I think there remains a lot of misunderstanding about global finance simply because very few people, including every economist I have seen, realize the systematic arrangement has drastically altered way beyond orthodox comprehension. The eurodollar system that replaced the gold standard has even itself morphed broadly in the past few decades (especially around 1995), and then again in the post-crisis period. That includes China which now features a large short dollar position owing as much to trading imbalances as “hot money.”

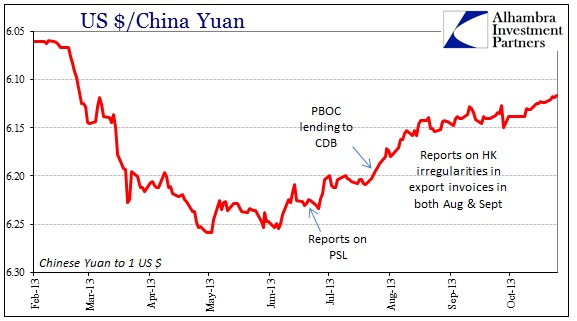

The problem of dollar financing was very apparent earlier this year when the yuan suddenly began to devalue against the dollar. Commentary then, as now, was mostly certain that the PBOC was punishing speculators, but that episode had all the signs of a dollar liquidity problem: rising $ cross, fears of defaults and losses, no Hong Kong bypass.

That last feature seems to have been conceded, at least as far as China staying out of the July-Sept global dollar tightening. There has been very little movement in yuan/dollar cross, and certainly not in the same direction as earlier in the year. Given that the Chinese are short dollars, it seems reasonable to expect off-the-books methodology. And that has largely been confirmed, even by the Chinese government.

China recorded $1.56 of exports to Hong Kong last month for every $1 in imports Hong Kong registered, leading to a $13.5 billion difference, according to government data compiled by Bloomberg. Hong Kong’s imports from China climbed 5.5 percent from a year earlier to $24.1 billion, figures showed yesterday; China’s exports to Hong Kong surged 34 percent to $37.6 billion, according to mainland data on Oct. 13.

The question now is whether this is unofficially sanctioned via implicit “approval” from the PBOC as a means to “control” dollar disruption. If they learned anything about the early part of 2014, it was that the PBOC does not have control over dollar-driven behavior which is a direct rebuke of PBOC’s preferred “omniscience.” Given that they are engaged in monetary “reform” away from “flooding” reserves as “stimulus”, the PBOC does not need a dollar flare at this moment.

So I find it curious that Hong Kong is suddenly a central point for export “cheating” once more. Further, that this comes during a sharp dollar episode certainly offers the possibility of exactly this kind of unofficial monetary policy position.

Even with that established, commentary surrounding the “Asian dollar” remains stuck with anachronistic notions of “capital” flow and dubious “hot money” assertions.

After almost uninterrupted annual gains since 2005 that saw the yuan rise about 33 percent versus the dollar, speculators have come to see China’s currency as a one-way trade. That prompts hot money to seek out China on currency appreciation bets. Worries about distortions had abated this year after a government crack down and as the yuan dropped.

Recognizing the dollar for what it is (which is that it is impossible to even define now) destroys too many comfort zones for central banks – figuratively (omniscience narrative) and literally (Hong Kong flows).

Stay In Touch