The primary monetary channel for “stimulating demand” has traditionally fallen through real estate. Mortgage finance is the largest private source of financialism, reaching directly to people’s personal economy. The price appreciation of houses and the availability of mortgage credit are seen by orthodox economics as the basis for marginal “demand” changes in a theoretical philosophy that prizes nothing but activity for the sake of activity.

Not long after launching QE3, which was a direct subsidy to wholesale mortgage finance (and a great deal more in terms of one-way liquidity capacity), then-Fed Chair Ben Bernanke stated:

Many savers are also homeowners; indeed, a family’s home may be its most important financial asset. Many savers are working, or would like to be. Some savers own businesses, and–through pension funds and 401(k) accounts–they often own stocks and other assets. The crisis and recession have led to very low interest rates, it is true, but these events have also destroyed jobs, hamstrung economic growth, and led to sharp declines in the values of many homes and businesses. What can be done to address all of these concerns simultaneously? The best and most comprehensive solution is to find ways to a stronger economy. Only a strong economy can create higher asset values and sustainably good returns for savers. And only a strong economy will allow people who need jobs to find them. Without a job, it is difficult to save for retirement or to buy a home or to pay for an education, irrespective of the current level of interest rates.

The way for the Fed to support a return to a strong economy is by maintaining monetary accommodation, which requires low interest rates for a time. [emphasis added]

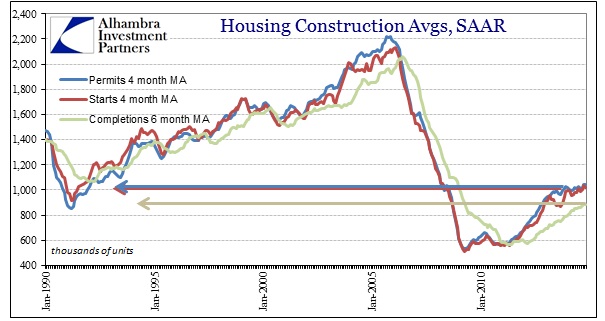

The latest home construction figures tend to agree with the highlighted statement above (setting aside that whole “pay for an education” bubble). For “some” reason, home construction has been stuck at a singular level despite everything that the Fed has done to render “aid” through two additional QE’s. That would seem to suggest, as Bernanke suggested in 2012, that interest rates are only a partial package and ultimately useless without job growth. The population is expanding but there remains little actual relative demand for home construction.

That is certainly a problem for those that continue to express the current circumstances in recovery or healthy economic terms. Certainly some of that deficiency is a legacy problem, but a legacy of Bernanke/Greenspan doing the exact same thing one cycle prior (and Greenspan using eurodollar-financed credit expansion as a GDP-filler for all the 1990’s).

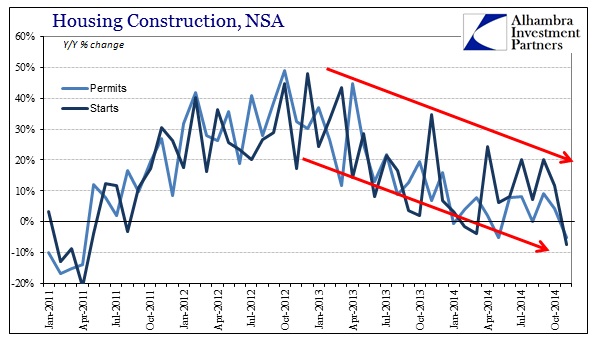

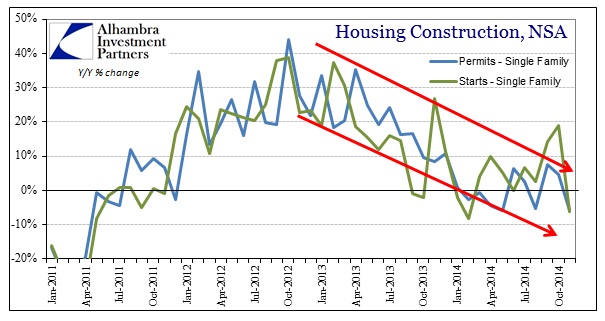

As I hinted above, the construction figures for November were ugly across the board – every segment in permits and starts were negative Y/Y.

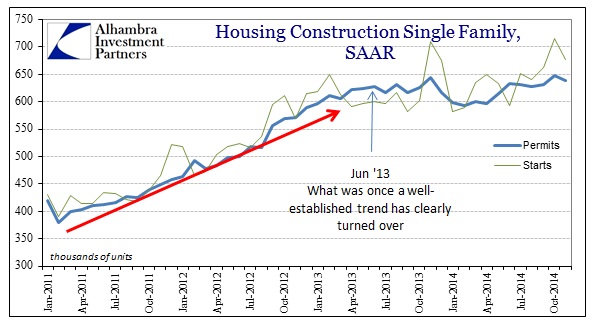

While there were base effects to consider with single-family home starts, permits, the leading, less volatile indicator, have been stuck at the same level for almost two years. Again, QE3 seems to have left no trace of an imprint (outside of prices in the institutional channel, which is not quite what they had in mind).

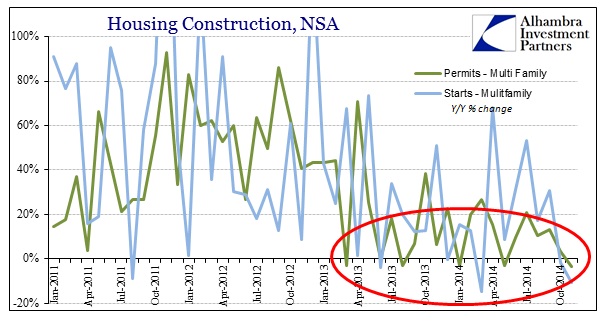

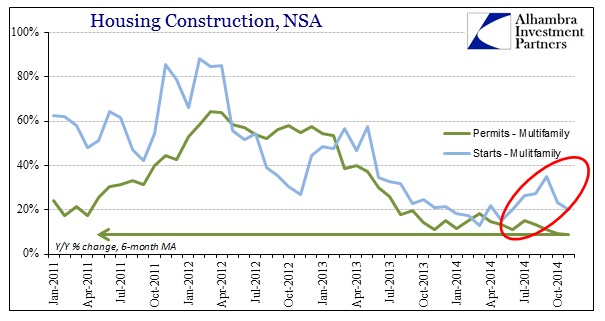

What may be the most worrying signal, though, is the lack of apartment construction. This seems to be directly tied to jobs as Bernanke predicted, though in the opposite direction. If home prices and tight lending standards have conspired to keep marginal buyers out of the single family market, then at least population growth should propel apartments. And it did, at least in a temporary burst of financed subsidy that didn’t gain any expected durability.

In this year of supposed payroll expansion to the point of being the “best in decades” there is very little by way of construction for new dwellings in which to house this new and expanding worker base. It’s as if these “workers” don’t have any income to start new households.

In fact, apartment construction (permits) seems to tail off not long after the start of QE3 (and coincident to the outset of QE4). I have to agree with Bernanke’s assessment that interest rates mean little as “stimulus” without job growth. Home construction would seem to suggest, as others are recognizing, that QE has little impact on job growth, but that low interest rates are potent in other less desirable areas. It is indeed proving quite impossible to jumpstart an economy on nothing but negative factors.

Stay In Touch