Back at the end of August, it was becoming clear that there was a growing sense of maybe not distrust but far less blind faith emanating from credit markets all over the world. Without a single epicenter it has been far more difficult to simply side step all economic permutations as singularly important, rather the culmination of increasing worry is that there will essentially be no place to hide. The implication, starkly, is that there are no “clean dirty shirts” but rather one, single dirty shirt that is perhaps stained and torn beyond all repair.

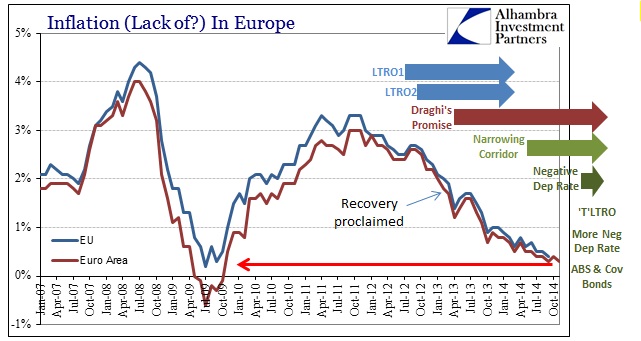

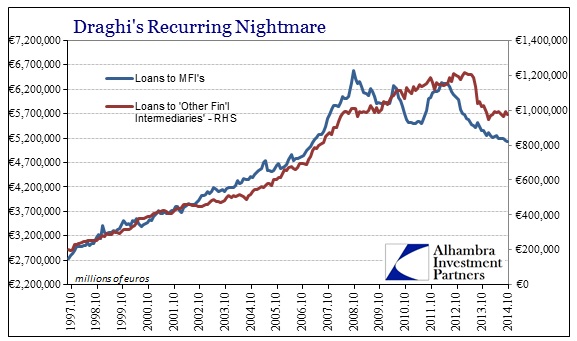

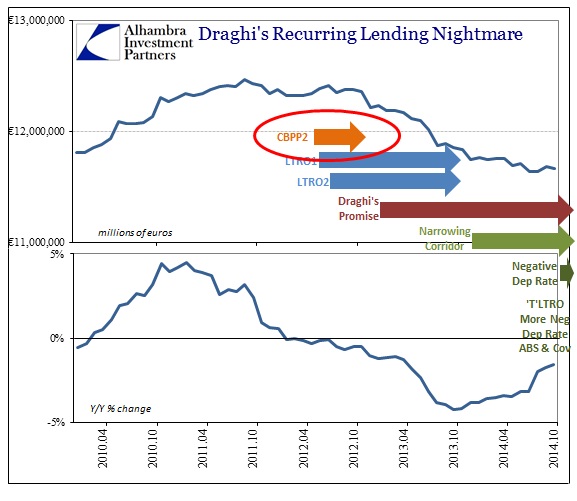

It was the middle of August when I said that there would be dark days ahead, especially Europe. While Japan has taken the central role in edifying such as decay, it is perhaps fitting that both the ECB and BoJ are losing their religion faster than anywhere else. While there exists some cursory criticism that the ECB hasn’t gone far enough, nobody can question the lengths to which they have so far gone (sunk?) in comparison to what used to pass for legitimate boundaries of monetary intrusion. The LTRO’s were nearly €1 trillion and were taken in combination of collateral rules that really ceased to be anything like rules, amounting to a free-for-all of any kind of financial junk.

Nothing has worked, outside of the bank orgy in sovereign debt. Despite all these massive monetary disturbances there has been nothing like an economic recovery, even to the point that financial recovery itself is again in doubt. Part of the reason the ECB went after the negative deposit rate, to beat the dead horse of Eonia, was that fragmentation in interbank “markets” never healed – it is still there (chart below).

The real problem with Europe in its current state is that it has disproven the central point of monetary theory as it relates to “currency elasticity.” Modern orthodoxy has been built upon the premise (along with monetary neutrality and Keynesian “pump priming”) that financial panics or disorder were impediments upon the natural course of the economy, and that natural course was unaffected by any financial irregularities over the long run (a big part of neutrality).

Yet, here we see again, as in the US and Japan, now maybe China too, that removing financial panic and disorder has done nothing about setting the real economy back to its “rightful” trend. In fact, despite all the constant monetary interference (to the unbiased, rather than “despite” it is “because”) the credit-driven assumptions of “pump priming” remain something of anachronistic, pre-crisis dreamland.

Lending in Europe continues to contract, though admittedly the rate of contraction is flattening out due simply to inertia. And while the interim between 2011’s near global re-panic and now was thought to be “the recovery” it was only the mask of that rigid faith in central bank efficacy. The plight of the European economy never much changed, instead it is only being revealed once more to those blinded by ECB “charm.”

So the further attrition in the European economy, amidst all that the ECB has done and continues to do, threatens to unwind all the “currency elasticity” that has taken place, suggesting rightfully exactly the means by which financial function actually works – central banks impale upon illusion alone.

Also worryingly for policymakers at the European Central Bank, who are struggling to bolster growth and drive up dangerously low inflation, factory activity declined in the bloc’s three biggest economies of Germany, France and Italy.

“The situation in euro area manufacturing is worse than previously thought… There is a risk that renewed rot is spreading across the region from the core,” said Chris Williamson, chief economist at survey compiler Markit.

“Renewed rot” is only appropriate if you think there was a recovery in the past few years, cast under the spell of “liquidity.” In other words, nothing has much changed in the real economy as the charts above show all too well. The carefully crafted façade now crumbling, the facets evident of the 2011-12 crisis are once more coming out – furthering to a high degree the global warning (not warming) that is spreading in scope and magnitude. The global economy, not just Europe, is on the brink and credit markets are preparing for the worst.

Central bankers would prefer you pay no heed to such “folly”, but privately they are just as concerned since it is always credit that moves first.

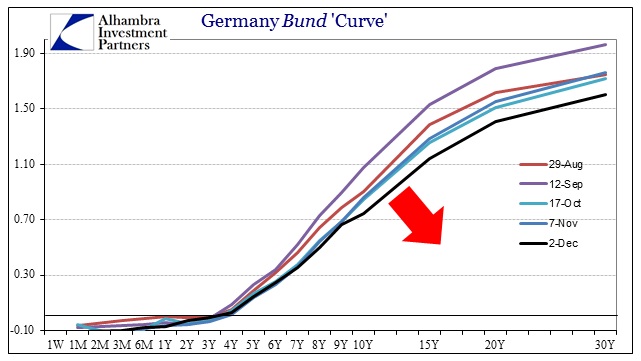

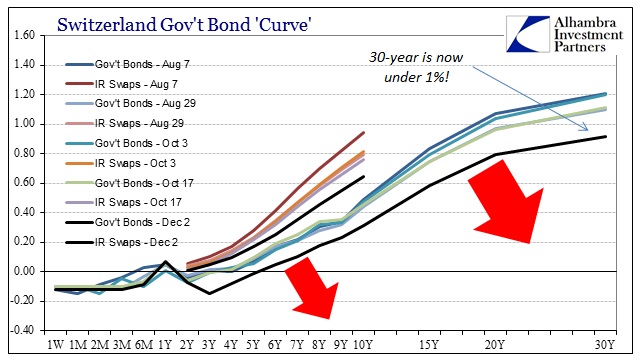

While Germany’s bond market grabs most attention due to its size and position at the center of the euro liability chain, it really is Switzerland that shows such rapid deterioration in sentiment. The yield curve in both countries continues toward bear flattening, with Germany seeing much activity in the outer years. However, the move in the Swiss curve these past two weeks echoes very closely the collapse in oil prices; providing, yet again, more confirmation that American crude supply is not much of a consideration.

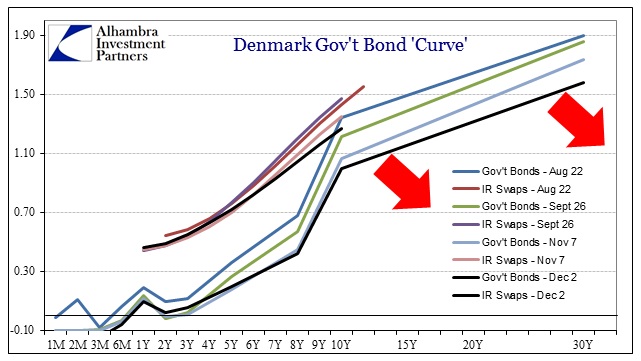

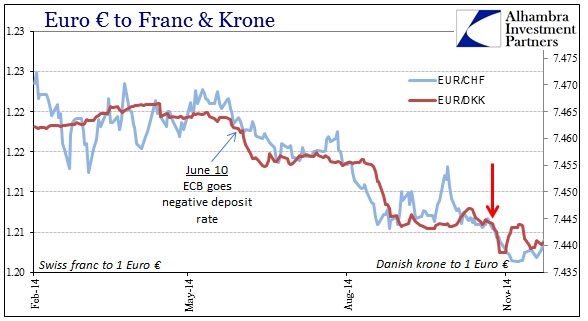

To emphasize that point, illustrations of Denmark financials match that interpretation. Again, both Denmark and Switzerland are highly connected to the Eurozone but maintain separate currencies, providing a very clear element of visibility into euro-financial worries.

As with US credit and crude oil, everything is moving in the same direction at the same time to the same degree (mostly). That cannot be ignored, though that is exactly what each and every central banker is trying to implore on a consistent and constant basis. Remember it was Janet Yellen who earlier this year dreamed of a financial world where “market” agents simply disregarded and overlooked exactly this kind of turmoil in favor of an anesthetized stupor of total (totalitarian?) disregard of everything but monetary policy intent (not even action).

What is taking place here and globally is the exact opposite, as “markets” finally awaken from the two or three years of anesthesia only to find a still-rotten corpus of economic mismanagement into dangerous attrition. They are now set about not moving closer to Yellen’s ultimate fantasy, but moving starkly against it.

The magic is nearly gone as predicate positions in global finance head toward exit and shelter. The screws have tightened, and many hatches are being battened. Dark days indeed.

Stay In Touch