In July 2014, just as the dollar was beginning to tighten with what seems like an overly sensitive trigger, the US Treasury Dept’s Office of Financial Research published a paper by Zoltan Pozsar that attempted to map out the financial system as it actually exists (hat tip to W Kraus for sending it to me). The 67 pages of commentary and notes were accompanied by a 160 page attachment that shows the author’s version of the complicated inner workings of financial plumbing, indelibly putting to rest any notion orthodox economists have over generic “money supply” policies and programs.

In one sense, this is hopeful in that at least parts of the officialdom as it relates to finance is getting the sense that finance has moved so far beyond the M’s. I often relate that “evolution” as difficulty in explaining exactly what a “dollar” actually is in this modern sense, and Mr. Pozsar has made something of a leap in tangibly painting just such an impressionist picture.

There are far too many pieces worthy of additional comment and argument, but there are several that I think highlights the ongoing nature of the global dollar short. Mr. Pozsar’s contributions here parallel a theme I addressed yesterday, namely how QE and central bank measures are “crowding out” liquidity across the “dollar” system.

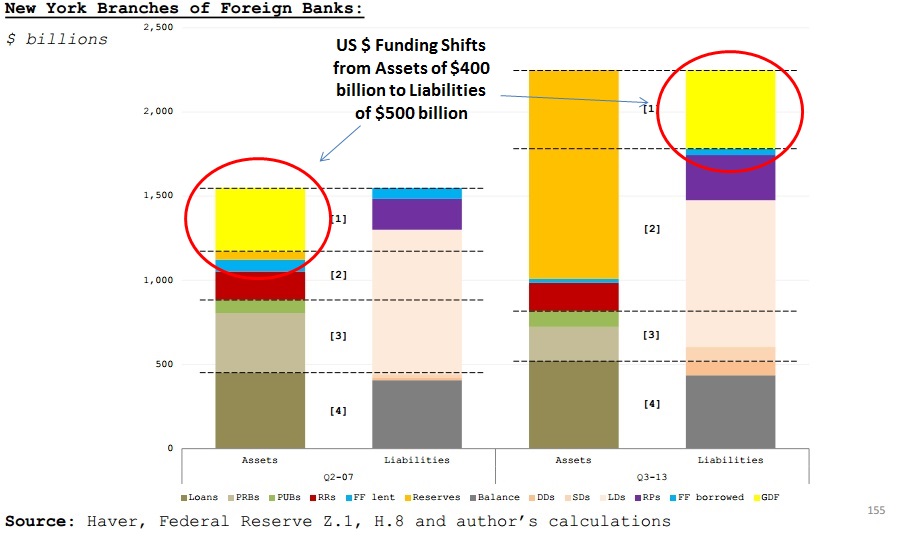

On page 155 of the appendix, we see the presentation of foreign banks operating branches in NYC and the changes in their accumulated balance sheet just prior to what I maintain is a permanent change in the eurodollar standard (Q2 2007) to almost current (Q3 2013). The notes on the chart above (and arrows and circles) are my own and not from the original source material.

There are a couple of points to be made from the shifting content of foreign banks in “dollars”, including that loan-based lending rose only slightly from $450 billion to $500 billion while capital-based lending declined from $400 billion to $300 billion. On net, foreign banks have reduced their dollar footprint, at least in this part of what we can actually see (through their NYC branch holdings).

It is the parts that we cannot see here, as this paper is focused solely on the domestic side, that is perhaps far more important; but that is glimpsed in the changing content of what Mr. Pozsar calls the “global dollar funding” (GDF – yellow rectangle above). There has been, on balance sheet, nearly a $1 trillion shift in this position. Pre-crisis, foreign banks were sourcing and funding about $400 billion domestically, transferring those “dollars” to London (or elsewhere) to be used in eurodollar markets. In the years since, that has reversed as foreign banks seem to now be moving in the opposite direction, “raising” $500 billion in eurodollars and transferring those “dollars” back domestically.

Mr. Pozsar describes it thus,

Segment [1] shows that between the second quarter of 2007 and the third quarter of 2013 the volume of global (or interoffice) money dealing by these branches went from raising $400 billion in the U.S. money market and lending it to headquarters globally in order to fund Eurodollar lending, to raising over $500 billion in Eurodollar markets and funneling these back to the United States to fund reserves at the Federal Reserve.

I don’t think that is quite right, given the clue as to “why” this has shifted from an asset pre-crisis to a liability now – to “fund reserves at the Federal Reserve.” As is plain in the huge increase in the orange rectangle in the chart, that would be the cumulative impact of QE’s, and to say that the reverse eurodollar “flow” is “funding” this is technically correct but meaningless (with all due respect to Mr. Pozsar).

This gets back to the very idea of what a eurodollar actually is and is not. European banks during the housing bubble were dominant participants in accumulating dollar-denominated assets. We do not see that here because those assets were included in their domestic balance sheets, not in their NYC branches (for the most part). All we can tell of that process is the yellow rectangle as an asset – in other words foreign bank branches in NYC were borrowing in domestic money markets and transferring those ledger balances to their home offices (thus, the home office was borrowing “dollars” from their subs in NYC, which is why it shows up as an asset).

That was not the only conduit by which those foreign banks were funding their “dollar” loans and securities, as they were also borrowing in eurodollars (which also does not show up here because eurodollars that fund offshore bank holdings are never apart of the US statistics, which is one reason, among many, M3 was discontinued). Since the great panic in 2008 was centered in eurodollars, those foreign banks had a major problem sourcing alternate forms of “dollar” funding that had little to do with their NYC subs – enter the Fed.

The Fed engaged in dollar swaps with other central banks, meaning that foreign banks with that “dollar” imbalance, the global dollar short, could at least “borrow” “dollars” from their local central bank, who, through the Fed swap, were essentially “borrowing” dollars from the Federal Reserve System.

But that wasn’t enough, either, as it may have alleviated some liquidity strain but did not create the price reversal that orthodox policy demands from its new framework (I’ll have a lot more to say about this in my RCM column next Friday). So in addition to dollar swaps, the Fed engaged in QE which was dominated by foreign participants. But QE from a foreign bank is not really possible since the Fed only deals with NYC banks – which include at least their NYC subs (of the largest banks, anyway).

So to get these now-illiquid dollar-denominated assets off their books (mostly MBS), foreign banks had to transfer them to NYC, thus “paying back” “dollar” loans originated from their funding in domestic markets. Instead of a dollar loan to their home office, the foreign sub now engaged in QE purchases is instead credited in their “reserve” account with the Fed – the asset side changes from a loan to the home office to a cash reserve balance.

That technical explanation out of the way (and I have oversimplified a little here), the primary interpretation as it relates, importantly, to the global dollar short is that European banks have retreated from the “dollar” market by about $900 billion across the last seven years or so. But that is, again, only the portion of their retreat that we can see; I have little doubt there is more, at least from the European side (as noted previously, there are actual indications the global dollar short has been picked up in that stead via Asia) as we can see from TIC flows and general, though indirect, indications that eurodollar markets themselves are far less robust.

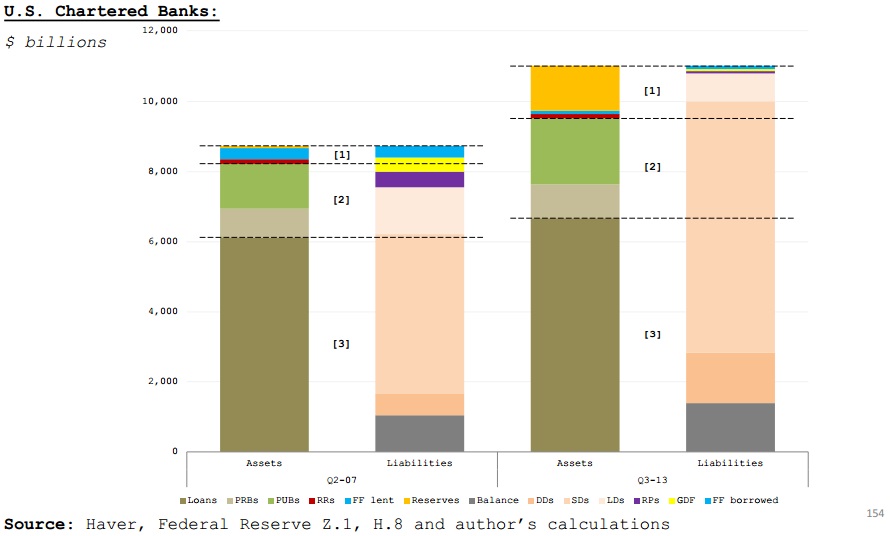

If that weren’t enough of a shift, we can also observe here that foreign banks are now the dominant participants in at least the US money markets. In contrast, US banks have largely retreated from what Pozsar calls “money lending”, again the relation to QE being quite direct (the orange rectangle below).

The blue rectangles show that interbank money dealing accounted for half of U.S. banks’ money dealing activity precrisis and shrank significantly since then…

The balance sheet composition by activity of the New York branches of foreign banks is in marked contrast to the balance sheet composition by activity of U.S. banks, which (as shown in Chart 8) are first and foremost lenders via loans and second, lenders via portfolios of capital market instruments, activities funded primarily with deposits. At 15 percent of total assets as of the third quarter of 2013, money dealing by U.S. chartered commercial banks was also much lower relative to that of foreign banks’ New York branches.

Once more the idea of a closed system is obliterated by actual conditions outside of academic theory, meaning that there are very close “dollar” ties between the US and Europe (and now Asia), both on the way up and now potentially on the way down. The chief marginal conduits of “dollar” liquidity in even domestic markets are now foreign banks, and even their systemic capacity is seemingly “crowded out” by persistent central bank influence.

That would suggest whatever is left outside of this domestic focus is quite susceptible to essentially eurodollar financial considerations – perhaps offering another compelling explanation as to why the global dollar short is so asymmetric in 2014 compared with even 2013 and prior. And while that may seem to be a better place domestically, I think the opposite interpretation is more appropriate given that the domestic system has been seriously eroded and that the foreign system now having moved away from “eurodollar Europe” to who knows what in its place.

Again, I think there is a great deal of merit in how Mr. Pozsar presents his view, but that it is still dangerously incomplete (again, with much respect for the tremendous effort and what was accomplished). I would include in that criticism the continued tendency to stylize and compartmentalize (which may just be unavoidable), not just in the global dollar system as presented here but also the dealer system which for some reason always seems to split securities “flow” from derivatives (they are all one) and to assume dealers are neutral (always a matched book).

Apart from those, however, there is no doubt this should advance (hopefully significantly) the official “knowledge” of financial plumbing. Although this is about a decade too late, given that most orthodox economists including those at the FOMC are not even aware of this stuff, it is far better to catch up as much now as to stay in the dark forever. We can only hope this is the beginning of such a trend and not an ultimately hollow gesture swallowed up and ignored by rigid ideology.

Stay In Touch