proclaims “resilience” and a desire for private markets to just ignore all of this under a rigid paradigm of total faith in her and her global counterparts.

Stay In Touch