With all the election post-mortems flying about, there really only needs to be reference to pre-mortems that predicted such results. Even typically leftist media outlets have seen the “message” for what it was. From The DailyBeast:

Yes, the stock market is booming but overwhelmingly Americans are unhappy with their economic situation—and for good reason. Wages are stagnant and middle-class household incomes continue to decline. President Obama is on track to become the first president in history to leave office after two terms with fewer full time jobs than when he took office.

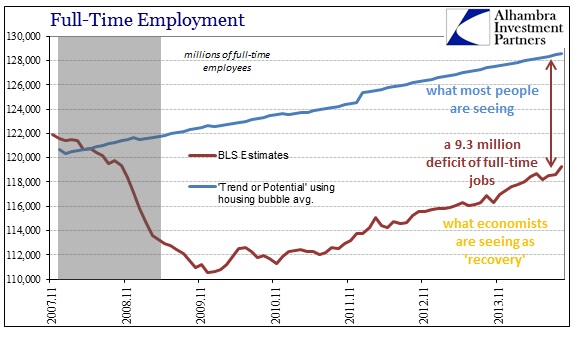

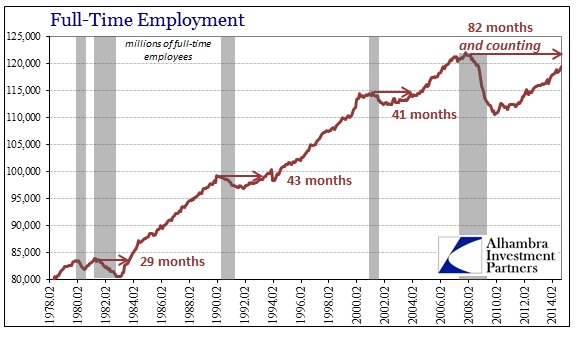

In the weeks leading up to the election, incumbents (mostly D’s) were heard to say that “they” created 10 million jobs over the past 55 months as if to prove the recovery was working (an unfortunate choice of wording that left a gaping hole in credibility). Simple back-of-the-envelope calculations proved that to be already deficient on its face – a monthly gain of 181k is at best lackluster.

That, however, isn’t the actual standard most people are using, especially when they are surveyed to where the economy remains their primary concern seven years into it all; above all others in an age with plentiful problems of significant attention and gravity. Back in August, the New York Times, of all places, was sounding this warning which largely went (and still goes) unheeded by not just politicians (of both parties) but economists and media commentary driven by economists. What the people are experiencing is energetically different than what economists are proclaiming, leading to not just disconnect but growing distrust.

For five years, the United States economy has been expanding at a steady clip, the stock market soaring, the headlines filled with talk of recovery. Yet public opinion polling shows most Americans still think the economy is pretty miserable.

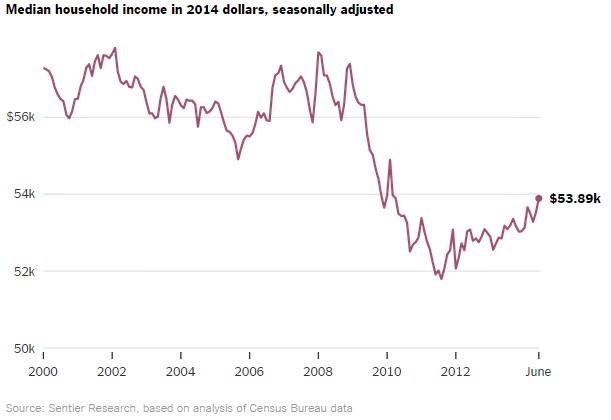

What might account for the paradox? New data from a research firm offers a simple, frustrating answer: Middle-class American families’ income is lower now, when adjusted for inflation, than when the recovery began half a decade ago.

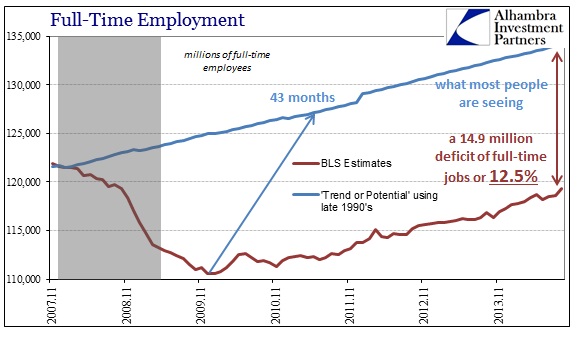

The figure above is due in full part to what has actually happened this century – secular stagnation. What that means is that the economy has most assuredly not “been expanding at a steady clip” but rather it only appears to be. The entire vote in this election, or at least the heavy emphasis of it, was in the direct proportion to the feckless spinning of this economy as in recovery. Even that 10 million “created jobs” number is misleading, as the discrepancy between job growth and income is even greater due to the significant decay in full-time employment.

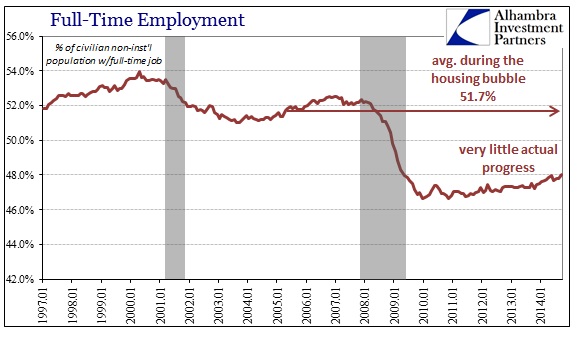

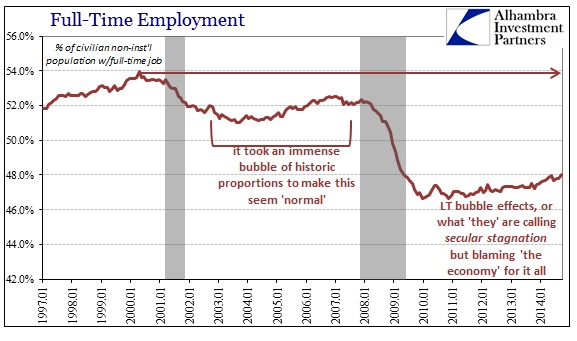

During the late 1990’s, almost 54% of the civilian non-institutional population was employed full-time. As you can see quite clearly, the ratio dropped after the dot-com bust and never regained that prior peak. Beyond the Great Recession, the jobs “market” looks drastically different than what is being used as the primary narrative about “recovery.” Thus the vote.

To an economist, the economy is not shrinking outright (positive numbers all around) so the idea of recovery which is as much ephemeral and theoretical is taken as “real.” This is reinforced in the orthodox treatment of monetary policy as “always” effective. The number of full-time jobs is gaining, which is all that gets displayed and coded in that conventional narrative.

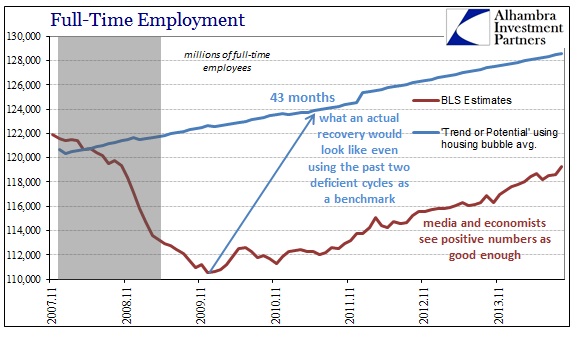

However, personal experience in the real economy longs for those pre-crisis days where full-time jobs were if not plentiful at least evident. So the true gap in employment is not that the number of employees finally surpassed the prior cycle peak, nor is it even that full-time jobs (in September) are still 2.6 million fewer than November 2007, it is that the economy in actual recovery would likely have generated about 9.3 million more full-time positions by now (using the average full-time population ratio from the housing bubble period). No wonder not just discontented emotions as that goes a long way in explaining the deficiency in the very real account of median income (and, of course, per capita income).

And so a true recovery is not just that jobs and even full-time jobs are growing, but that they do so in a manner that is consistent with prior levels of experienced growth. Even if we use the past two cycles as a benchmark for full-time employment re-attainment, the difference between what we have now and those substandard recoveries is stark and alarming. That should, as the election perhaps suggests, signify that large swaths of the electorate have begun searching for answers for the remained state of defunct expectations.

The main incongruence is easy to find once moved beyond uncritical faith in orthodox economics – the massive and historic amounts of monetary intrusion done in the name of “stimulus.” For all that intervention the only accounting has been vague allusions to “it probably would have been worse.” That may have been acceptable in 2011, but in 2014 is stretches credibility by a great amount.

Economists and those in the media that are captured by the narrative keep talking about recovery, but this deficient economic condition, as even the New York Times in August noted, stretches back a lot further than 2007, having been in place for about two decades. It was not as noticeable in the decade of the 2000’s simply because of the housing bubble (though the 2004 Presidential election was notable, in this context, for the first references to the “jobless recovery” phenomenon), though it was there lurking beneath the surface in the form of dangerous attrition. It was dangerous because the artificial foundation of any bubble of debt is doubly dubious (pardon the alliteration) where incomes and actual employment growth are not sufficient, or even as sufficient, to carry it all – thus the severity of the Great Recession and its aftermath.

In that sense, a real recovery to an economy that predates the serial bubble period is almost 15 million full-time jobs above what we see now. That is an immense gap that isn’t really closing in any meaningful sense, which is why incomes remain so unsuitably undersupplied.

Economists have started, finally, to take notice of this problem though they have yet to find its actual meaning. Because of the doctrine of monetary neutrality they see serial bubbles are a “necessary” condition since they occurred and did so during this deficient period. That is upside down, of course, as neutrality prevents an economist from connecting what are very simple dots – that bubbles are not “necessary” to gain even deficient economic growth, but rather deficient economic growth is the result of bubbles causing corrosion and attrition. The longer they go, the more bubble “cycles” in succession, the worse the loss of true wealth and true economic foundation.

Earned income is a signal of true wealth creation, and any economy that looks to be moving forward without it (like the 2000’s) is doing so in an unsustainably artificial manner. But that itself being bad enough, the true devastation is not revealed until the bubbles no longer “contribute” to even artificial “growth.” The more paper “wealth” that is “created” through primary “stimulus” means, the less actual wealth remains as the economy begins to literally consumer itself.

Once the bubbles burst enough, that is revealed as an economy that can’t seem to recover in any significant sense. So the economists in their models see a recovery that nobody, outside of further asset inflation, actually experiences. We know this economy is not truly growing because it is not creating actual wealth (which would be expressed as jobs and especially full-time jobs at a sufficient rate), therefore suggesting whatever is driving these positive numbers that are taken for a recovery is artificial and unsustainable.

The more “they” (whether that is media, economists or politicians) tell us that it is “working” under these conditions, the less such orthodoxy is believable. Maybe that is the silver lining, though it would be far better if it wasn’t so historically costly.

Stay In Touch