I have to hand it to the good work done by Gallup, as their tracking polls have “previewed” the “official” retail sales reports these past few months. Gallup found another Polar Vortex-like hole in consumer spending and sure enough the Census Bureau confirmed as much. It is decidedly ugly and can do nothing but put a major dent in the euphoria over the payroll reports of late. If there are jobs, they don’t pay and people don’t spend (except on cars).

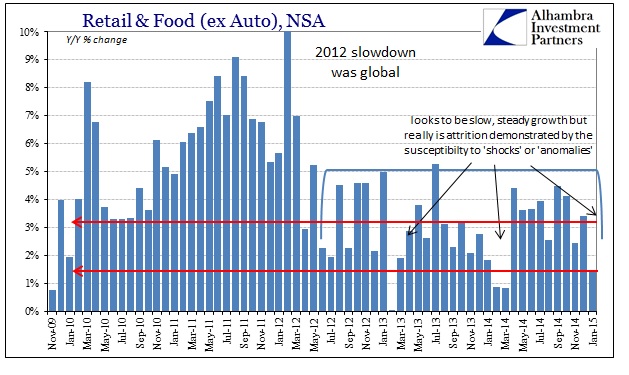

Overall retail sales were up just 2.85% in January, and that is compared to a “bad” January 2014. Auto sales were up just shy of 10% Y/Y, so if you take out credit-driven mania focused there retail sales (ex autos) were an unpleasant 1.41%. If you subtract spending on food and beverage places, “growth” in January 2015 was -0.38%!

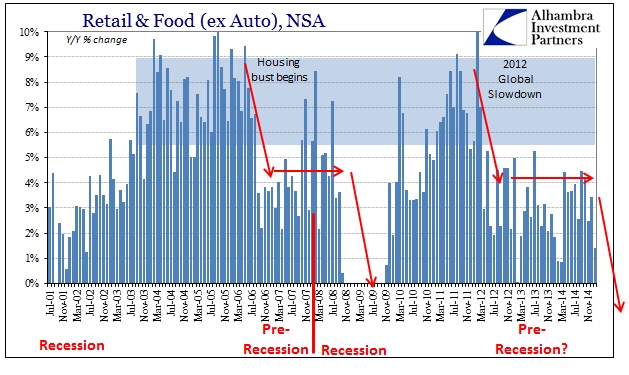

And that is why the economy feels recessionary but doesn’t act like it in full. Auto sales aren’t nothing, which keeps a good deal of the economy from falling toward where the rest already resides. That plus food/entertainment highlights the redistribution effects of an economy bifurcated by monetary influence. It proves yet again that spending for the sake of spending does not lead to a broad and sustained advance, only that, in the long run, attrition will take its toll eventually – the “winners” of redistribution don’t bring up the rest of the economy, instead the “losers” ultimately bring everything down.

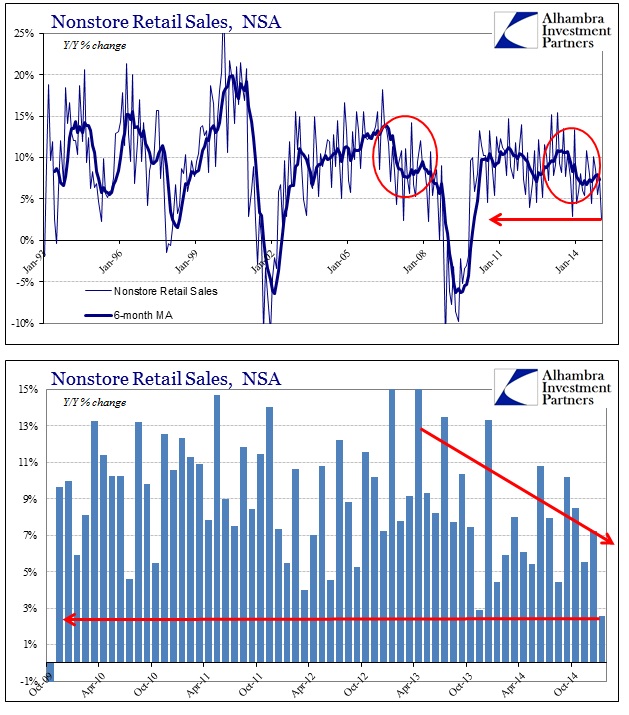

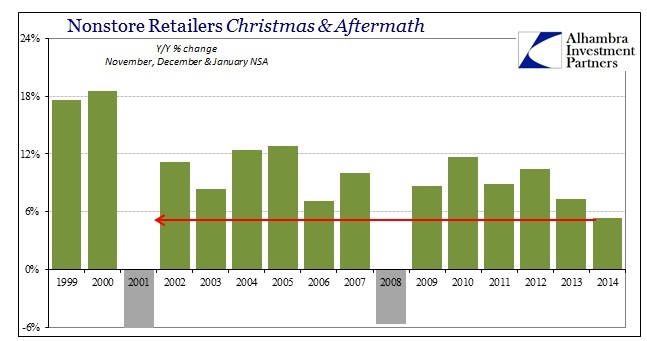

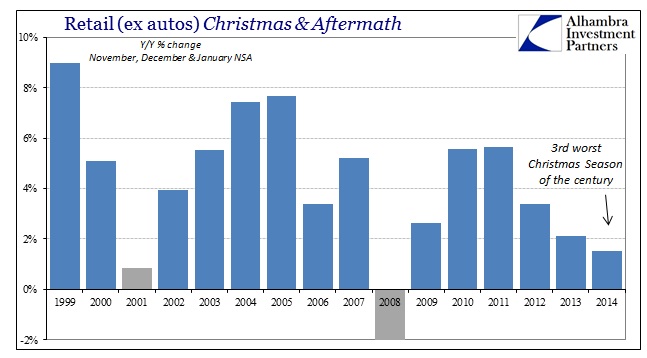

In terms of the just-concluded holiday season, including the January aftermath, there is nothing to show an economy heading upward; just the opposite. Some of the weakness in retail has been “explained” by the industry trends toward online shopping, but that did not happen this past holiday season. In fact, January’s nonstore growth was the worst of the “recovery.”

For the season overall, online shopping simply never materialized and now that people have spent what little discretion (gas “windfall” and all) January is back in the bunker. That should not happen at all if the economy was as healthy as it seems by the unemployment rate.

Without the online portion making up the difference, the entire holiday season from buildup to aftermath was a huge disappointment, maybe even squarely a bust. While winter has been cold, with a few major storms, there isn’t anything like 2014’s “news events” to provide an alternate explanation.

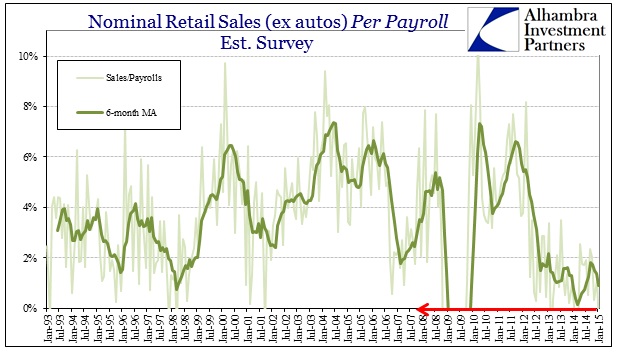

The greater challenge for this current season is why all those purported new jobs have had absolutely no effect. For all the constant chatter and proclamations, from politicians on down, spending and “demand” doesn’t just remain stubbornly weak, it has declined further toward disastrously weak. The fact that the Establishment Survey has gone so far in the extreme now only makes this dichotomy more concerning (as it calls into question the validity of so many statistics that I think are unprepared for these circumstances). Either the statistical process about payrolls is broke, or the economy is. I’d prefer the former over the latter, however the two are not mutually exclusive in a worst case (which may actually be the most likely).

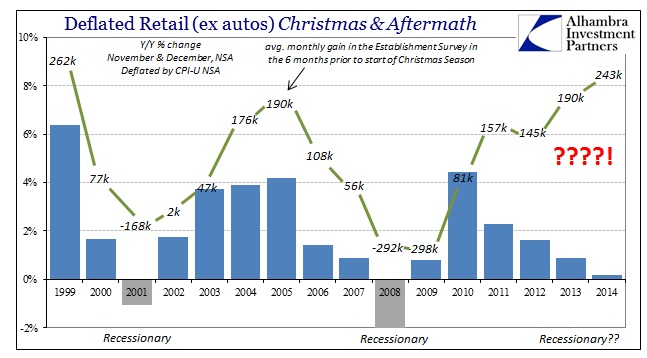

If you take into account at least some measure of price fluctuations, which the CPI will have to be sufficient, there was actually no real growth whatsoever in the 2014-15 Christmas Season – which accounts for almost all profit and an oversized proportion of pure activity. The contrast to the payroll count cannot be more distinct. I chose the average Establishment Survey estimate for monthly payroll growth of the six months prior to the start of the shopping season to account for any lags in “sentiment”, but even if you add November, December and January job gains little changes. In fact, for 2014, the disparity actually grows far worse (from +243k in the six months prior to November 2014 to an unbelievable, literally given these spending accounts, +274k through January 2015).

What we are left with is an enlarging trend that looks nothing like the economy of the payroll reports, instead pointing in the other direction. It is possible that the retail sales figures are the defective series, but widespread corroboration of so many other estimates and anecdotes, like credit markets, strongly suggest that is not the case (against the payroll report that has no corroboration anywhere, even tax receipts). It wasn’t such a long way down from the “inarguable” 5% GDP after all, proving yet again that, at best, this artificial economy is still highly unstable.

Stay In Touch