Apparently St. Louis Fed President James Bullard is aiming toward the myth of the FOMC as “data dependent.” It wasn’t all that long ago that he suggested a pause in rate “normalization” as credit markets were signaling the “dreaded” disinflation appearance. A few weeks is all it has taken to change his mind and put the monetary world right back on track to proving everything worked whether the economy likes it or not.

A top Federal Reserve official stuck to his forecast of raising interest rates in the first quarter of next year, with rebounding inflation, strong jobs data and lower oil prices propelling a strengthening U.S. economy.

Just last month, St. Louis Fed President James Bullard suggested the central bank pause its bond-buying program, as inflation expectations were declining.

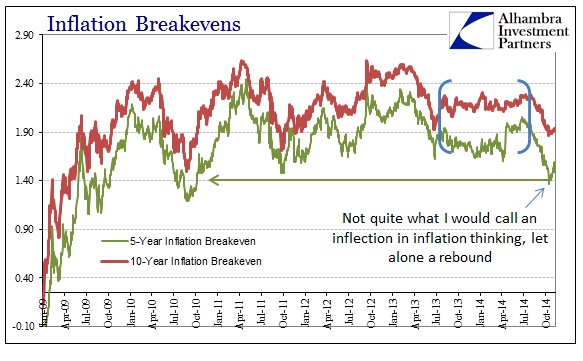

The key phrase is located in the first paragraph, alluding to “rebounding inflation.” That is a curious reference given that there is no actual indication of any such thing (in the orthodox definition which discounts commodity prices in favor of wage “pressures”). Scanning the credit markets shows very little of what might convince a non-ideological observer that credit markets have taken any different view on the subject.

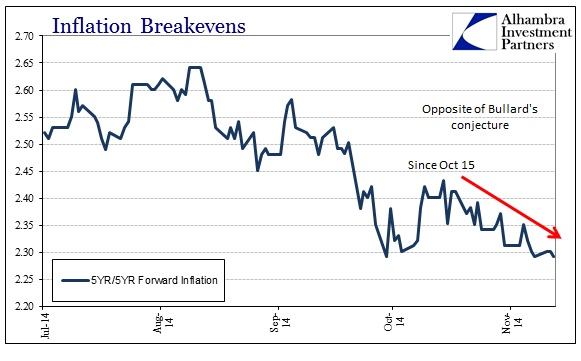

Undoubtedly, breakevens, especially in the 5-year, have come up but only slightly off the low point on that “shocking” day, October 15. Given that Bullard admitted concern over the prior months, since July and the “dollar’s” tight trip, the difference in scale should not be interpreted as anything approaching an inflection.

But it is actually worse than that for Bullard’s case, especially since this “rebound” has been almost totally contained to the more volatile 5-year breakevens. The 10-year hasn’t much done anything like that, instead staying rather close to that October 15 breakdown.

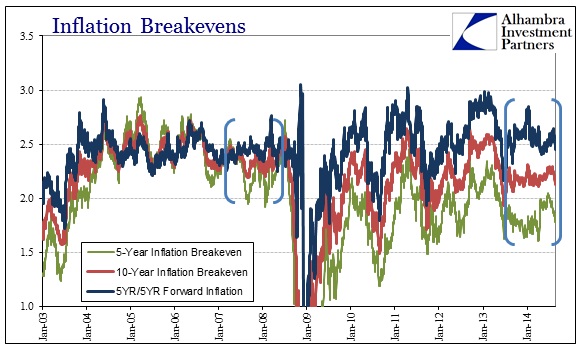

The FOMC itself actually prefers to use the 5-year/5-year Forward Inflation Expectation calculation as its guide for credit market stance on the subject. For my own part, I pay no attention to the estimate as I don’t see much value in chopping up breakevens, especially when they can, at times, tell you rough trends without resorting to piecemeal visibility through arbitrary proportioning. But we are talking about Bullard’s purported perceptions and I have to believe that he would be, as the rest of the FOMC, well aware of the 5-year/5-year.

As the name implies, this estimate essentially takes the difference in breakevens from the 10-year down to the 5-year. In that respect, it is a calculation of the daylight between the two tenors, as if there is more information content about inflation expectations in the 6-, 7-, 8-, 9- and 10-year maturities than anything prior.

To calculate the “correct” proportioning requires a numerator of the 10th power of the 10-year breakeven divided by the 5th power of the 5-year breakeven, with the fifth root of that fraction standing in as the final number. It really is a convoluted way to simply arrive at the distance between the 5-year and the 10-year. And, as you can see plainly above, that is pretty much all that gets measured.

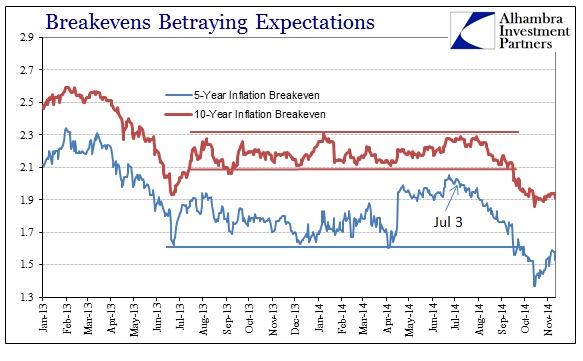

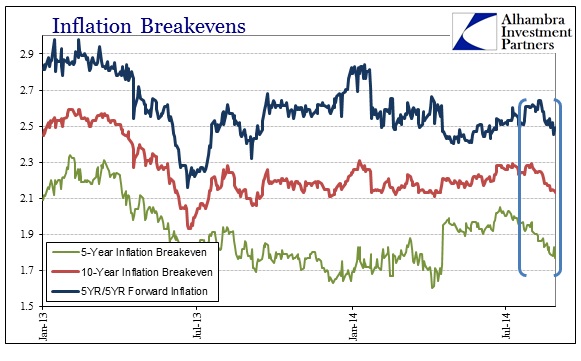

What is interesting, and little talked about by those that prefer this mathematical salad, is that the Great Recession has bifurcated the correlated behavior. All these inflation stand-ins were rather closely spaced prior to 2007; but now with some distance appearing as a permanent factor. Getting back to Bullard’s inflation assertion in November 2014, the 5-year “rebound” to which he is relying is set against a 10-year breakeven that has not moved. In the 5-year/5-year forward calculation that is bad news for Bullard’s contention:

With both the 5- and 10-year breakevens moving lower after early July, the 5-year/5-year forward did so as well. Now with the two moving somewhat and slightly against each other since October 15, the summation of “inflation expectations” in that outer five years continues downward in the opposite existence of what Bullard is trying to use as cover for his changed position.

In fact, the 5-year/5-year forward is now seriously below the level of early 2013 when credit markets were actually more inclined to believe QE3 and QE4 might work, and not appreciably different than troughs in 2013, 2011 and even 2010. So the Fed’s preferred measure of inflation expectations has not only not rebounded where Bullard claims, it has actually joined the rest of the credit markets in essentially discounting all those apparent economic factors that suggest, to him, a strengthening economy. In other words, credit is ignoring the unemployment rate and Establishment Survey in favor of wages and retail sales that don’t lead anywhere optimistic (and certainly haven’t yet).

As I said above, I doubt Bullard is ignorant of the forward expectations measure, and I believe he is instead posturing in what would be fully consistent with the growing “secular stagnation” viewpoint. In other words, there is something else driving his “need” toward raising interest rates:

Bullard also said in a question and answer session after prepared remarks here that he is concerned about asset bubbles forming. The Fed’s measures for preventing such bubbles are untested, he said, and it’s unclear whether or not the central bank can move quickly.

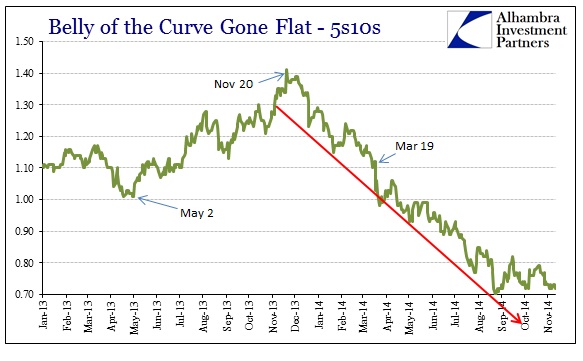

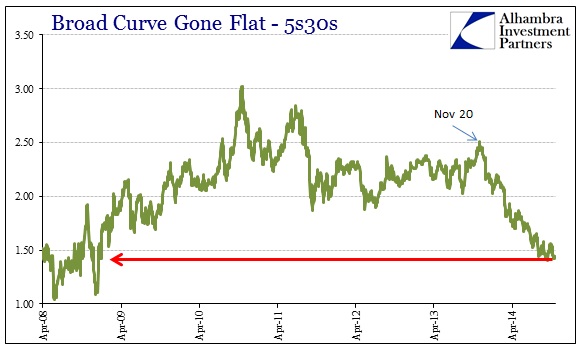

There is one segment of credit and funding “markets” that does seem to be positioning for an FOMC shift that would discount any such economic factors in favor of bubble “fighting.”

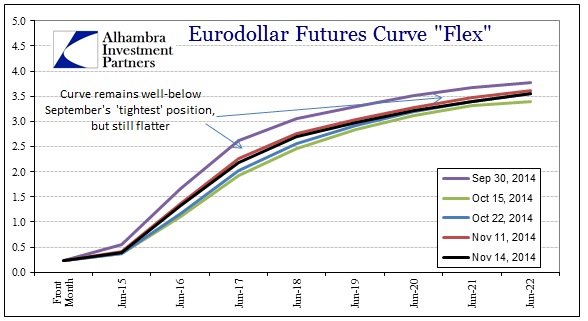

There is no part of the credit markets that is “buying” the recovery idea with or without “inflation”, instead reinforcing only that growth is absent and the Fed might “tighten” anyway. But even that is not being practiced anywhere outside of swaps, as the cousin to IR swaps, the eurodollar curve, is showing much reticence toward Bullard.

I think that credit markets have started to appreciate the fix that the Fed has gotten itself into, defined now between an economy that won’t respond even to four huge QE’s and the unwelcome appearance of certain “risk” markets that did all too well. There is only one way out of that trap, namely to try to convince “the economy” that everything is awesome so that it doesn’t fall apart at the same time you are trying to let some air out of the bubble(s). That certainly sounds like what Bullard (and Yellen too, if you listen closely) is saying without saying, only credit markets aren’t giving much chance for threading such an awfully small needle.

Stay In Touch