Janet Yellen and her colleagues would like to welcome you, not unlike Tim Geithner’s 2010 expedition in this area, to the recovery. They have removed pretty much all language that would make you think there was anything like lingering destructiveness or erosion. In doing so, they make it very plain that they want you to believe that they will be ending ZIRP, just as they have done to QE.

There is the “solid pace” of economic expansion which has meant “strong job gains”, though, curiously, there won’t be any of the mainstream “inflation” that usually accompanies this outlook. The world may be concerned about oil and all that, but the FOMC wants you to know that you should focus on them instead of such distractions.

Yet for all the supposed expertise and the “best and brightest” that sit upon the monetary throne in the US, funding markets just rejected everything the FOMC proclaimed. Knee-jerks are usually conforming, at least in some manner, but the eurodollar market, in particular, traded in the “opposite” direction of what you might expect had the FOMC left any impression.

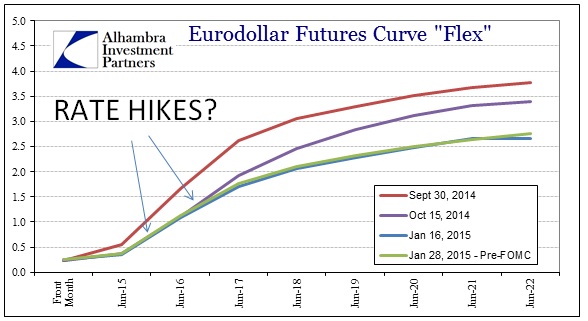

The eurodollar curve has been more than suspicious about the Fed’s preferred narrative for some time, going back to June, but you would at least think that this latest statement might carry enough weight as to cause the “right” direction if only in short-term trading. These markets are conditioned toward policy proclamations almost at face value (again, in the short run).

The path of “projected” rate changes has noticeably declined, which amounts to either a lower probability of actually getting to policy rate increases or a much diminished period of receiving them (the Fed does raise rates, but the economy isn’t what they say and the asset bubbles cannot withstand the paradigm shift so that it all ends very badly once more). The inward, flattening of the eurodollar curve, which is supposed to be the closest “market” to funding rates, is a direct contradiction to the “booming” economy as spun by the economists and their models.

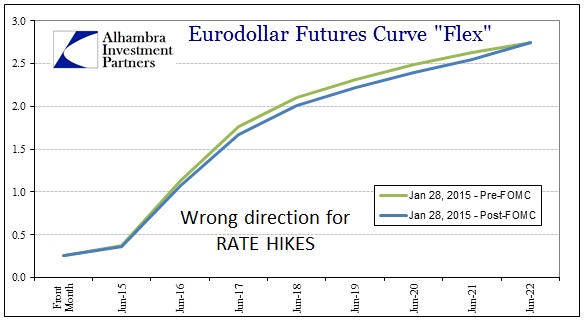

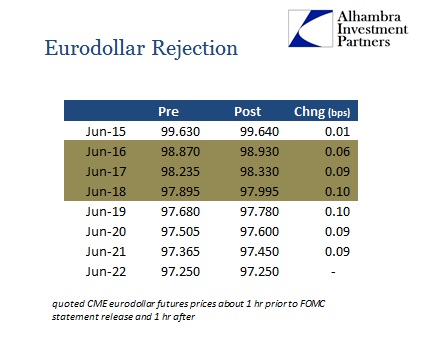

I have rescaled the curve to zoom closer to the action so you can plainly see the intraday eurodollar curve moving in the opposite direction of any intended rate increases. And the majority of those movements are right in that central area of focus, the policy window from 2015-17.

These may not seem like large moves, but given the volume of contracts and the amount of “money” in the notional values there is a bit of exaggeration here. A 10 bps swing in a matter of a couple hours is significant, but very much so given that the “money section” of the funding curve not only dismisses the monetary policy statement in full, but actively trades against it. Eurodollars are essentially calling the FOMC’s bluff.

I have said this pretty much since the beginning of the taper drama, that policymakers are acting out rational expectations theory or at least how they see it. In other words, their job is not to analyze actual economic conditions, but to condition economic thought toward the end goal. If they convince you that they believe the economy is on track they further believe you will act accordingly (“you” being both investor and economic agent). The more the economy diverges from the “preferred” projection, the more emphatic the cries of “recovery” become. At some point, desperation becomes palpable.

There are other factors to consider here, of course, but it is at least interesting as that seems to be theme guiding funding market trading here. The more the FOMC says the economy is great, the less credit markets seem to believe it – desperation rather than reality, now even to the shortest of timescale.

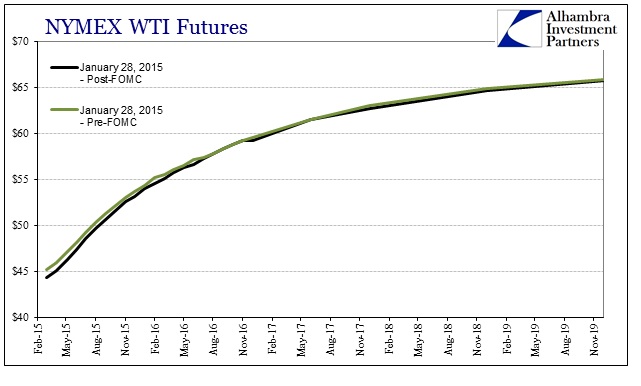

UPDATE: You can add crude oil to the list of markets not impressed by the FOMC’s economic forecasting with front month WTI down almost a full dollar since the FOMC statement.

Stay In Touch