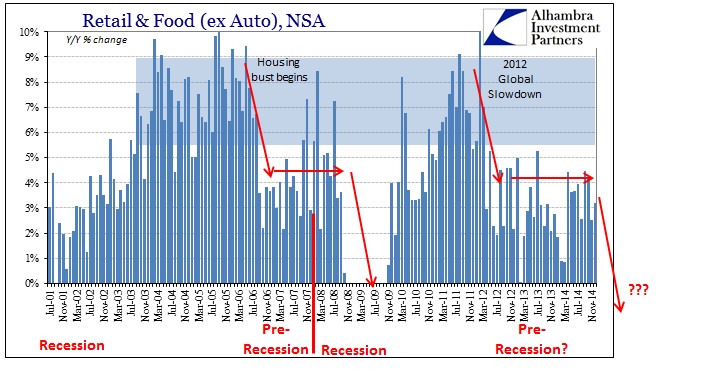

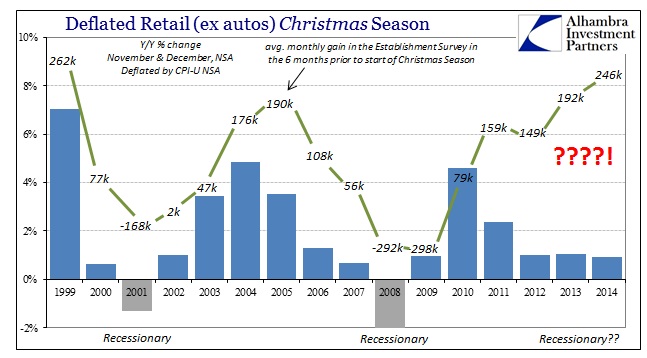

For all the hype about jobs and the booming (GDP) economy, the major portion of the retailer calendar around Christmas was a total bust. In many ways it was worse than last year, which emphasizes simply how the business “cycle” as it was understood in textbook economics no longer applies. The US economy, indeed the global economy as there are no idiosyncrasies in the globally financialized world, remains stubbornly captured by attrition.

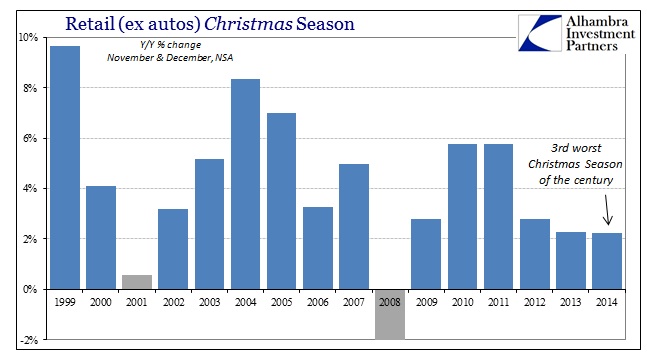

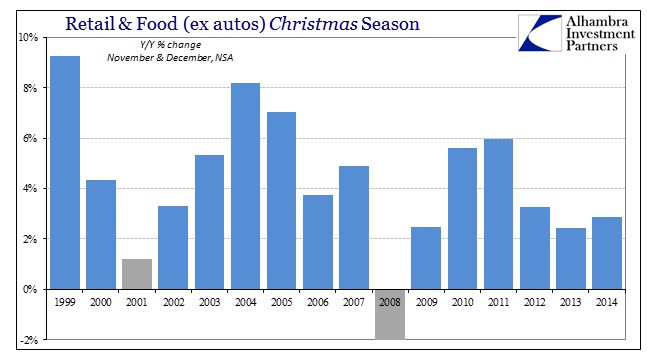

Retail sales (ex autos) were barely 3% in December, still about half of what should mark the floor for an actual economic expansion. Taken as a unified calendar event, the core of Christmas shopping (subtracting both food sales and autos) was the third worst of this century, meaning 2014’s holiday season was only better than the two recession years.

Even adding back food sales only raises the comparisons slightly, indicating a primary reason why expansion hasn’t been a true recovery these past few years. The disparity here between auto and food sales at the margins and all the rest is an artifact of artificiality. There is clearly a bifurcation in economic terms, as those who are doing well can afford to eat out at expensive places and buy big ticket autos, especially luxury, but for all the rest there is nothing but gut-wrenching attrition.

That is where the elongated cycle originates, as the economy performs far less uniformly than in the past where this type of misallocation was less apparent. Unfortunately for those monetary adherents that believe in asset bubbles as something of an ingredient within “aggregate demand”, this is pretty conclusive evidence that spending for the sake of spending does not lead to more homogenous expansion. Instead, with stratification intensifying, the segments of the economy unreached by asset inflation and redistribution efforts are left to pay the price for the socialization of “fill in the troughs without shaving off the peaks.”

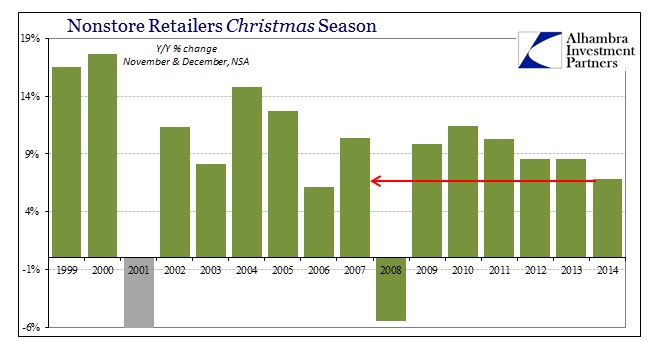

As you can plainly see in the charts above, those doing well enough because of redistribution are not enough of an offset to the far, far greater numbers increasingly left behind. That is how you get even online shopping faltering when it was fully expected to perform the role of economic savior (in terms of consumerism and retailer profits).

This is all undoubtedly nothing surprising for credit and funding markets that are increasingly pricing higher probabilities of an end to the elongation (and that’s not good). In other words, the dichotomy between growing pessimism in credit/funding and economists is due to the continued failure of the economy to produce what economists expect. For their part, economists at least acknowledge somewhat of past failures in expectations, as even the FOMC was forced to admit a distinct and clear lack of wage growth, instead relying solely on a major difference this year with GDP and the unemployment rate being significant and valid.

As I said earlier this week, that means optimism about future wage growth is all that stands before an end to the recovery narrative.

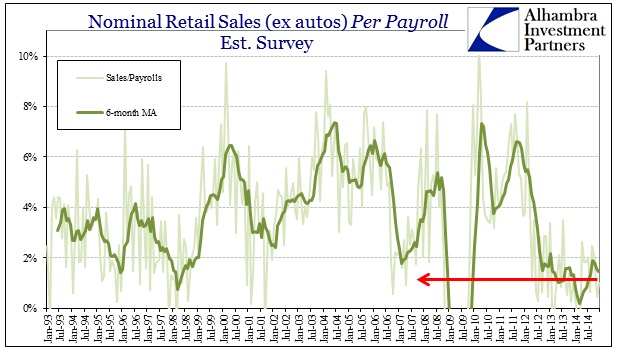

But if you actually examine the pattern of major economic statistics against these spending figures there is even more reason to doubt future wage growth. As is completely well-known by now, the Establishment Survey has kicked into high gear in 2014, producing the best run in job growth since 1999. Yet, as you see plainly immediately above, what was once a relatively robust correlation between the Establishment Survey and actual spending no longer seems to apply. For the most part, the breakdown in the Establishment Survey against spending seems to have occurred sometime in 2013 (since jobs are a lagging indicator, the slowdown in 2012 should have shown up by Christmas 2013; instead the Establishment Survey simply parted company with retail sales and pretty much everything else).

So the one account upon which economists are placing the whole of the recovery, and to which they plead for “markets” to ignore everything else, doesn’t even make much sense in the manner it should most.

That can only mean that the jobs being created are so ridiculously low paying as to be essentially worthless in terms of economic and income circulation, or those jobs simply don’t exist. The behavior of the labor force itself, which amounts to a curiously high degree of economic apathy, concurs with probably more emphasis on the latter explanation (the jobs don’t exist).

If this dichotomy were limited to a much more condensed time period then it may not matter so much. However, I think, especially with December, that markets have simply given up waiting for the Establishment Survey to produce something other than glowing media reviews about an artificial or even imaginary economy that doesn’t exist anywhere else. The rest of the world has given up on the US “recovery” so it may just be a matter of time before the narrative falls apart in full and the revisions to the labor market are due.

In terms of future growth, this reductive holiday spending reality means more discounted goods into 2015 (“deflation” wholly apart from crude oil) and less robust ordering until laid up inventory clears. In other words, the winter is likely about to get much colder.

Stay In Touch