The inflection points of the past year and a half or so have become waypoints by which to mark the progress toward seemingly darker days ahead. In many respects, as I tried to express earlier today, this is nothing new not just in recent history but in troubling comparison to far worse fates. Those specific dates have taken on added meaning in terms of the context that has developed whether or not we have actually pieced together what actually occurred – October 15, for example, is pretty much straight-forward (and not electronic trading), whereas November 20, 2013, remains a mystery as to specific details but easily understood for the implications of that mystery.

For all the bearishness in credit and funding that has developed between those days, there is another period shaping up as an inflection in behavior. There is no specific financial occurrence at which to begin the accounting, but there is no less of an imprint upon and around December 1. The month of December saw some of the most concerning trading and financial performance yet without an easily discernable and apparent reason for it.

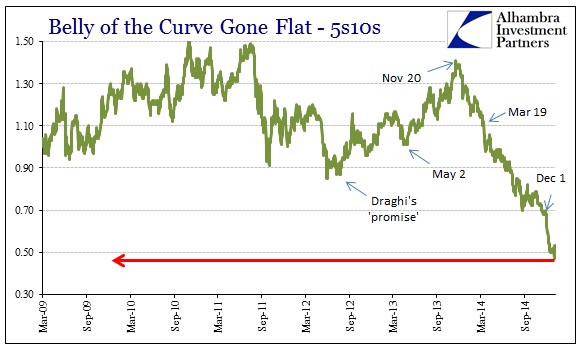

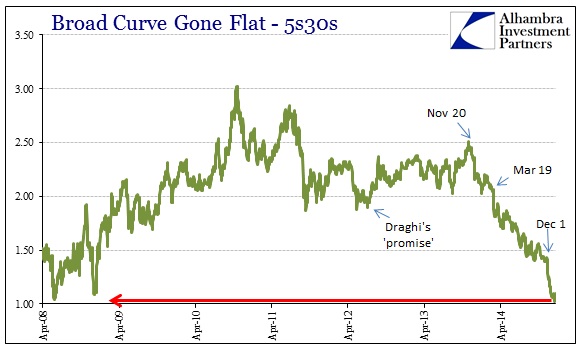

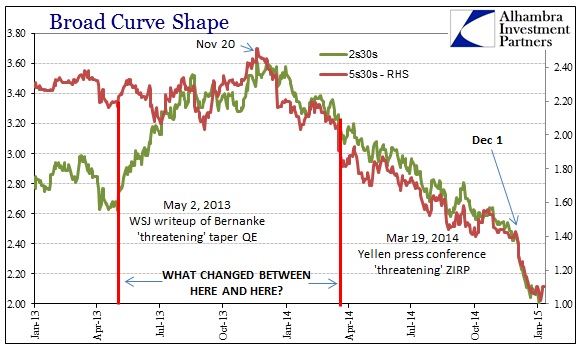

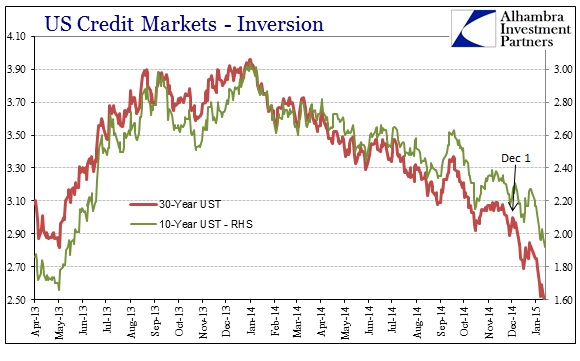

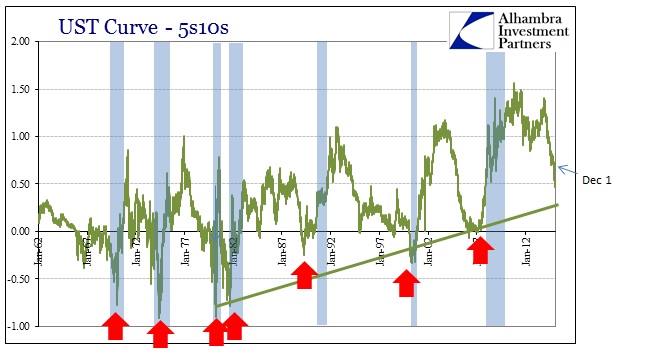

The starkest examples of this shift in sentiment surrounding December 1 center on the UST yield curve shape.

There can be no doubt that the turn from November led to a significant change in credit mechanics at the UST benchmark (even considering the independent nature of credit in opposition to Alan Greenspan’s supposition that everything is tied to “risk-free”). Again, there is no obvious event upon which to theorize cause to these effects.

Even nominal yields were impressed upon that date, as clearly there have been persistently heavy bids for especially longer-dated UST issues.

The 30s in particular have seen yields decline, with the nominal yield falling an amazing 51 bps in the weeks since it last rested at 3% on December 2.

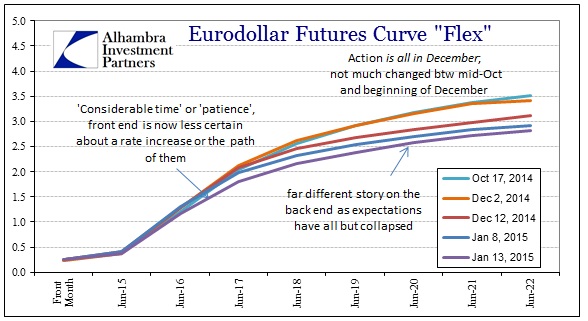

The eurodollar curve, in relation to UST and credit markets, is important not just for interest rates and “dollar” settling, but as a busy intersection of finance and economics; of monetary policy and the intended results. As you can plainly see above, there wasn’t much change in the curve between mid-October (immediately after the drama of the October 15 waypoint) and the start of December. Almost immediately into last month, by contrast, the eurodollar curve not only flattened massively in the outer years there was an almost rejection of the FOMC’s language shift as a rather slight trade in the opposite manner from Yellen’s economic certainty (as the shorter maturities lose yield it signals lower estimated probabilities of future rate hikes or their intensity).

Again, without an established financial “event” or element to offer an explanation for all this, we are left increasingly with only economic factors and considerations. I think that is where the eurodollar curve is drawing itself as discounting about future considerations are clearly not being influenced by expected policy changes (or at least in the direction the FOMC wants to see). In other words, the eurodollar curve shifted to a much higher degree of pessimism about opportunities for the placement of “dollars” not just in the future but the nearer future.

The increasing economic nature of these financial indications is not lost on the context of the intrusive influence of monetary policy itself, in this case the artificiality of the steepness of the yield curve due almost entirely to policy.

That would seem to suggest that credit markets are not “fooled” by Greenspan’s past affinity for disrupting the “risk-free” rate and instead calibrate, through these inflection points, to something else entirely. In terms of December 1, it seems as if, across all these credit and funding markets, that economic pessimism deepened to a degree not seen at any other point in this “recovery” period. The implications of that are such where credit may have had some hope for “being wrong” and the FOMC (and the parroting of economists) getting this right even after October 15, but post-December 1 that was undone rapidly as what can only be viewed as economic observation and expectations.

Again, without any specific financial reason to tie this all to, I have to believe that this is not related to policy but just plain doubts about upcoming economic reality. The sharpness of the action only heightens that analysis. Is December 1 perhaps the day the last nail was hammered into the coffin of the recovery?

Stay In Touch